Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 23, 2024

Flash UK PMI signals solid economic growth and further downshifting of inflation

The September PMI data bring encouraging news, with solid economic growth being accompanied by a cooling of selling price inflation. The data therefore hint at a 'soft landing' for the UK economy, whereby the fight against inflation is showing increasing signs of being won without higher interest rates having caused a downturn.

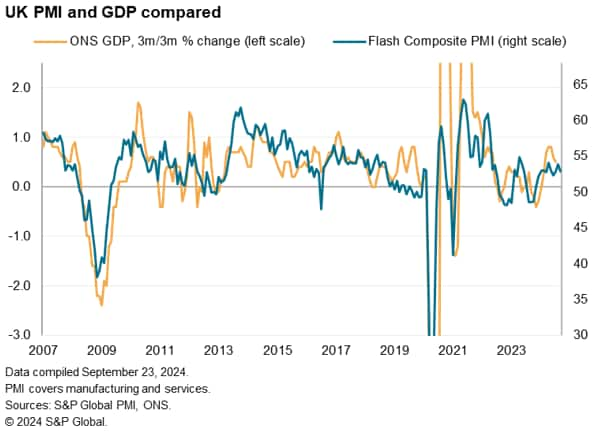

A slight cooling of output growth across manufacturing and services in September should not be seen as too concerning, as the survey data are still consistent with the economy growing at a rate approaching 0.3% in the third quarter, which is in line with Bank of England's forecast.

Business optimism has also risen, albeit with concerns about the impact of the Autumn Statement jangling nerves somewhat, notably in the manufacturing sector. Investment plans in particular are reported to have been put on ice pending clarity on the new government's policies, especially towards taxation. Hiring likewise has been stifled by business uncertainty about the near-term economic outlook ahead of the Budget.

In the meantime, stubbornly elevated services charge inflation, which has been the bugbear of the Bank of England, cooled in September to the lowest since February 2021 to help bring the Bank of England's 2% inflation target closer into view. The survey data therefore support the view that interest rates could fall further in the closing months of 2024.

Output growth moderates but remains solid

Business activity rose for an eleventh straight month in September, according to early PMI survey data. The rate of growth lost some momentum but closed off the third quarter which has seen the PMI run slightly above the average seen in the second quarter. The headline economic growth indicator from the flash PMI surveys, the seasonally adjusted S&P Global UK PMI Composite Output Index, fell from 53.8 in August to 52.9 in September but remained well above the 50.0 no change level.

The latest PMI reading is broadly indicative of the UK economy growing at a quarterly rate of 0.25% in September and a near 0.3% rise in the third quarter as a whole, based on the historical relationship of the PMI with GDP. This is broadly in line with Bank of England expectations and adds to signs that the economy has sustained a robust underlying pace of expansion after a solid first half to the year.

Official GDP data have come in stronger than the PMI so far this year, signaling a 0.7% expansion in the first quarter and a 0.6% rise in the second quarter, but monthly real GDP data for June and July have shown no growth. This points to a cooling of the economic growth rate signalled by the ONS data as we head into the second half of the year, but the PMI data suggest that the underlying expansion remains relatively healthy and less volatile than indicated by the ONS GDP data.

Manufacturing and services expand but goods sector suffers further export fall

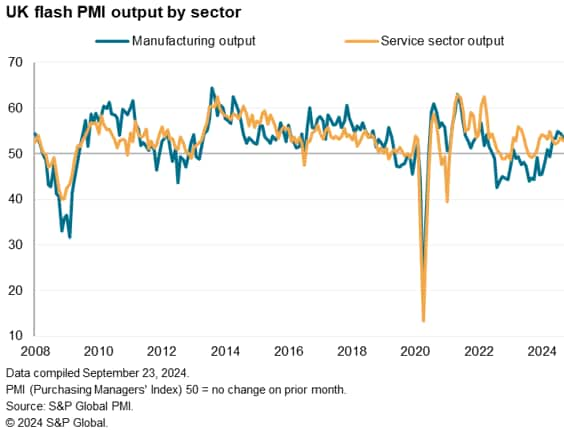

At the broad sector level, the expansion in September was driven by rising output across both manufacturing and services, albeit with both sectors losing some growth momentum.

However, service sector growth reflected rising IT and financial services activity, with consumer-facing services, transportation and business services all reporting lower output to reveal very divergent trends within the services economy.

In manufacturing, a key divergence persisted in terms of the expansion being driven by domestic demand, as export orders continued to fall, having now deteriorated in 36 of the past 37 months. Exporters blamed slower global demand growth, barriers to easy exporting and the recent strength of sterling.

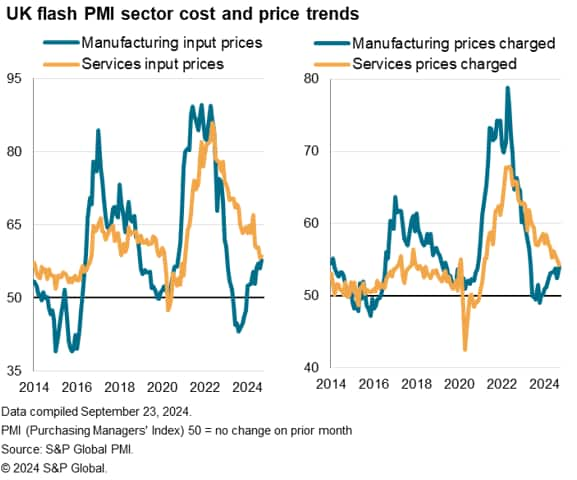

Service sector inflation at 43-month low brings BoE target closer into view

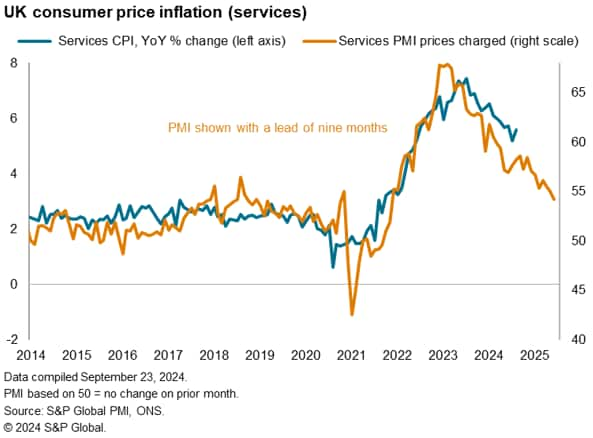

While growth remained resilient, price pressures moderated further to hint further at the economy experiencing a 'soft landing', whereby the fight against high inflation has been won without the economy sliding into recession. Most importantly from a policymaking perspective, the PMI survey data point to a moderation of service sector inflation, which has been the main area of concern to the Bank of England. Services inflation ticked higher to 5.6% in August, according to official data, but the PMI's gauge of average prices charged for services fell further in September to its lowest since February 2021. Particularly weaker price trends were indicated for business services and hotels & restaurants.

As this survey gauge tends to lead the official data by many months, the PMI's price gauge points to services inflation cooling in the months ahead, albeit remaining somewhat elevated. The services price gauge has now fallen to 54.2 from 55.0 in August, which compares with a pre-pandemic ten-year average of 51.7 but represents a further marked slowing in the rate of inflation compared to the highs seen in the pandemic.

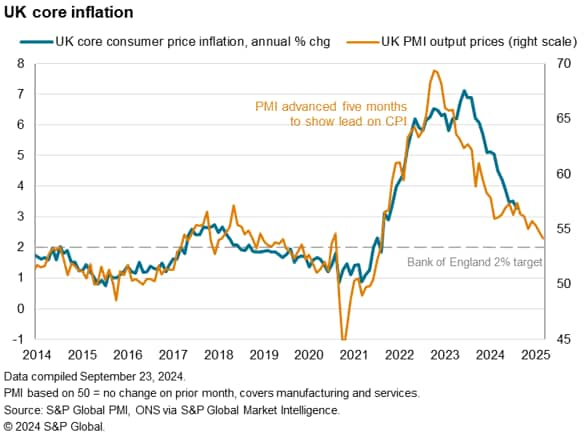

Although goods price inflation picked up to a 16-month high in the September flash PMI survey, when combined with the weaker PMI selling price data from services, the overall signal from the PMI for goods and price inflation is one of prices rising at the slowest rate since February 2021, bringing the Bank of England's 2% inflation target closer into view.

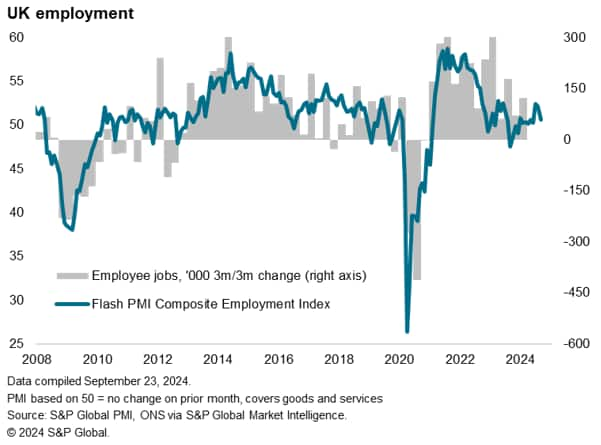

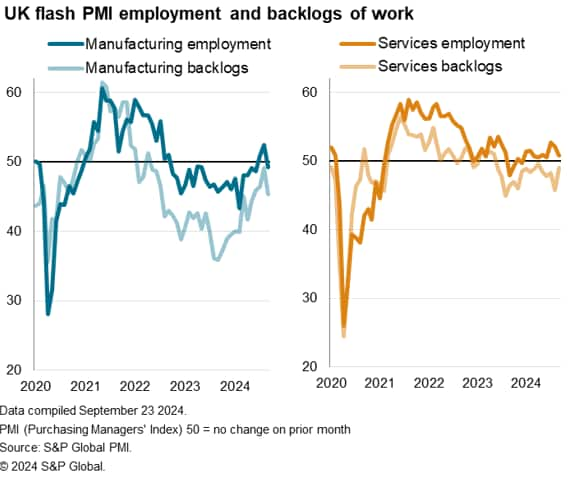

Jobs growth slows

The lower price pressures in services in part reflected lower input cost growth, which increased in September at one of the slowest rates seen over the past three and a half years. The relatively subdued cost growth in turn reflected reduced wage pressures as hiring slowed in the service sector as well as in manufacturing, the latter in fact reported a drop in employment for the first time in three months. Overall, employment rose in September at the slowest rate since June.

These reduced hiring trends can be linked to backlogs of uncompleted work falling in both manufacturing and services in September, which typically points to the existence of surplus operating capacity relative to demand, but also in part reflected some uncertainty about the economic outlook, notably in terms of government policies ahead of the Autumn Statement.

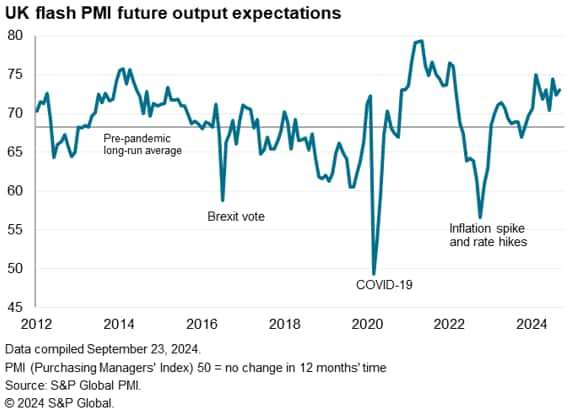

Outlook marred by uncertainty

More positively, future output expectations ticked higher in September to remain well above the survey's long-run average. However, there were mixed signals by sector. While service sector optimism recovered to the third-highest seen over the past 31 months, manufacturing optimism slumped to the second-lowest in 21 months to indicate a potential divergence in the growth paths of the two sectors in the near-term.

Improved sentiment was centered on expansion plans amid a supportive economic environment as the cost of living impact continues to wane and demand remains resilient.

However, political uncertainty and the new policies of the fresh government in the UK, as well as concerns over the broader global geopolitical environment and growth worries in major trading partners, notably Europe, injects some uncertainty - especially at manufacturers. Investment plans in particular were often reported to have been put on ice pending clarity on the new government's policies, especially towards taxation.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-signals-solid-economic-growth-and-further-downshifting-of-inflation-sept24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-signals-solid-economic-growth-and-further-downshifting-of-inflation-sept24.html&text=Flash+UK+PMI+signals+solid+economic+growth+and+further+downshifting+of+inflation+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-signals-solid-economic-growth-and-further-downshifting-of-inflation-sept24.html","enabled":true},{"name":"email","url":"?subject=Flash UK PMI signals solid economic growth and further downshifting of inflation | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-signals-solid-economic-growth-and-further-downshifting-of-inflation-sept24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+UK+PMI+signals+solid+economic+growth+and+further+downshifting+of+inflation+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-signals-solid-economic-growth-and-further-downshifting-of-inflation-sept24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}