Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 30, 2020

Holiday shopping outlook is positive despite damper from COVID-19

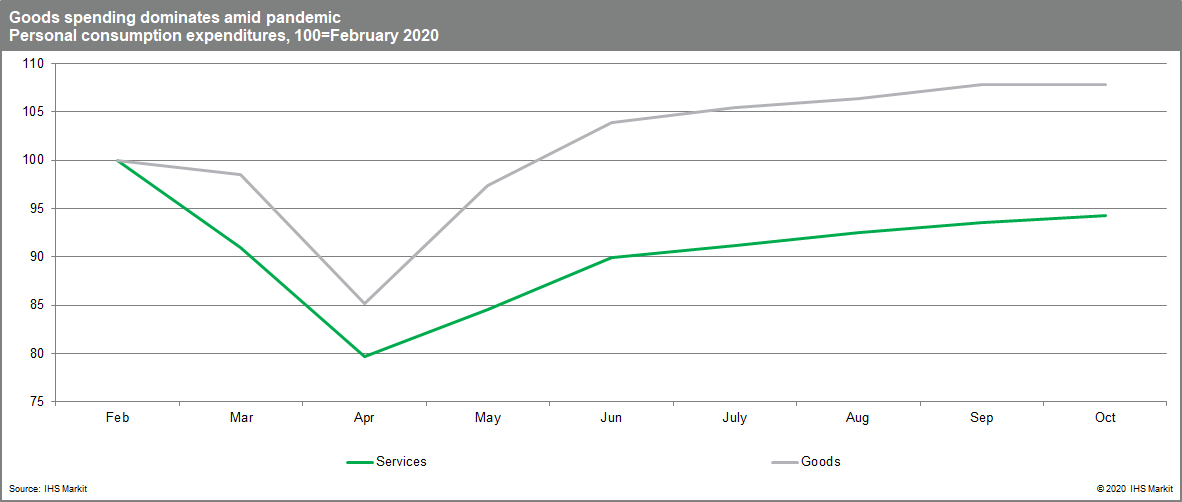

If the typical holiday shopping season was not already stressful enough, navigating the season during the COVID-19 pandemic is sure to heighten anxiety levels for retailers and consumers alike in 2020. It has already been a devastating year, both from a humanitarian perspective and for the global economy. But US consumers have found a way to spend money amid the chaos and retail has been a key beneficiary of a widespread shift in spending from services to goods.

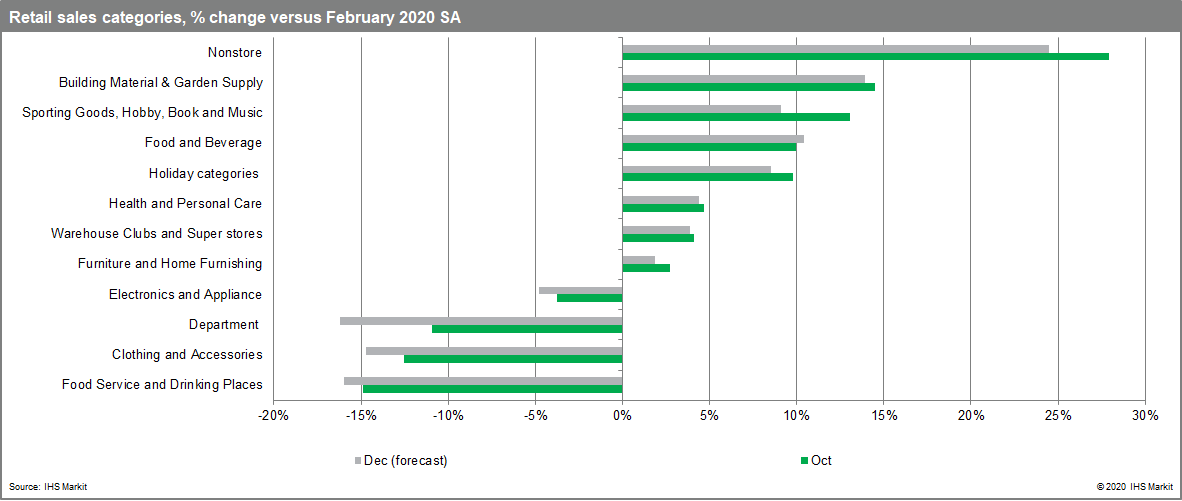

Total retail sales (excluding food services) through October were

7.7% above the February pre-pandemic level, in stark contrast to

the 5.8% deficit for nominal personal consumption expenditures on

services over the same period. Even within retail categories, the

chasm between "winners" and "losers" is striking. On one end of the

spectrum, sales at nonstore retailers were up 28% from February in

October; at the other extreme, sales at clothing & accessory

stores were down 13%. These sharp contrasts are borne out of

consumer apprehension to engage in socially dense spending

activities as well as the containment measures meant to curtail

such activities. For retailers, this holiday season is either going

to be one to remember or one to forget, depending on how the

pandemic has impacted sales in that industry.

Holiday sales promotions have been

rolling out earlier and earlier each year, diminishing the

importance of the traditional Black Friday/Cyber Monday sales

events and pulling sales forward as early as September. This year,

because of the pandemic, Amazon moved its Prime Day sales event

from July to mid-October and it served as an unofficial kick-off to

the holiday shopping season. We forecast that online holiday sales

will grow 28.1% over last year, compared to the 16.1% rate in 2019

which was the strongest growth since 2004. The expected growth this

year would bump the online share of total holiday retail sales

roughly four percentage points from 21% to 25%—a rate of

increase three times the average since 2015. Online sales were

already destined for continued growth but the pandemic has

accelerated the market penetration rate about three years ahead of

schedule.

Holiday sales promotions have been

rolling out earlier and earlier each year, diminishing the

importance of the traditional Black Friday/Cyber Monday sales

events and pulling sales forward as early as September. This year,

because of the pandemic, Amazon moved its Prime Day sales event

from July to mid-October and it served as an unofficial kick-off to

the holiday shopping season. We forecast that online holiday sales

will grow 28.1% over last year, compared to the 16.1% rate in 2019

which was the strongest growth since 2004. The expected growth this

year would bump the online share of total holiday retail sales

roughly four percentage points from 21% to 25%—a rate of

increase three times the average since 2015. Online sales were

already destined for continued growth but the pandemic has

accelerated the market penetration rate about three years ahead of

schedule.

Consumer psyche remains a key question mark this holiday season as the pandemic has impacted everyone differently. The spiking number of cases ahead of the holidays and associated containment measures will deter some in-person shopping, as will uncertainty about the slowing economic recovery and questions about whether additional fiscal stimulus is likely. On the plus side, recent news about successful vaccine trials provides a light at the end of tunnel that could ignite a sense of optimism. Moreover, home prices and equity markets are shooting higher and providing a positive wealth effect for asset owners. This should provide enough optimism to make this a successful holiday season for retail sales.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fholiday-shopping-outlook-positive-despite-damper-covid19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fholiday-shopping-outlook-positive-despite-damper-covid19.html&text=Holiday+shopping+outlook+is+positive+despite+damper+from+COVID-19+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fholiday-shopping-outlook-positive-despite-damper-covid19.html","enabled":true},{"name":"email","url":"?subject=Holiday shopping outlook is positive despite damper from COVID-19 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fholiday-shopping-outlook-positive-despite-damper-covid19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Holiday+shopping+outlook+is+positive+despite+damper+from+COVID-19+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fholiday-shopping-outlook-positive-despite-damper-covid19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}