Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 02, 2018

Modest start to 2018 for Philippines manufacturing as new taxes hit demand

- Manufacturing PMI drops to 51.7 in January from 54.2 in December, weakest gain since September 2017

- Inflationary pressures intensify

- Optimism remains elevated

While the Philippines manufacturing economy ended last year on a high, it started 2018 on a more modest note as demand was partially hurt by new excise taxes, according to the latest PMI surveys. But the survey’s forward-looking indicators suggest this hit to demand is likely to be temporary.

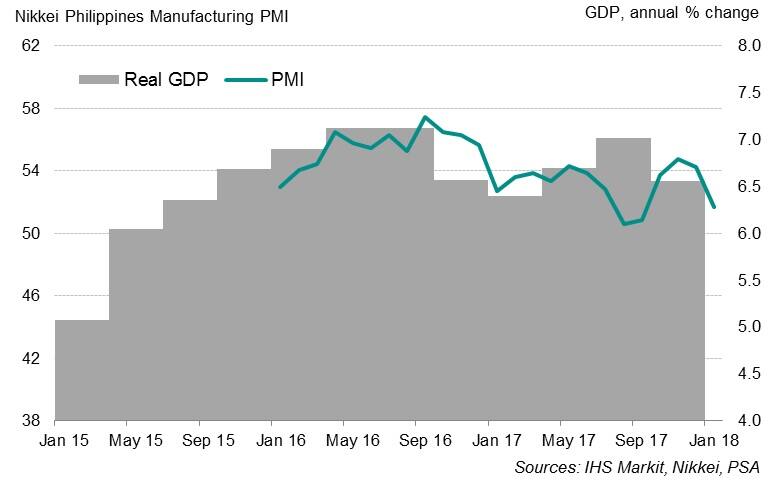

Philippines PMI and economic growth

Excise taxes hit demand

The Nikkei Philippines Manufacturing PMI™ slipped from 54.2 in December to 51.7 in January, signalling a more modest improvement in the health of the sector than the solid gains seen in recent months. The latest reading was the third-lowest in the two-year survey history.

Growth of both output and new business weakened markedly in January, alongside the smallest rise in employment since the declines recorded last summer.

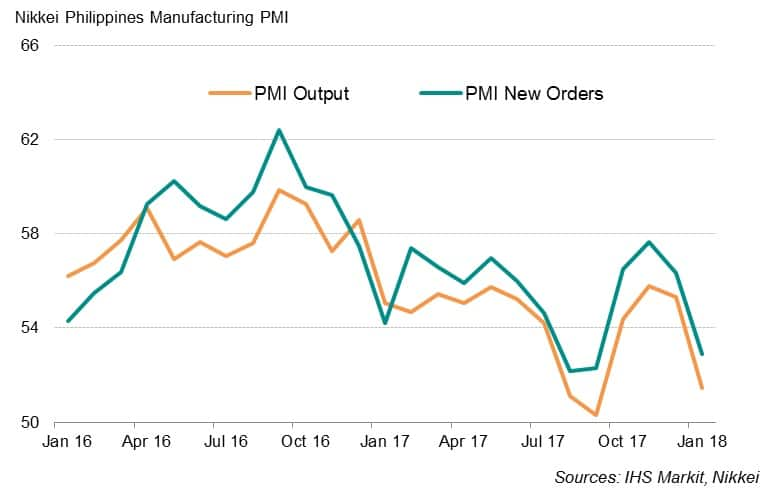

Philippines PMI: output and new orders

Firms’ responses to the survey revealed that the new excise taxes, effective January 2018, were a major factor behind the slowdown in business activity growth in January, weighing on client demand by pushing prices higher.

More encouragingly, other survey indicators suggest that firms are looking past the near-term slowdown towards stronger growth in the year ahead. The Future Output Index remained elevated, with the majority of businesses anticipating higher production over the next 12 months. In general, the expectation is that demand is likely to strengthen once the effects of the tax hikes fade, supported by public infrastructure projects.

Rising inflation

However, one area of concern is the renewed pick-up in price pressures, which could pose as a downside risk to future growth. Survey data showed input costs increasing sharply and at one of the fastest rates in the survey history, pushing Filipino manufacturers to raise selling prices at a record pace.

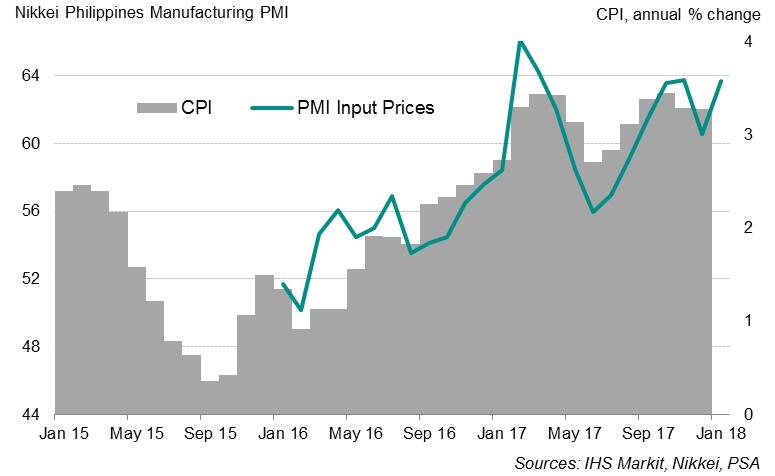

Philippines PMI and inflation

Anecdotal evidence showed that new excise taxes, a weak exchange rate and higher global commodity prices, especially for oil, metals and plastics, all pushed inflation higher. Given the strong relationship between the PMI survey’s gauge of input prices and official consumer inflation data, we could see stronger consumer price pressures in early-2018.

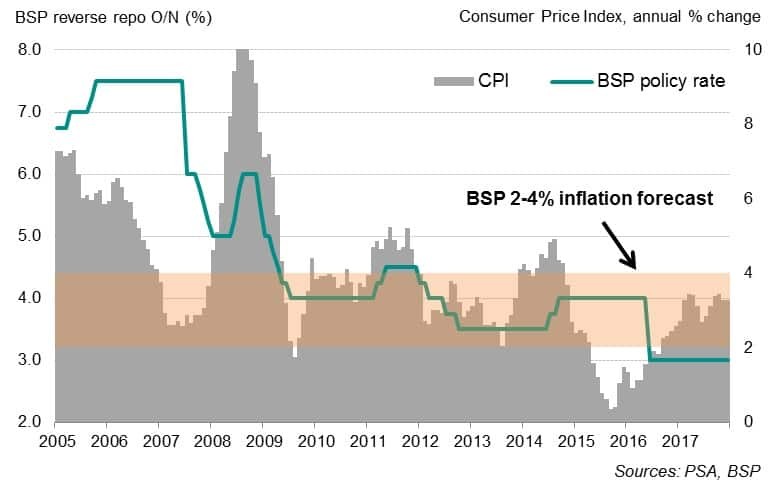

With economic growth remaining robust, rising inflation will add to expectations that Bangko Sentral ng Pilipinas (BSP) will consider taking on a more hawkish policy stance. The central bank last raised interest rates in September 2014. The next policy meeting is due on February 8th, 2018.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmodest-start-to-2018-for-philippines-manufacturing-as-new-taxes-hit-demand.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmodest-start-to-2018-for-philippines-manufacturing-as-new-taxes-hit-demand.html&text=Modest+start+to+2018+for+Philippines+manufacturing+as+new+taxes+hit+demand","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmodest-start-to-2018-for-philippines-manufacturing-as-new-taxes-hit-demand.html","enabled":true},{"name":"email","url":"?subject=Modest start to 2018 for Philippines manufacturing as new taxes hit demand&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmodest-start-to-2018-for-philippines-manufacturing-as-new-taxes-hit-demand.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Modest+start+to+2018+for+Philippines+manufacturing+as+new+taxes+hit+demand http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmodest-start-to-2018-for-philippines-manufacturing-as-new-taxes-hit-demand.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}