Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 04, 2024

Global PMI data point to stalled descent of inflation

Average prices charged for goods and services rose globally at an unchanged rate in December, according to the worldwide PMI surveys, meaning selling price inflation has remained largely steady at an elevated rate by historical standards over the past seven months.

Such stickiness of selling price data adds to evidence that policymakers will be concerned that consumer price inflation rates may struggle to reach their 2% targets in the near term.

Global prices rise at faster rate

S&P Global's PMI surveys, covering approximately 30,000 companies across 40 economies, recorded a further marked rise in average prices charged for goods and services at the end of 2023.

Although the pace of inflation remained among the weakest recorded over the past three years, the latest index reading of 53.5 continued to run considerably hotter than the ten-year pre-pandemic average of 51.2.

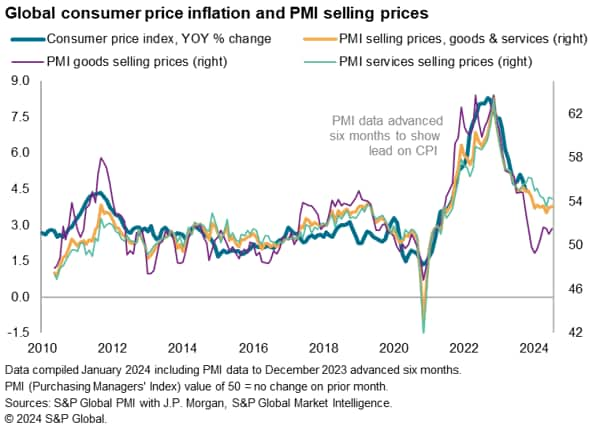

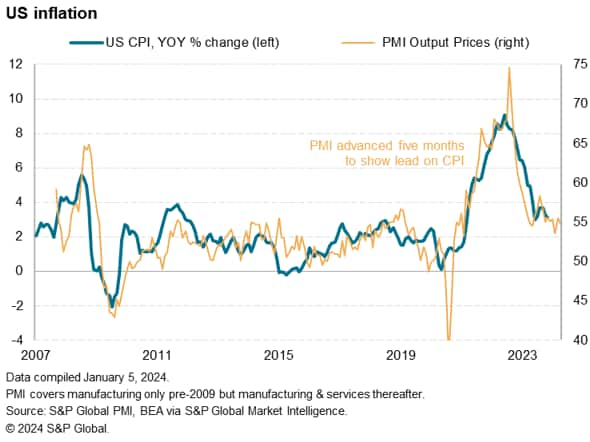

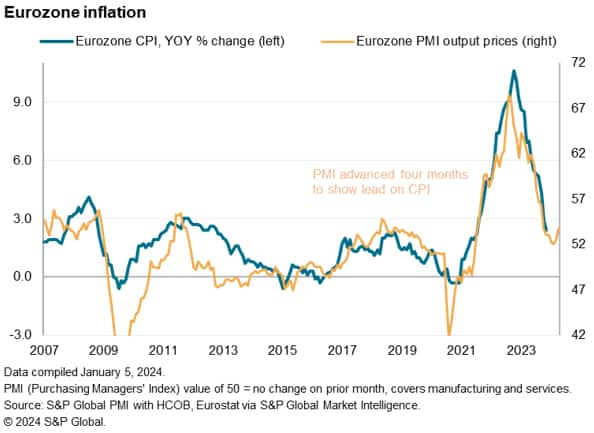

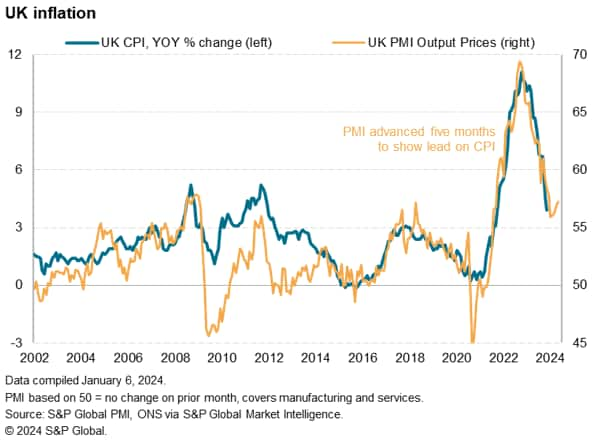

The leading-indicator properties of the PMI correctly anticipated the cooling of global inflation in 2023, which fell from a peak of 8.3% back in September 2022 to 4.4% last October. Some further progress in bringing inflation down is signalled for the coming months, to around 3.5%, though that compares with a pre-pandemic ten-year average of 2.6%.

The global PMI's selling price index has now been stuck in a range of 53.0 to 53.7 over the past seven months. With any reading above 50 signaling a rise in prices on the prior month, these index levels point to stubborn global inflation around to 3-4% mark.

Average selling price inflation for goods has fallen below its long-run average, reflecting healed supply chains, inventory reduction and recent falls in oil prices, though the disinflation impact of 2022 appears to have passed. The rate of goods price inflation in fact even ticked slightly higher in December.

The rate of price increase has meanwhile remained elevated by historical standards in the service sector, albeit having cooled slightly further in December.

Wage pressures and higher shipping costs feed inflation

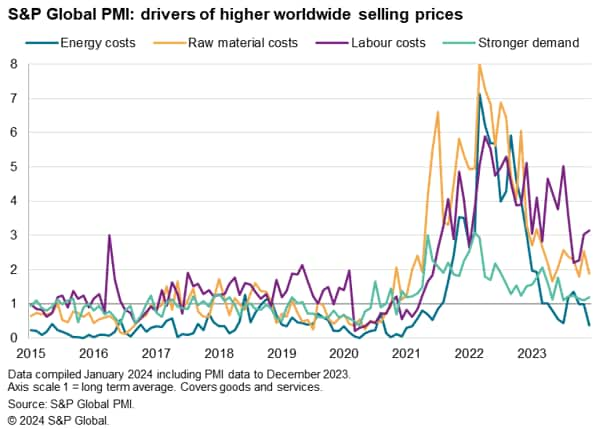

Looking at the most widely cited factors as having driven prices higher, labour costs remained the most commonly reported cause in December, with the incidence of wage-push price hikes rising to a four-month high (yet running well below recent highs in both manufacturing and services).

Energy was again the strongest disinflationary price force, linked to lower oil prices.

Demand-pull inflationary forces remained subdued by historical standards, running just above the long run average. Lower final demand has eroded pricing power from manufacturers in particular, though upward demand pressure on prices in the service sector have also fallen close to their long-run average in recent months.

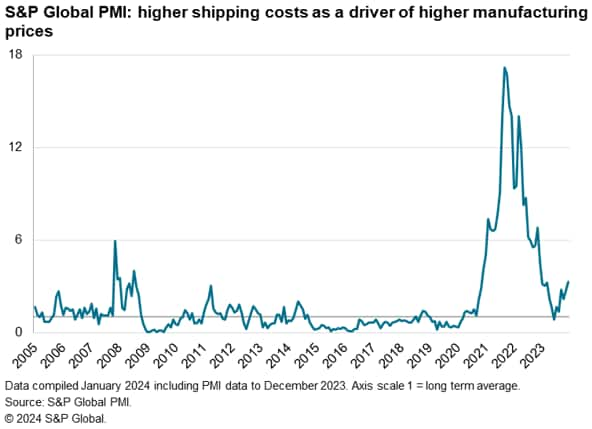

Upward pressure on prices from raw materials eased somewhat in December, albeit running above the survey's long run average. Higher input prices were increasingly linked to more expensive shipping costs, in turn often attributed to supply chain issues in the Panama Canal and Red Sea.

Upward price pressures on goods from shipping related issues have consequently hit the highest since 2008 if the pandemic months are excluded.

Harder last mile

Thus, while inflation pressures remain well off their levels of a year ago, the PMI price gauges provide further evidence that the "last mile" in the fight to get inflation consistently down to 2% targets generally looks hard to achieve. New orders inflows will help assess upcoming demand-pull inflation pressures, but supply-side factors also need watching, notably in terms of shipping and supply chains.

Access the Global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-data-point-to-stalled-descent-of-inflation-jan24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-data-point-to-stalled-descent-of-inflation-jan24.html&text=Global+PMI+data+point+to+stalled+descent+of+inflation+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-data-point-to-stalled-descent-of-inflation-jan24.html","enabled":true},{"name":"email","url":"?subject=Global PMI data point to stalled descent of inflation | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-data-point-to-stalled-descent-of-inflation-jan24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+data+point+to+stalled+descent+of+inflation+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-data-point-to-stalled-descent-of-inflation-jan24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}