Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 24, 2024

Flash PMI signals stalling of eurozone economy

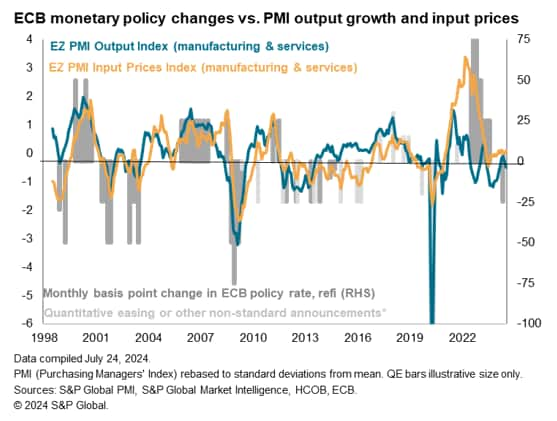

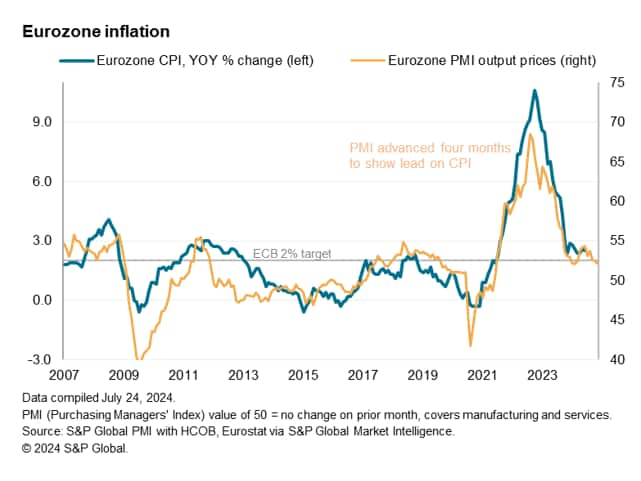

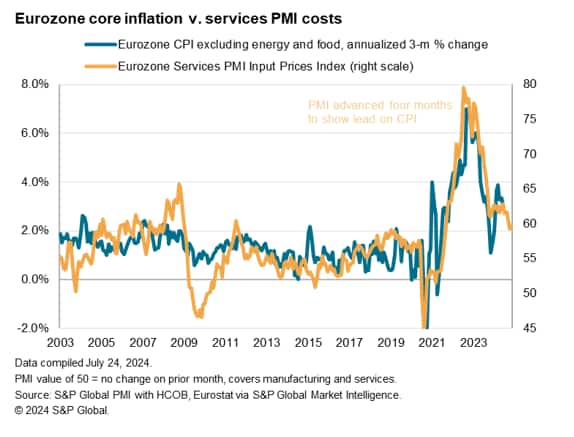

The 'flash' PMI® survey data for July brought welcome news that inflationary pressures continued to moderate, with cooling service sector price growth in particular adding to evidence that the ECB's inflation target is in sight.

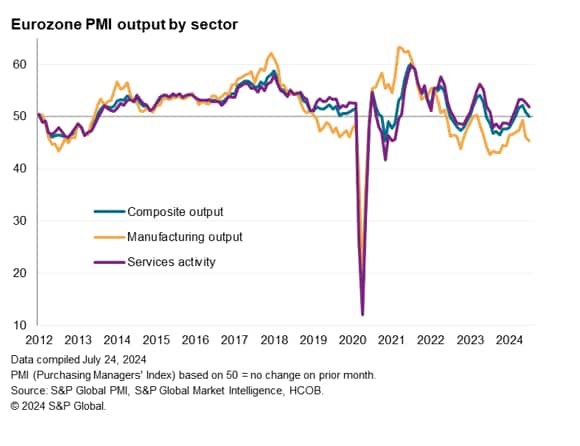

However, the survey also brought signs that the fight against inflation took a further toll on the economy, despite interest rates being cut for the first time in five years in June, with business activity and employment growth close to stalling. A deepening manufacturing downturn is being accompanied by a slowdown in the service sector, pointing to a broad-based weakening of economic conditions.

Here are our top-five takeaways from the July flash PMI data:

1. Economic growth stalls in July

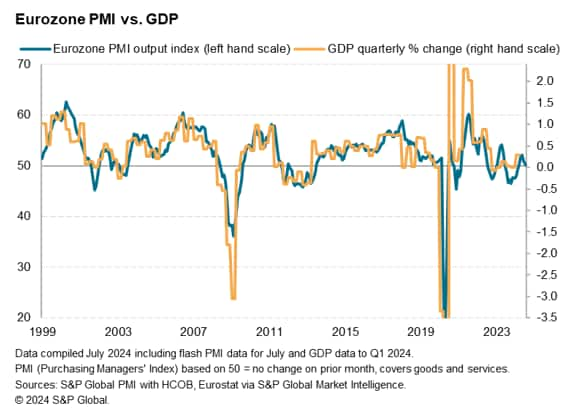

The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, fell to 50.1 in July from 50.9 in June. At a level only fractionally above the no-change mark, the PMI points to a near-stagnation of private sector activity. Output has now risen in each of the past five months, but the latest expansion was the smallest in this sequence.

A simple model using OLS regression indicates that the July PMI is consistent with unchanged GDP at the start of the third quarter, representing a deterioration from the 0.2% expansion signaled for the second quarter.

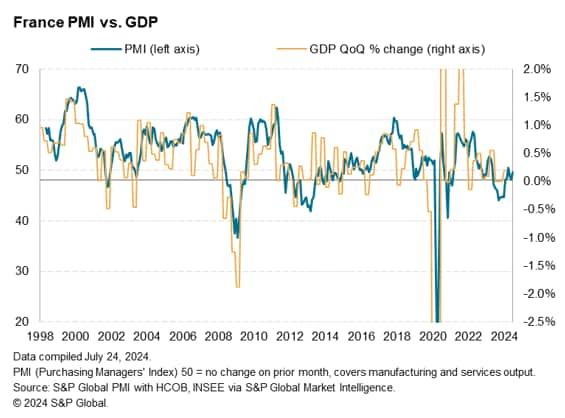

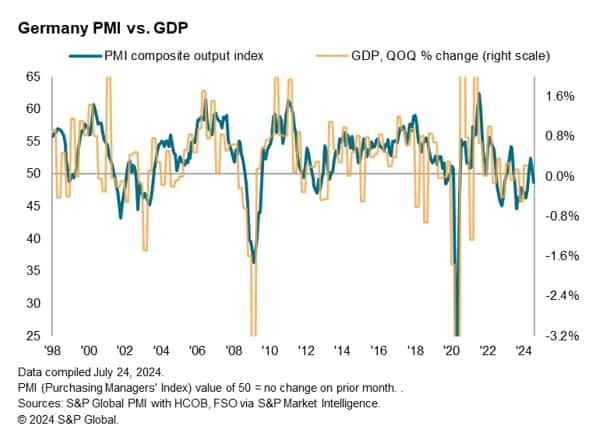

The two largest euro area economies continued to underperform. Output in Germany decreased for the first time in four months, while companies in France reported a third consecutive monthly reduction in business activity, albeit with the downturn moderating. The rest of the euro area as a whole continued to expand, but at the weakest rate since January.

The July flash composite PMI data indicate a 0.1% quarterly rate of GDP expansion in France (after a 0.1% second quarter expansion) and a 0.2% rate of contraction in Germany (following a 0.1% gain in the second quarter).

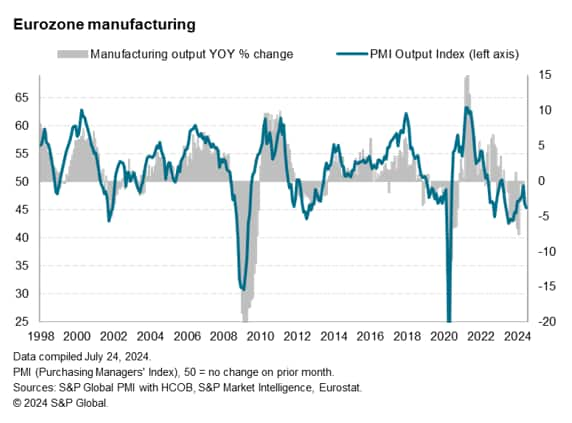

2. Manufacturing output slump deepens

Weakness was fueled by the manufacturing sector, where euro area output fell for a sixteenth successive month, declining at the sharpest rate since December 2023. Factory production fell at increased rates in Germany and France, the former again reporting an especially steep decline, and also fell for a second month running in the rest of the region as a whole.

New order inflows into the manufacturing sector also fell at the sharpest rate seen since last December, pushing the survey's new-orders-to-inventory ratios lower.

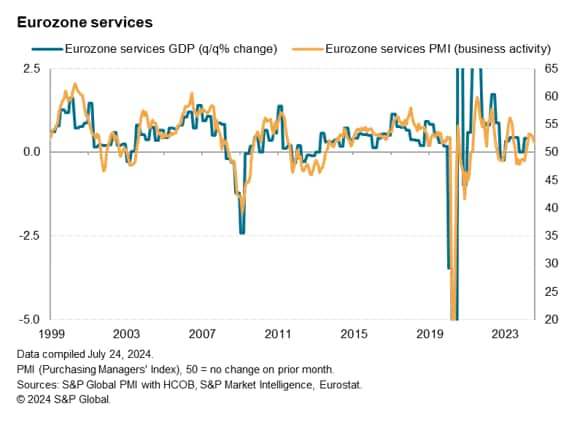

3. Service sector expansion slows despite return to growth in France

While service sector business activity increased for the sixth month running in July, the expansion was the slowest since March (indicative of the sector's GDP rising at a quarterly rate of just 0.3%). National variations were marked, however, with slower expansions in Germany and the rest of the region contrasting with a modest return to growth in France for the first time in three months, attributed to some stabilization of activity and demand following the snap election as well as increased activity around the Olympics.

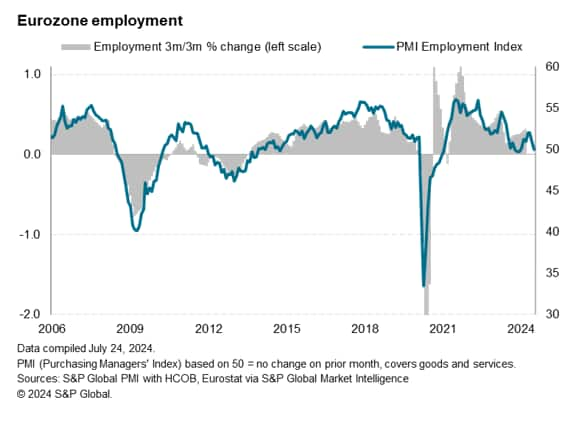

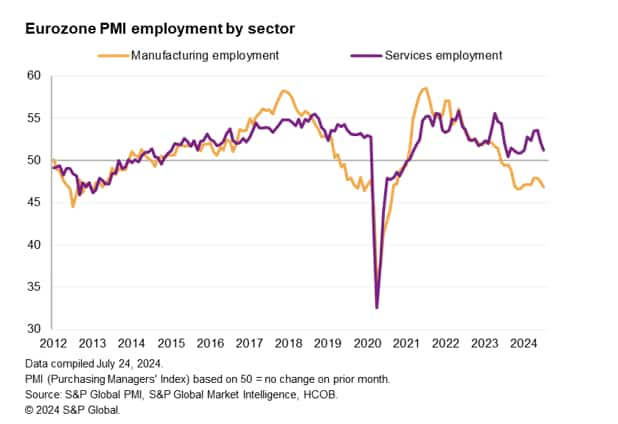

4. Hiring stalls

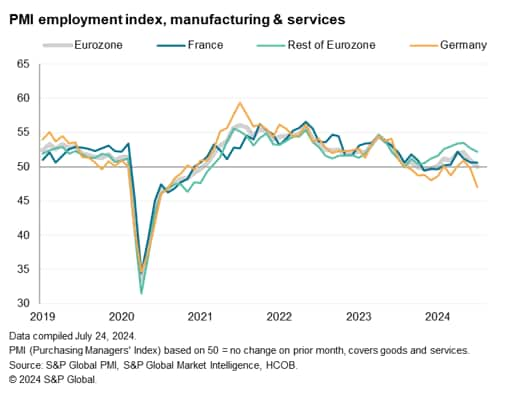

Employment was unchanged across the eurozone in July, ending a six-month spell of continual job creation. Service providers continued to increase staffing levels, but at the slowest pace since January. Meanwhile, manufacturing workforce numbers decreased to the largest extent in 2024 so far, registering one of the steepest declines seen since the 2012 debt crisis downturn if the pandemic is excluded.

A modest increase in staffing levels in France and a larger rise across the rest of the eurozone were offset by the sharpest cut in employment for almost four years in Germany. Excluding the pandemic, the drop in German employment was the largest recorded since January 2011.

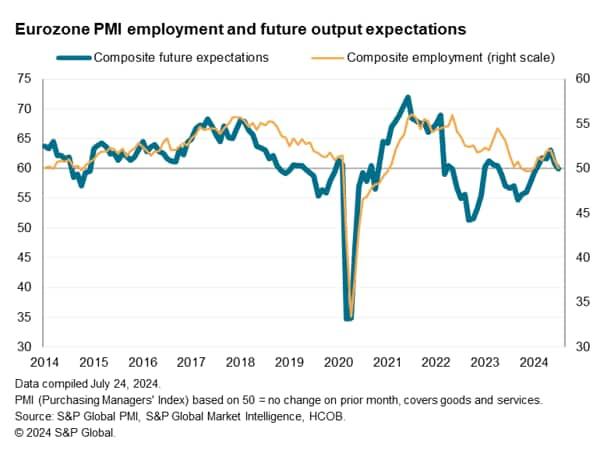

The stalled employment situation reflected a further pull-back in business expectations about output growth in the year ahead, which fell in July to a six-month low to 60.0, edging slightly below the long-run average of 60.6.

5. Prices rise at slower rate, consistent with ECB target

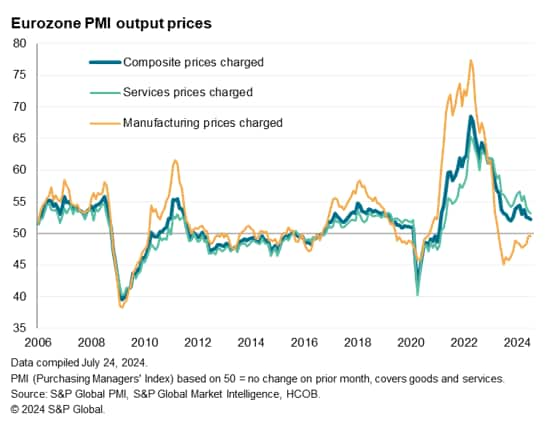

Average prices charged for goods and services across the eurozone rose at the slowest rate since last October, the rate of increase running at one of the weakest seen since inflation took off in early 2021.

The decline takes the index down to levels that are consistent with the ECB's 2% inflation target, according to historical comparisons, suggesting that headline inflation will fall further in the coming months from the 2.5% rate seen in June.

Services selling price inflation notably fell to the lowest since May 2021, the index now running only 0.7 points above the average seen in the two years prior to the pandemic. Manufacturing selling prices meanwhile fell for a fifteenth straight month, albeit dropping only marginally to point to a near-halting of the disinflationary trend seen in the manufacturing sector.

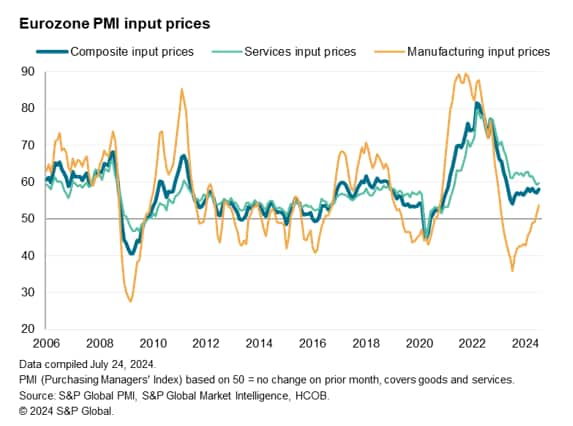

The July survey saw some firming of input cost pressures, the rate of inflation of which ticked up to a three-month high. Manufacturing input costs rose at the sharpest rate for one and a half years, and input costs in the service sector - which are heavily influenced by wage growth - also rose at a slightly increased rate. However, June had seen the slowest rate of services input cost inflation since April 2021, and the marginal upturn seen in July still leaves the survey gauge at a level indicative of core inflation close to 2%.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-stalling-of-eurozone-economy-Jul24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-stalling-of-eurozone-economy-Jul24.html&text=Flash+PMI+signals+stalling+of+eurozone+economy+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-stalling-of-eurozone-economy-Jul24.html","enabled":true},{"name":"email","url":"?subject=Flash PMI signals stalling of eurozone economy | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-stalling-of-eurozone-economy-Jul24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMI+signals+stalling+of+eurozone+economy+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-stalling-of-eurozone-economy-Jul24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}