Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 29, 2017

Global sovereign risk snapshot Q3 2017

Key sovereign rating highlights in Q3 2017

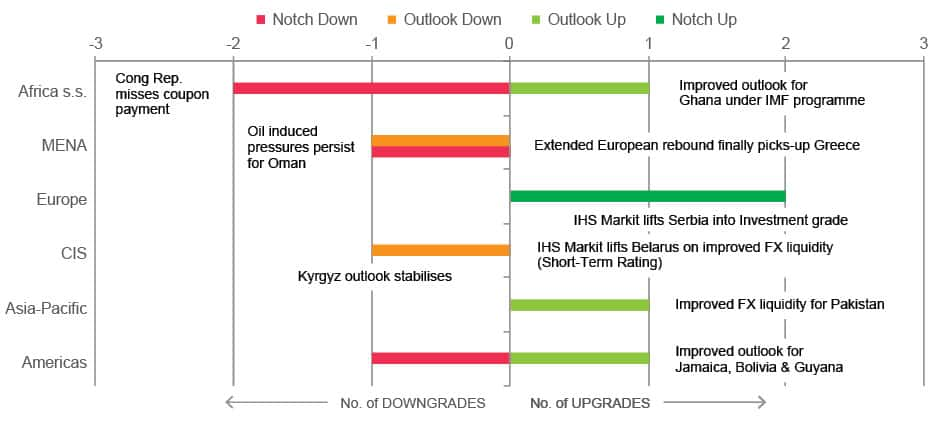

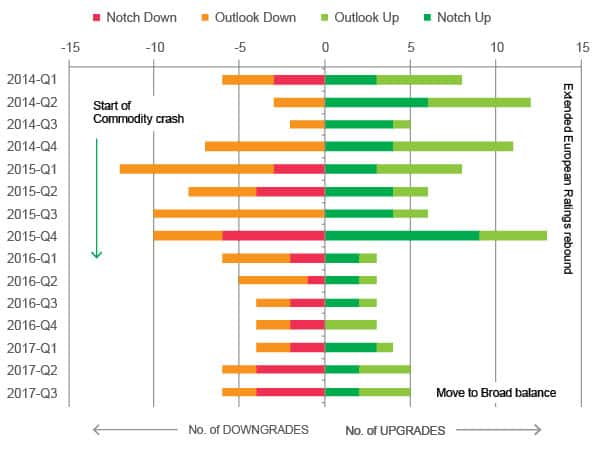

In the 3rd quarter of 2017, commodity-related downgrades continue to abate, but commodities still place negative pressures on the balance of payments of those countries late in adopting remedial policy measures. Europe further extended its upgrade gains, again taking nearly half of all global positive rating actions. Despite political uncertainty, Europe’s economic growth continues.

Global sovereign risk ratings

- Chile’s robust investment grade ratings loses its shine

- China and related sub-sovereigns downgraded on rising contingent risk concerns

- Outlooks begin to improve in the CIS for Belarus, Georgia, Kazakhstan, and Ukraine

- The Dominican Republic remains a bright spot in Latin America, while risks have eased for Mexico

- Israel remains a bright spot in the Middle East

Extended European ratings rebound continues

- Despite ongoing simmering political risks over Brexit, Catalonia, Hungary and Poland, the Eurozone and Eastern Europe continue to see economic strength and ongoing rating upgrades

- IHS Markit October Eurozone Manufacturing PMI was the second-highest in over 17 years; year-to-date growth in 2017 has been the strongest since 2000

- Serbia rating upgraded into lowest Investment grade by IHS Markit

- United Kingdom was the sole downgrade in Europe in Q3 as concerns over protracted Brexit negotiations grew

IHS Markit Eurozone Manufacturing PMI

Regional ratings changes in Q3 2017

- The global balance of all sovereign rating actions turned positive again in the third quarter of 2017 at 41 to 30.

- These results are the first time the trend balance has turned net positive in more than two years since the start of the commodity slide and the end of the commodity super-cycle that had ravaged many commodity dependent sovereign credits.

Rating changes for 2014 Q1 to 2017 Q3

The global balance of all sovereign rating actions turned positive again in the third quarter of 2017 at 41 to 30.These results are the first time the trend balance has turned net positive in more than two years since the start of the commodity slide and the end of the commodity super-cycle that had ravaged many commodity dependent sovereign credits.

The Sovereign Risk Service covers both short- and medium-term risks for 206 countries worldwide. It utilizes transparent sovereign risk ratings when assessing credit worthiness and trade credit risk and enables the comparison of IHS Markit ratings to the ratings of other agencies.

Jan Randolph is an Economist and expert for IHS Markit’s Risk Centre and heads the Sovereign Risk services.

Posted 29 November 2017

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-sovereign-risk-snapshot-q3-2017.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-sovereign-risk-snapshot-q3-2017.html&text=Global+sovereign+risk+snapshot+Q3+2017","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-sovereign-risk-snapshot-q3-2017.html","enabled":true},{"name":"email","url":"?subject=Global sovereign risk snapshot Q3 2017&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-sovereign-risk-snapshot-q3-2017.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+sovereign+risk+snapshot+Q3+2017 http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-sovereign-risk-snapshot-q3-2017.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}