Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 24, 2018

Italian fiscal stress scenario triggers domestic recession

Stress Scenario Assumptions

- The Italian stress scenario assumes that the Lega and the Five Star Movement coalition government presents expansive budgets for both 2019 and 2020, which rattles bond markets and rating agencies, leading to acute financial market turbulence.

- This uncertainty triggers a change in government during 2020, which begins to repair the damaged fiscal accounts at a time when Italy is in moderate recession.

- The scenario assumes some negative impact on the rest of the eurozone, particularly Spain and Portugal, but the impact will be less pronounced when compared with the last major sovereign debt crisis in 2010-13.

Key findings

- The stress scenario assumes that the new coalition government lasts at least two years, and includes the 2019 budget parameters and presumes another expansive fiscal plan for 2020. This contrasts to our current baseline, which assumes that the government folds in late-2019 as a result of increasing financial market stress after trying to flout European Commission budgetary rules for a second time in late-2019.

- The stress scenario assumes an additional public sector borrowing requirement of EUR24.8 billion in 2019 and EUR62.7 billion in 2020 compared to the May baseline that preceded the formation of the populist government.

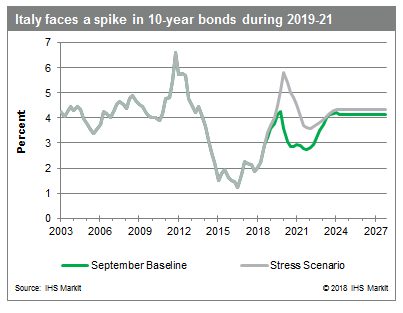

- The resulting financial turbulence lifts sovereign borrowing costs, with its 10-year bond yield on the secondary market climbing to 5.8% during the first quarter of 2020.

- The more expansive fiscal stance in the stress scenario delivers a temporary lift to growth in early 2019, before uncertainty and the resulting rapid and deep fiscal consolidation pulls back growth before finally tipping Italy into a modest recession.

- Domestic financial institutions will remain a major source of a demand for Italian sovereign debt, and they will continue to show "home bias", particularly at a time of acute stress.

- A period of uncertainty followed by economic contraction reverses the recent fall in non-performing loans (NPLs) by damaging domestic bank loans that are just performing.

- Increased uncertainty and financial market turbulence due to Italian political and fiscal developments will adversely affect financial and economic conditions in the eurozone, particularly via weaker investment. However, the spill-over effects onto other member states and the eurozone overall should be less pronounced than 2010-13.

Significant damage to the general government fiscal accounts in the stress scenario

In the stress scenario, we anticipate the fiscal shortfall will overshoot the government's target and stand at 3.0% of GDP in 2019 for the following reasons.

- The new coalition government lacks experience, and we suspect fiscal indiscipline could be entrenched given the sizeable policy differences between its coalition parties and a now weakened Economy Minister.

- The damaging gulf between the Economy Minister Tria and the leading lights of the coalition parties is highlighted by recent statements about pursing fiscal policy free of interference from the European Commission. Indeed, Salvini has questioned whether the EU has a consistent approach to fiscal indiscipline from other member states. He argues that France and Spain have been allowed to run deficits above 3% of GDP, but it appears to be a greater problem when Italy wants to lift its fiscal shortfall towards the upper limit to boost economic growth and provide more income support for Italian consumers.

- The official near-term growth projections sit above our more sober assessment. We are increasingly concerned about the strength of the upturn, and expect GDP growth to slow to 0.8% in 2019 and 0.6% in 2020 from an estimated 1.1% in 2018.

Larger general government fiscal balance in the stress scenario | |||

May baseline | September baseline | Stress scenario | |

Euros | |||

2018 | -40.8 | -39.2 | -34.6 |

2019 | -30.7 | -65.0 | -54.4 |

2020 | -16.6 | -53.6 | -76.2 |

2021 | -17.7 | -35.2 | -47.6 |

Percent of GDP | |||

2018 | -2.3 | -2.2 | -2.0 |

2019 | -1.7 | -3.6 | -3.0 |

2020 | -0.9 | -2.9 | -4.2 |

2021 | -0.9 | -1.9 | -2.6 |

Source: IHS Markit © IHSMarkit 2018 | |||

The timeline of the unfolding sovereign debt crisis in the stress scenario continues to evolve in 2019 and consists of:

- The Italian government ignores the demands from the Commission in late-2018 to rein back its unfunded stimulus measures in its 2019 budget plan.

- The stress scenario assumes that the VAT safeguard clause hike (from 22.0% to 25%) is not activated during 2019.

- Italy brushes aside previous general government budget deficit target of 0.8% of GDP in 2019 and a balanced budget by 2020.

- The pressure will intensify during 2019 with bond markets and rating agencies increasingly fearful that Italy is set to agitate for another expansive fiscal plan for 2020.

- Italy presents another expansive budget plan for 2020 in late-September 2019, focusing on a more radical tax cutting agenda, which is predominately unfunded.

- The above events trigger a steep climb in Italian sovereign borrowing costs, with its 10-year bond yield peaking at an average of 5.8% during the first quarter of 2020.

The spread between the Italian 10-year yield and the German equivalent widens to 4.9 percentage points by early 2020 and German 10-year yield estimated at 0.9%). This compares with a spread of 5.2 percentage points in November 2011, the height of Italy's last sovereign debt crisis, when the German 10-year bond yield stood at 1.8%.

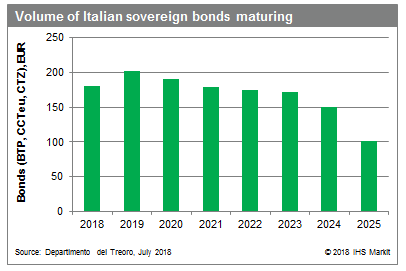

Italy faces a heavy sovereign debt redemption schedule during 2019-21

The stress scenario assumes higher sovereign debt funding costs, which will receive additional traction from the strong likelihood that the main rating agencies will downgrade Italy's long-term credit worthiness. More elevated sovereign borrowing costs in the stress scenario are ill-timed with Italy facing a heavy schedule of sovereign debt redemptions in 2019-20. The stress scenario implies that maturing bonds and treasury bills will be rolled over at notably higher interest rates when compared with the yields attached on the maturing debt.

The stress scenario assumes the country's treasury will have to offer yields in excess of 5% to place 10-year bonds in late-2019 and most of 2020. Higher sovereign borrowing costs imply a step-up in general government interest expenditure, hitting a historical high in excess 6% of GDP from late-2020.

The key threat is that domestic financial institutions are increasingly reluctant to step up their demand for BTP bonds in the face of a sell-off at the height of crisis in the stress scenario. The risk is that their large exposure to Italian sovereign debt alongside falling bond prices damages their core capital ratios. In addition, with European Central Bank's (ECB's) net purchases of sovereign bonds set to terminate at end-2018 alongside foreign investors limiting their exposure to Italian bonds, domestic investors will have to step up.

But the stress scenario assumes domestic investors will be the marginal buyer for Italian sovereign debt holds. Critically, the scenario assumes solid bid-to-cover ratios (a measure of investor demand) in auctions of Italian bonds and treasury bills during the height of the crisis. We assume the following supports:

Domestic financial institutions will remain a major source of demand for Italian sovereign debt, and Italian banks will continue to show "home bias", particularly at a time of stress. Italian banks will continue to favor the country's bonds in the stress scenario, attracted by the higher yields, which are risk-free barring a state default.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fitalian-fiscal-stress-scenario-triggers-domestic-recession.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fitalian-fiscal-stress-scenario-triggers-domestic-recession.html&text=Italian+fiscal+stress+scenario+triggers+domestic+recession+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fitalian-fiscal-stress-scenario-triggers-domestic-recession.html","enabled":true},{"name":"email","url":"?subject=Italian fiscal stress scenario triggers domestic recession | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fitalian-fiscal-stress-scenario-triggers-domestic-recession.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Italian+fiscal+stress+scenario+triggers+domestic+recession+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fitalian-fiscal-stress-scenario-triggers-domestic-recession.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}