Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 27, 2018

Holiday sales to bring plenty of cheer to US retailers this year

Job market driving the holiday retail sales outlook; tax cuts not providing as much lift

The job market is grasping the reins of this year's holiday retail sales outlook with a sturdy grip. The unemployment rate is the lowest it has been since 1969 and wage growth is finally spreading to more job-holders. Job security among Americans and their willingness to change jobs is also elevated. These labor market improvements are contributing to the heightened consumer mood. In addition to these positives, the sharp decline in retail gasoline prices over the last few weeks will give consumers more spending money over the holidays. Reliable consumer fundamentals are the key ingredient for a bright holiday retail sales outlook.

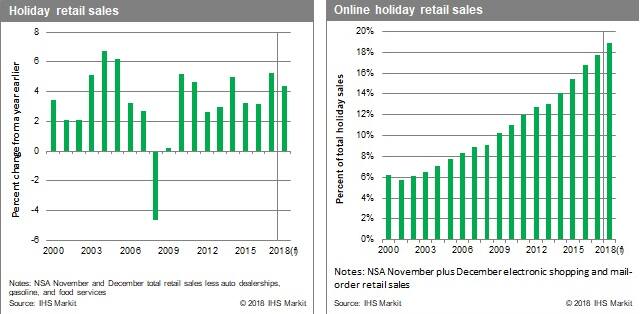

The initial sugar rush from personal income tax cuts began late last year, as consumers anticipated the benefits of lower tax rates before they went into effect in January. This propelled 2017 holiday sales to the strongest performance since 2005 at 5.3% year-over-year growth, setting a high bar for holiday sales this year. Through mid-2018, this surge in spending was especially large at restaurants, where it has since reversed in the last few months-perhaps an indication that tax-cut exuberance is fizzling. Retail sales in key holiday categories have also recently been soft, making it unlikely that holiday sales growth will suddenly accelerate in year-over-year terms.

Financial market turbulence may dampen holiday spirit

Financial market volatility, and particularly losses in equity markets, is a risk to the consumer outlook and could be a tangible restraint on holiday retail sales. The S&P 500 has essentially erased the entirety of its 2018 gains in the past six weeks amid heightened volatility. Just as stock price increases that accumulated during the first nine months of 2018 likely boosted consumer activity over that period, the recent pullback may cause shoppers to think twice before making large purchases or upgrading from generic to luxury brands this season.

As markets mull over a more negative risk profile-including the prospect for faster interest rate increases, fading tax stimulus, a downtrodden housing market, tariff escalation, and other geopolitical tensions-it would not be surprising if this turbulence continued over the holiday shopping season. This will catch the eyes of some shoppers, although it will not likely be disruptive enough to cause a major panic in consumer confidence. Nonetheless, sporadic market selloffs will negatively influence higher-income consumers who have a larger share of their wealth in financial markets. And since this is happening in a rising interest-rate environment, auto sales and other big-ticket purchases that rely on financing stand to take the brunt of the hit. The good news is that high-income households most impacted by the stock market selloff received the largest tax breaks, which will soften the blow for these households.

32 days of Christmas

The 2018 calendar sets up nicely for retailers, as it gives holiday shoppers ample opportunity to get their gift-buying done with time to spare. Since Thanksgiving Day falls on its earliest possible date of 22 November, that leaves the maximum 32 shopping days (including five full weekends) between then and Christmas. That means some consumers will have an extra paycheck or more to work with ahead of the holidays. This alone will be a slight boost for holiday sales numbers.

Retailers are advertising discounts earlier than in the past. Holiday promotions began as early as October, so some "holiday sales" have already occurred and will not be captured in the official numbers given our definition. Similarly, historically important shopping days such as Gray Thursday, Black Friday, and Cyber Monday are less of an extravaganza than they were in the past, as shoppers can easily find deals outside of this timeframe. Much of this is owed to the growing accessibility of e-commerce and mobile shopping; retailers have realized that to compete for sales, they need to offer discounts early and often. Online holiday retail sales will continue to outperform other channels, as their share of total holiday retail sales will grow to 18.9% from 17.8% last year.

Wrapping up

US consumers have the confidence and ability to spend well this holiday season, thanks to a strong job market and mild tailwinds from lower gasoline prices. They will have no shortage of opportunities, given that discounts are already available and will be for five weeks leading up to Christmas.

That said, the psychological and tangible benefits of the 2017 tax cuts may be starting to fade, as evidenced by weak core retail sales in the past few months. Additionally, consumers may be spooked by negative financial market developments, including rising interest rates and stock market declines. This could be enough to make 2018 a good year instead of a great year for retailers. Taking all this into consideration, we have lowered our holiday retail sales forecast from 4.7% to 4.4% growth. These headwinds would have a much bigger impact if the economy were not doing as well as it currently is-employment and incomes are rising strongly enough to overshadow mild drag from an erratic stock market and waning tax stimulus.

Note: We define holiday retail sales as not-seasonally-adjusted November plus December total retail sales excluding automobile dealerships, gasoline stations, and food services. We define online holiday retail sales as not-seasonally-adjusted November plus December electronic shopping and mail-order retail sales.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fholiday-sales-bring-plenty-cheer-us-retailers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fholiday-sales-bring-plenty-cheer-us-retailers.html&text=Holiday+sales+to+bring+plenty+of+cheer+to+US+retailers+this+year+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fholiday-sales-bring-plenty-cheer-us-retailers.html","enabled":true},{"name":"email","url":"?subject=Holiday sales to bring plenty of cheer to US retailers this year | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fholiday-sales-bring-plenty-cheer-us-retailers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Holiday+sales+to+bring+plenty+of+cheer+to+US+retailers+this+year+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fholiday-sales-bring-plenty-cheer-us-retailers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}