Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 15, 2024

Global economic outlook: October 2024

Learn more about our data and insights

Our global economic outlook continues to be centered on gradually moderating inflation, more widespread monetary policy easing and, consequently, a soft landing. This assessment is vulnerable to a multitude of risks, including geopolitical developments such as conflict escalation in the Middle East and potential policy shifts following the US elections in early November. The additional fiscal stimulus in mainland China is likely to mitigate another key downside risk to global growth. Still, the scale and timeline of the measures are yet to be fully fleshed out and appear to be oriented toward public investment rather than household spending.

Futures markets now anticipate a less rapid pace of near-term rate cuts in the US. At the time of writing, about 65 basis points of cuts by the US Federal Reserve are priced in by January 2025, down from over 100 basis points shortly after mid-September's initial cut. Futures markets expect a similar amount of easing by the European Central Bank over the same period. These expectations look reasonable, with our base case now for two cuts of 25 basis points by both central banks before year-end. As expected, policy rate cuts have become more widespread since the bold start to the Fed's easing cycle, although monetary policy prospects are not uniform given differences in inflation rates, labor market conditions and currency dynamics. The tightening in Brazil is a case in point, and we expect more rate hikes there before year-end.

S&P Global's Purchasing Managers' Index™ (PMI®) data continue to flag deteriorating prospects for the manufacturing sector. Output, new orders and employment indexes remained in contraction territory in September, along with the new export orders index, which continued to indicate weaker global trade dynamics during the second half of the year. The more widespread and protracted the weakness in manufacturing, the greater the likelihood of spillovers to other areas. On the positive side, the contagion to the service-sector PMIs has been limited to date, although the global PMI's composite output index has slipped to its lowest level in eight months.

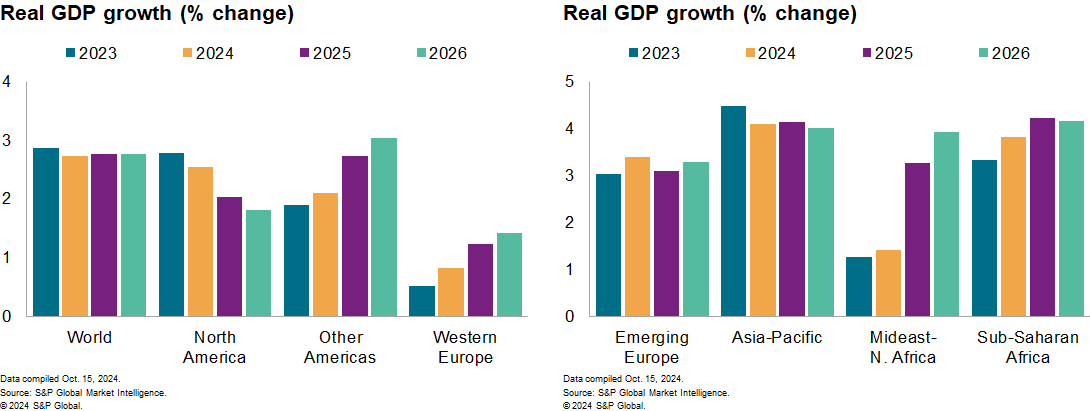

Revisions to our near-term growth forecasts have diverged in our October update. Weakness in manufacturing and trade has driven the downgrades to our real GDP growth projections for Western Europe in 2024 and 2025, with Germany now expected to enter a technical recession in the second half of this year. Conversely, the annual real GDP growth forecasts for 2025 have been revised upward for the US, Brazil, India and Russia, partly owing to carry-over effects due to recent strong data. The net result is a slight uptick in our global growth forecast for 2025, from 2.7% to 2.8%, although this is partly a rounding effect. On a quarter-over-quarter basis, global growth is expected to lose a little momentum from mid-2024.

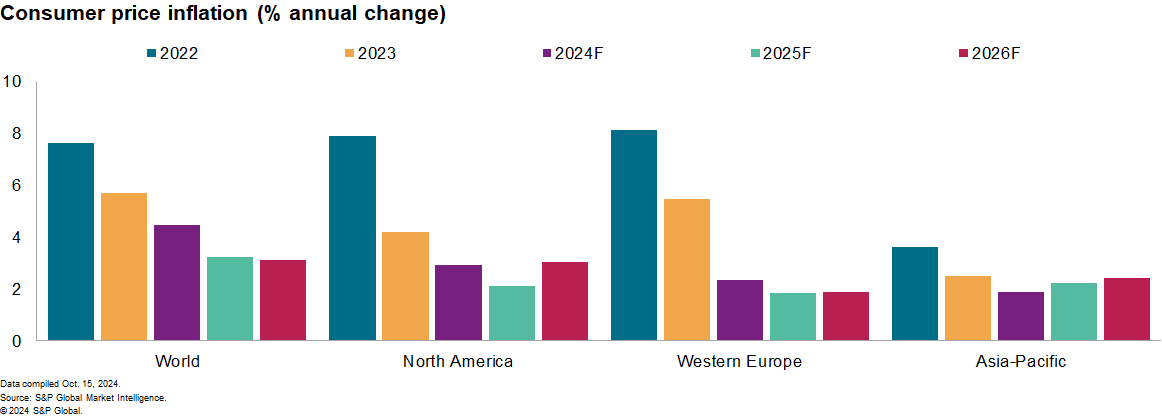

Disinflation in goods has continued, while broader price signals have been mixed. The consumer price inflation rate for core goods in the Group of Five economies remained negative for the fifth straight month in August, and various indicators suggest that goods price pressures will stay subdued in the period ahead. These indicators include S&P Global's PMI and the ongoing deflation in producer prices in mainland China. Still, crude oil prices have rebounded, owing to developments in the Middle East, and service inflation rates, while generally below their pandemic-driven peaks, remain comparatively elevated. Consumer price inflation rates are generally still forecast to decline gradually, with our global forecast for 2025 revised slightly lower to 3.2% in October's update, primarily reflecting downward adjustments in North America.

Hear our economists discuss the potential for an industrial upcycle in Europe

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-october-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-october-2024.html&text=Global+economic+outlook%3a+October+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-october-2024.html","enabled":true},{"name":"email","url":"?subject=Global economic outlook: October 2024 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-october-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economic+outlook%3a+October+2024+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-october-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}