Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 22, 2019

Flash eurozone PMI signals economy stalled for third month in a row

- Flash Eurozone PMI at 50.3 in November, indicative of 0.1% GDP growth

- Steep manufacturing downturn accompanied by further moderation of services growth

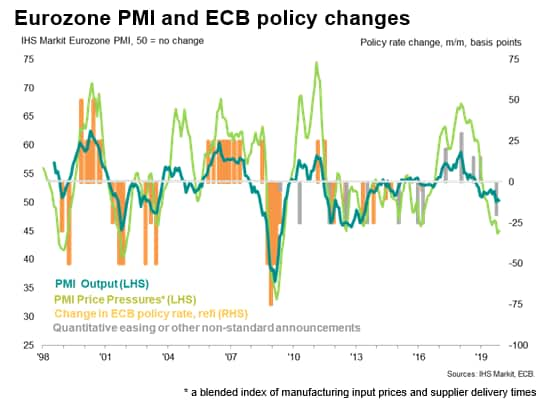

- Jobs growth lowest since January 2015, price pressure lowest since 2016

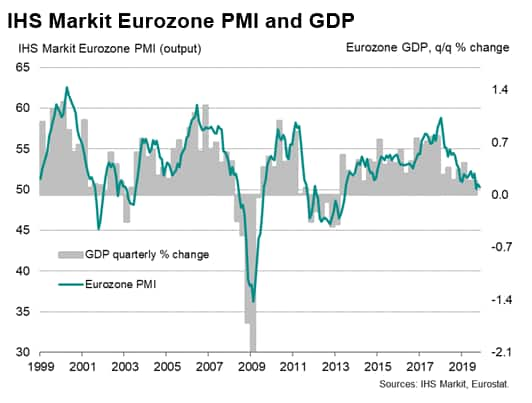

The eurozone economy was becalmed for a third successive month in November. At 50.3 in November, the 'flash' IHS Markit Eurozone Composite PMI® fell from 50.6 in October to signal the second-smallest expansion of output across manufacturing and services since the current upturn began in July 2013. The past three months have consequently seen a continual near-stagnation of output, contrasting markedly with robust growth seen over the same period one year ago.

The lacklustre PMI is indicative of GDP growing at a quarterly rate of just 0.1%, down from 0.2% in the third quarter.

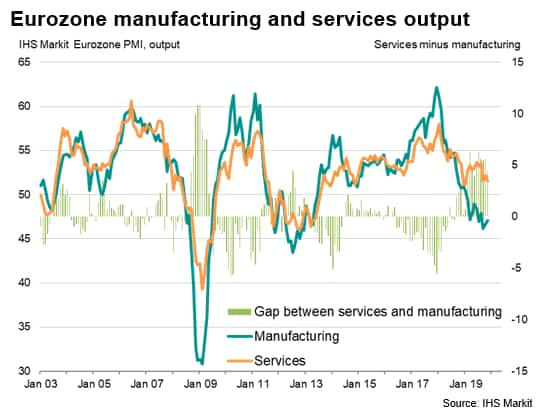

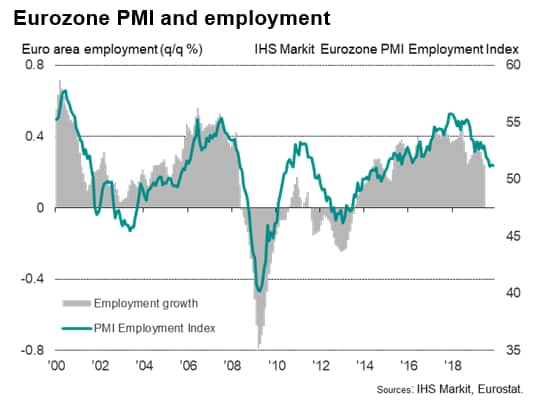

Manufacturing remained stuck in its deepest downturn for six years amid ongoing trade woes, albeit with the rate of decline of output easing modestly for a second month. November saw further signs of the factory weakness spilling over to services, notably via slower employment growth. Service sector growth waned to the lowest since January as new business inflows into service providers showed the third-smallest increase for almost five years.

Resilient jobs growth had provided a key support to the more domestically-focused service sector earlier in the year, but with the recent PMI surveys showing employment now rising at its slowest pace since early-2015, it's not surprising to see the service sector now also straining. However, the divergence between the struggling manufacturing sector and the more resilient service sector remains striking. The extent to which this can persist is explored more fully in our recent special report, which sees signs for cautious optimism.

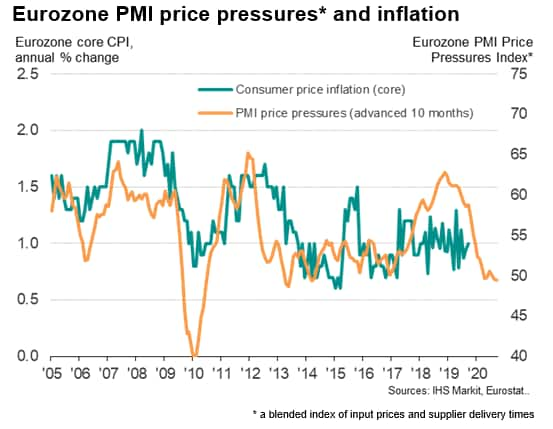

The weakening demand environment also fuelled more price discounting as firms sought to boost sales. Average prices charged for goods and services rose at the joint-weakest rate for three years in November, while average input cost inflation slipped to the lowest since August 2016. Such weak price pressures suggest consumer price inflation will remain subdued in coming months.

Expectations about future output meanwhile remained well below levels seen earlier in the year, reflecting heightened geopolitical uncertainty, including Brexit, trade wars and auto tariffs, plus general concerns about slowing demand. However, sentiment was nevertheless the best for four months, albeit by a small margin.

News by country was mixed. Tentative signs of life in the core eurozone countries of France and Germany contrasted with a fresh concern that the rest of the region has slipped into decline for the first time since 2013.

Outlook

The PMI signalled a 0.2% rise in GDP in both the second and third quarters of this year, in line with the official data, but rounding to one decimal place masks a slowdown trend. In fact, growth weakened from 0.24% in the second quarter to 0.17% in the third quarter, according to a linear regression model. The further deterioration so far in the fourth quarter, with 0.1% GDP growth signalled by the PMI, therefore hints that the economy has continued to lose momentum (alongside moderating price pressures) despite recent stimulus from the European Central Bank.

We expect continued weak growth and underlying inflation rates to prompt a further 10 basis points reduction in the ECB's deposit facility rate (currently -0.50%) by March 2020 at the latest.

Our colleagues in the European economic forecasting team expect eurozone GDP growth to have slowed from 1.9% in 2018 to 1.1% this year, weakening further to 0.8% in 2020, when a bottom will hopefully have been reached. Risks to the outlook remain skewed to the downside. Concerns include larger spill-overs from manufacturing to services and households, the imposition of US tariffs on autos, uncertainty over Brexit and increased volatility in global financial markets.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-economy-stalled-for-third-month-in-a-row-nov19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-economy-stalled-for-third-month-in-a-row-nov19.html&text=Flash+eurozone+PMI+signals+economy+stalled+for+third+month+in+a+row+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-economy-stalled-for-third-month-in-a-row-nov19.html","enabled":true},{"name":"email","url":"?subject=Flash eurozone PMI signals economy stalled for third month in a row | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-economy-stalled-for-third-month-in-a-row-nov19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+eurozone+PMI+signals+economy+stalled+for+third+month+in+a+row+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-economy-stalled-for-third-month-in-a-row-nov19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}