Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 23, 2023

Japan's economic growth quickens in August as service sector counters factory decline

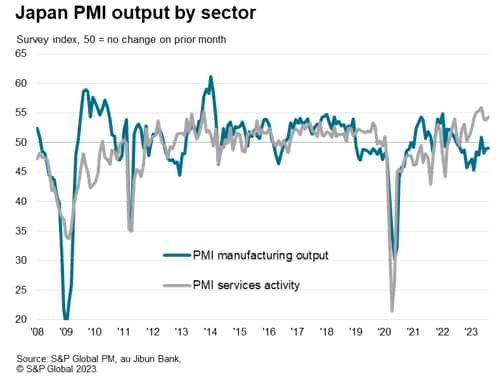

Growth across Japan's private sector economy quickened midway into the third quarter of 2023, according to flash PMI data. This extended the growth streak that began at the start of the year and was again supported by solid services activity growth. Manufacturing output, however, remained in contraction.

Cost pressures rose in August with higher input cost inflation though the passthrough to selling prices was limited by efforts to drive sales particularly amongst goods producers.

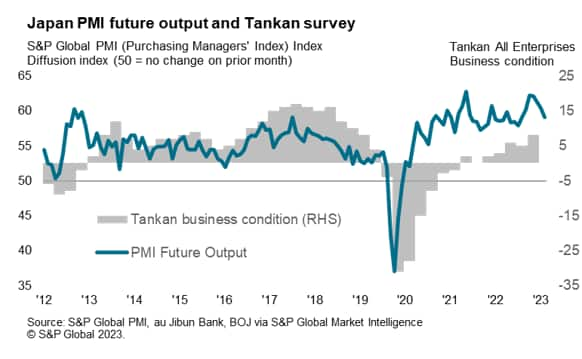

Overall business sentiment within the private sector remained positive in August, indicating optimism about the outlook for business activity. That said, the degree of business confidence declined further in August, reinforcing the likelihood that we have seen growth peak earlier in Q2.

Japan's flash PMI indicates growth continuing in August 2023

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, rose to 52.6 in August from 52.2 in July. Sustaining above the 50.0 no-change mark for the eighth straight month, the latest flash PMI reading indicated that Japan's private sector continued to expand midway into the third quarter. Although the pace of expansion inched up from July, it remained below the Q2 average to suggest that growth trended lower over the majority of Q3 so far.

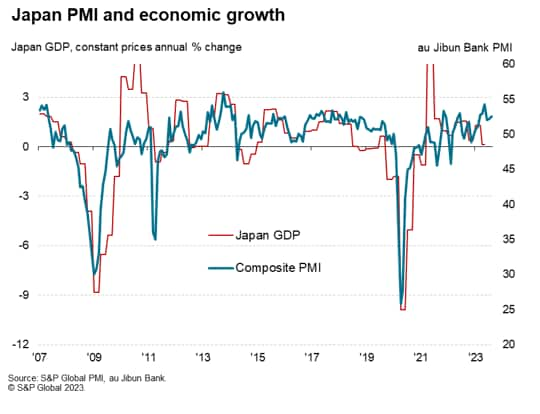

The service sector remained the key driver for growth in August as manufacturing output contracted for the third month in a row. The latest composite output reading, covering both sectors, is broadly consistent with GDP growing at a solid annual rate of around 2%.

Japan's economic growth remains services driven

The August flash PMI data revealed that services activity expanded at the fastest pace since May. Not only has this extended the growth streak recorded since September 2022, it is also the first time that the pace of expansion quickened since the recent peak in May. Furthermore, the rate of service sector new business growth accelerated, supported by better underlying demand notably in tourism, which bodes well for near-term output. However, we are cautious in over-reading into one month's data, especially with the service sector Future Activity Index having fallen lower again in August to suggest that companies themselves are sceptical of current strong demand growth persisting.

In contrast, Japan's manufacturing sector output remained in contraction according to the latest August flash PMI data. The latest decline marked the third consecutive month of factory output decline, albeit still at a marginal pace. A slower fall in new orders led to a corresponding reduced output decline. Likewise for overseas new business, orders for Japanese manufactured goods from abroad fell for the eighteenth consecutive month in August. This is while manufacturers' work-in-hand further depleted, pointing to an excess of capacity within the sector. Consequently, employment stayed unchanged in August, concluding the 28-month streak for workforce expansion among goods producers and contrasting with robust service sector net hiring.

Put together, the latest composite PMI data indicated that, while growth hastened, this masked the persistent divergence in sector performance over August. The gap in output performance persisted at the widest since April despite both manufacturing output and services activity indices having moved in the same direction in August.

Input cost inflation rises in Japan though selling prices increase at slower pace

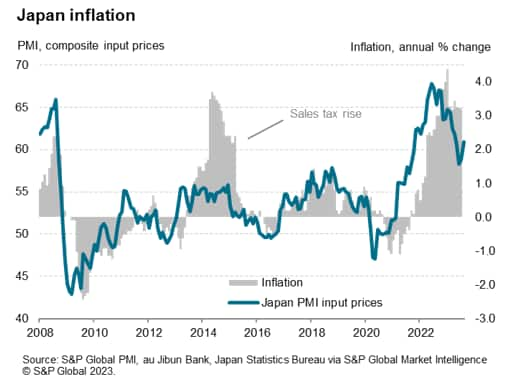

Meanwhile mixed inflation signals were received via the flash PMI release. Higher input cost inflation contrasted with a decline in output price inflation. The former stemmed from faster increase in costs across both the manufacturing and service sectors in August. Rising energy costs and currency conversion costs were frequently mentioned by Japanese firms as reasons for their shouldering of higher cost burdens.

However, firms were mixed in their ability to pass on these rising costs to clients. While stronger demand in the service sector enabled output price inflation to increase fractionally in August, manufacturers were limited in their efforts to raise prices as some absorbed the price increases to help sustain sales. The resultant impact is that overall composite output price inflation declined in August though remained elevated by historical standards.

That said, any sustained increase in costs may still lead to firms raising their selling prices to maintain margins. As such, when we look to the input cost gauge for guidance on the consumer price (CPI) trend, we observe the likelihood for inflation to stay relatively elevated later into the year. While not unexpected, this will be worth watching, given its implication for monetary policy formulation.

Future activity gauge point to slowing growth momentum in the near-term

Finally, the survey's only sentiment-based gauge, the Future Output Index - which also encapsulates important information on the expected trend for output in the next 12-months - edged lower for a fourth straight month in August. Despite private sector output rising at a moderately faster rate over the latest survey period, optimism among private sector firms was further pared back amid concerns over a resurgence in cost inflation and an uncertain economic outlook.

The latest data therefore continue to point to slower growth over the third quarter of 2023 after having seen a solid expansion in Q2, which will likely represent a recent peak.

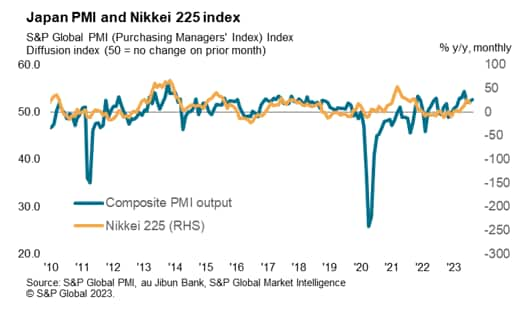

Meanwhile, for the Japanese equity market, which finds a broad correlation with PMI data, the latest PMI figures remain supportive of prices. Further upsides in the near-term may nevertheless be limited given the trend for private sector expansion thus far into the second half of 2023.

Access the press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-economic-growth-quickens-in-august-as-service-sector-counters-factory-decline-aug23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-economic-growth-quickens-in-august-as-service-sector-counters-factory-decline-aug23.html&text=Japan%27s+economic+growth+quickens+in+August+as+service+sector+counters+factory+decline+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-economic-growth-quickens-in-august-as-service-sector-counters-factory-decline-aug23.html","enabled":true},{"name":"email","url":"?subject=Japan's economic growth quickens in August as service sector counters factory decline | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-economic-growth-quickens-in-august-as-service-sector-counters-factory-decline-aug23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan%27s+economic+growth+quickens+in+August+as+service+sector+counters+factory+decline+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-economic-growth-quickens-in-august-as-service-sector-counters-factory-decline-aug23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}