Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 16, 2018

Go-slow exit for ECB

- The recent growth slowdown reinforces the case for a further extension of the asset purchase program (APP) beyond September this year.

- Consistent with the ECB's forward guidance, policy rate hikes will only occur "well beyond" the end of net asset purchases.

- Persistent low core inflation, uncertainty over the degree of slack in the economy and sensitivity to tighter financial conditions all point to a cautious approach to unwinding unconventional measures.

- The departure of Mario Draghi and other key members of the Executive Board by early 2020 implies longer-term uncertainty over the ECB's reaction function.

Predicting the timing, magnitude and sequencing of the ECB's exit from its array of unconventional policy measures is no easy task. Still, on the issue of sequencing at least, the ECB's forward guidance has been comparatively reliable (unlike some other European central banks we could mention). It has also been effective in limiting upward pressure on market interest rates, supporting the economic expansion.

Specifically, the ECB expects policy rates to remain at their present levels "for an extended period of time" and "well past the horizon" of net asset purchases. In broad terms, therefore, it is following the Fed's template. The focus of attention near-term will be net asset purchases, currently scheduled to continue at a rate of EUR30 billion per month until September this year "or beyond, if necessary". Heightened uncertainty over the economic outlook is reinforcing the strategic arguments favoring an extension beyond September.

There are practical limits on how far the ECB can go, however. These relate primarily to scarcity issues due to the capital-key-based approach to the public sector purchase programme (PSPP). Our base case is still for a "short taper", probably concluding in December this year. An extension out to spring 2019 is feasible though if the fog over the economy fails to lift. Either way, the focus will shift before long to reinvestments of maturing assets. This we expect to continue for several years yet.

The ECB's intentions for the APP beyond September could be revealed as soon as the next policy meeting on 14 June. However, we think it more likely that an announcement will follow at the subsequent policy meeting on 26 July. In periods of uncertainty, extra time is helpful. The publication of the account of April's policy meeting later this month will be scrutinized for any pointers.

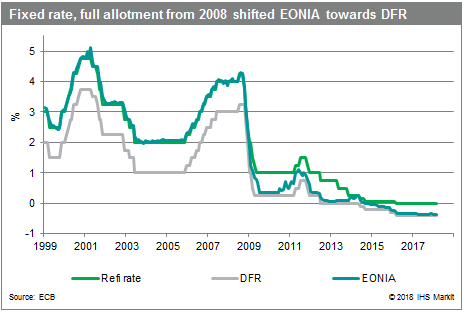

The conclusion of net asset purchases will of course influence markets' expectation of when policy rates will start to rise. Our baseline scenario is a first hike in June 2019. We expect this to take the form of a less negative deposit facility rate (DFR). In part, this is to rectify the unusual asymmetry in the ECB's policy rate corridor due to the zero lower bound on the refinancing rate. It will also reduce the direct cost of negative rates to the banking sector which has increased markedly due to the surge in excess reserves stemming from the APP.

The adverse impact of negative interest rates on the financial sector was outweighed in the past by the need to use whatever policy ammunition was available to try to ward off the deflationary threat. Now those deflation risks have "vanished", to quote the ECB, the case for maintaining such a negative level of rates is less convincing.

Still, the ECB's forward guidance leaves plenty of room for interpretation when it comes to how long the gap might be between the end of net asset purchases and the onset of rate hikes. A delay beyond mid-2019 is certainly possible should the economy stutter and/or financial conditions tighten significantly, jeopardizing the prospect of delivering on-target underlying inflation over the medium-term.

The risk of tighter financial conditions through the exchange rate channel has recently diminished given the resurgence of the US dollar. But in trade-weighted terms the euro is vulnerable to further appreciation should weakness in emerging market currencies persist. A populist government in Italy and policies which flout the EU's budgetary rules is another potential source of tightening via higher sovereign yields and risk premia more generally.

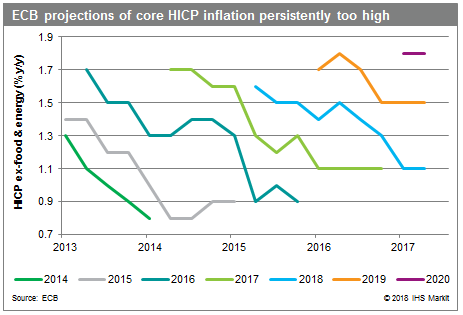

For a variety of reasons, the ECB under Mario Draghi's stewardship will pursue a very cautious approach to policy normalization. These include in particular the considerable uncertainty over the degree of slack in the economy, flatter Phillips curves and the consequent outlook for underlying inflation. Traditional inflation forecasting models have fared poorly due to various structural changes inside and outside the Eurozone. Having repeatedly over-predicted core HICP inflation, the ECB will want to see convincing evidence of a durable upward trend.

By November 2019, of course, there will be a new sheriff in town, generating longer-term uncertainty over the ECB's reaction function. Moreover, it's not just Draghi who will stand down over the next couple of years. Another three key members of the Executive Board will be gone by early 2020. The next president (the subject for a future blog) is unlikely to embark on a radically different policy path to his predecessor shortly after taking the reins and given the inflation backdrop, we would still expect a rather pedestrian normalization of policy rates. Nonetheless, this may not stop financial markets speculating to the contrary.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgoslow-exit-for-ecb.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgoslow-exit-for-ecb.html&text=Go-slow+exit+for+ECB+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgoslow-exit-for-ecb.html","enabled":true},{"name":"email","url":"?subject=Go-slow exit for ECB | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgoslow-exit-for-ecb.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Go-slow+exit+for+ECB+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgoslow-exit-for-ecb.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}