Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 24, 2023

Flash PMI data signal fastest developed world growth for 11 months, price pressures rise further

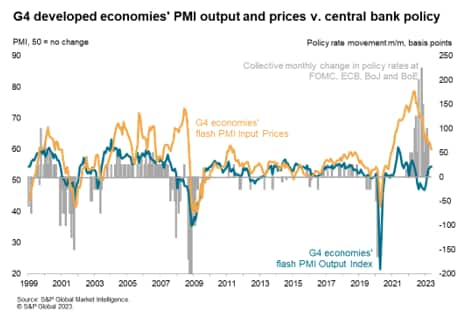

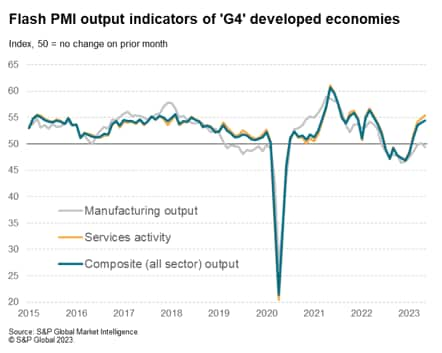

Economic growth across the four largest developed economies has accelerated to the fastest for 13 months in May, according to early 'flash' PMI data compiled by S&P Global. Growth was driven entirely by services, however, as manufacturers continued to report broadly stalled production.

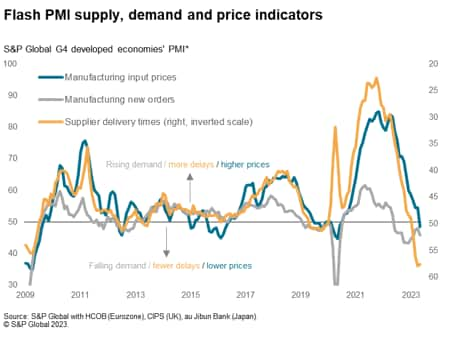

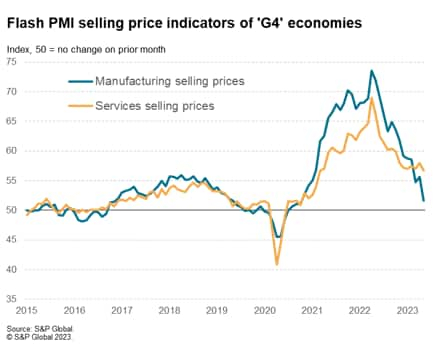

Spending therefore continues to shift from goods to services, bringing with it a change in inflationary pressures. Prices for goods are falling amid excess supply, but prices charged for services continue to rise at a solid pace as a post-pandemic demand surge exceeds supply. Input costs and selling prices consequently continue to rise at elevated rates by historical standards, albeit having cooled markedly from last year's peaks.

Central bank rhetoric will need to be watched for their assessment of the stickiness of inflation and the resilience of growth. However, the strength of the service sector is likely to add to pressure on central banks to keep interest rates higher for longer, and in some cases perhaps even reach higher terminal rates, which will add to the likelihood of economic growth cooling as the year proceeds.

Economic growth revival driven by services

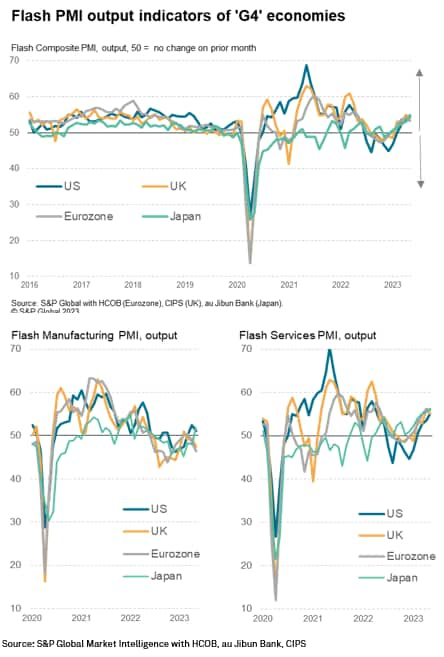

Business activity rose across the four largest developed world economies (the "G4") for a fourth month running in May, according to provisional 'flash' PMI data. The rate of growth accelerated to the fastest since April 2022.

Growth was skewed heavily towards the service sector, where business activity rose at the fastest rate for 14 months across the G4 in response to an acceleration in growth of incoming new business, in turn reflecting resurgent post-pandemic demand. In contrast, manufacturing output fell slightly when measured across the G4, fueled by a steep and accelerating rate of loss of new orders.

Growth was recorded in all four economies for a fourth straight month, indicating a synchronised and broad-based improvement geographically.

The strongest expansion was recorded in Japan, where output across manufacturing and services rose at a rate not seen since October 2013. Service sector growth hit a new survey high, accompanied by the first rise in factory output for 11 months.

Strong and accelerating growth was also seen in the US, where output across both sectors rose at the steepest rate for 13 months. An increasingly strong surge in US services activity was joined by a further rise in manufacturing output, albeit with the rise in factory production growth losing momentum to show only a modest gain.

In contrast, growth slowed in Europe, with expansions losing some steam from recent peaks in April in both the Eurozone and UK. Both economies nevertheless continued to report robust growth, albeit in both cases with service sector upturns losing some pace from impressive levels in April and with both economies reporting increasingly marked manufacturing downturns.

Demand shifts further from goods to services

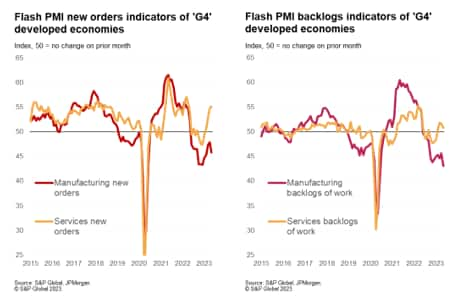

Whereas inflows of new business across the G4 service sector grew at the sharpest rate for just over a year, rising strongly in all four economies, new orders at factories fell for a twelfth successive month, the rate of decline hitting the fastest since February. Only Japan saw an increase in new orders for goods, and even here the rise was only slight. The steepest decline - by some margin - was witnessed in the Eurozone.

The diverging new order trends also led to a further contrast in backlogs of work, which rose for a fourth consecutive month in the service sector but fell in manufacturing at a rate not seen since the global financial crisis barring pandemic lockdown months. Backlogs fell in manufacturing in all four economies in May but rose in services in all cases.

The survey data therefore add further to signs of a shift of spending away from goods towards services. This likely reflects the further reopening of the global economy in 2023 which, for the first year since 2019, allows unfettered cross border travel. This shift in spending is in turn leading to the development of excess capacity in manufacturing but is straining capacity in the service sector.

Prices fall in manufacturing but rise sharply again for services

Varying demand conditions and capacity constraints also played a role in determining inflationary trends. In manufacturing, the recent softening of demand for components has led to discounting and has been accompanied by lower energy costs. Input costs consequently fell on average across the G4 for the first time in almost three years, dropping all cases bar Japan.

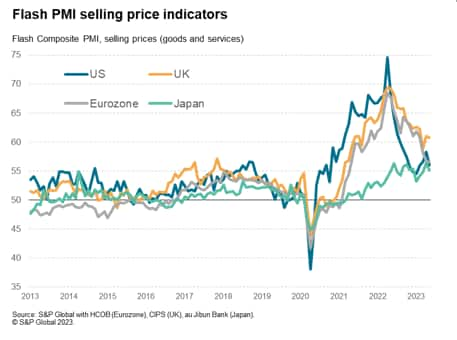

These lower costs have been passed on to customers as goods producers seek to shore up weaker than anticipated sales. As a result, average selling prices for goods across the G4 rose in May at the slowest rate since October 2020. Selling prices even fell in the eurozone and barely rose in the US, leaving Japan and the UK with the steepest rates of increase, though even in these economies the rate of goods inflation moderated.

Inflationary pressures in the service sector proved more stubborn. Although average prices charged for services across the G4 service sectors declined from April, the rate of increase remained elevated by historical standards, not just greatly exceeding the survey average seen in the decade leading up to the pandemic but also exceeding any prior peaks seen over this period by a wide margin. Particularly stubborn service sector inflation was seen in the UK and eurozone, though elevated rates also continued to be recorded in the US and Japan.

In contrast to manufacturing, which saw improved supply and weakening demand, the service sector saw further instances of companies being constrained by a lack of labour while simultaneously reporting resurgent demand, hence pushing both costs and prices higher.

Recession averted, for now

The common theme in the May flash PMI data for the major developed economies is one where a post-pandemic revival of spending on services has helped sustain robust economic growth midway through the second quarter. This upsurge in demand has strained capacity at service providers, notably via difficulties in hiring, and hence led to stubbornly high cost and selling price inflation rates.

Spending has meanwhile been diverted away from goods, leading to a situation of excess supply which has in turn fueled increasing instances of price discounting as factories seek to reduce inventory levels.

A key question for the outlook therefore relates to the sustainability of this tailwind from the pandemic, which has spurred a shift in spending from goods to services. Higher interest rates are likely to take their toll eventually, especially if these signs of resilient economic growth encourage further rates hikes.

In manufacturing, destocking is likely to act as less of a drag once inventories are normalized, probably later in 2023, but it remains to be seen how adversely affected demand for goods will be from other factors, such as the increased cost of living and higher interest rates.

We therefore retain the impression from the data that, while recession appears to have been averted for now, there remains a strong possibility of substantially weaker economic growth later in the year as the impact of higher interest rates - which are less likely to have peaked given May's flash PMI data - feeds through to the economy.

Access the full press release for Japan, Eurozone, UK and US.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-signal-fastest-developed-world-growth-for-11-months-price-pressures-rise-further-May23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-signal-fastest-developed-world-growth-for-11-months-price-pressures-rise-further-May23.html&text=Flash+PMI+data+signal+fastest+developed+world+growth+for+11+months%2c+price+pressures+rise+further+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-signal-fastest-developed-world-growth-for-11-months-price-pressures-rise-further-May23.html","enabled":true},{"name":"email","url":"?subject=Flash PMI data signal fastest developed world growth for 11 months, price pressures rise further | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-signal-fastest-developed-world-growth-for-11-months-price-pressures-rise-further-May23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMI+data+signal+fastest+developed+world+growth+for+11+months%2c+price+pressures+rise+further+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-signal-fastest-developed-world-growth-for-11-months-price-pressures-rise-further-May23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}