Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 09, 2020

Eurozone recovery and COVID-19 — heading for a double dip

- The initial estimate of eurozone GDP growth in Q3 far surpassed expectations.

- But renewed COVID-19 restrictions point to a sizeable GDP decline in Q4.

- Whether the eurozone can avoid another technical recession is uncertain at this point.

- Either way, the road back to pre-pandemic output levels will be a long one.

Huge positive surprise in Q3…

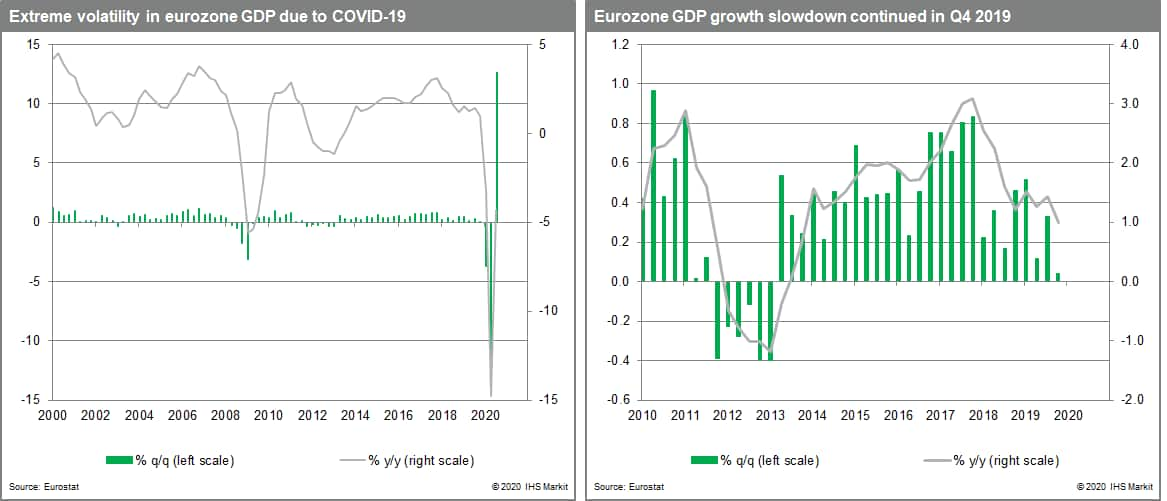

Eurostat's preliminary flash estimate for Q3 GDP in the eurozone delivered a huge upward surprise. The record q/q increase of far surpassed the market consensus expectation (9.3% according to Reuters' survey) and also IHS Markit's baseline forecast (8.3%).

Among the larger member states, upward surprises in Q3 were most pronounced in France (18.2% q/q), Italy (16.1% q/q) and Spain (16.7% q/q), partly reflecting their relative underperformance in the prior two quarters. German GDP also surprised to the upside (8.2% q/q) but by a much smaller margin.

On a y/y basis, eurozone GDP fell by 4.3% in Q3 2020, a double-digit improvement relative to Q2's record contraction (-14.8%). Unfortunately, that's where the good news ends.

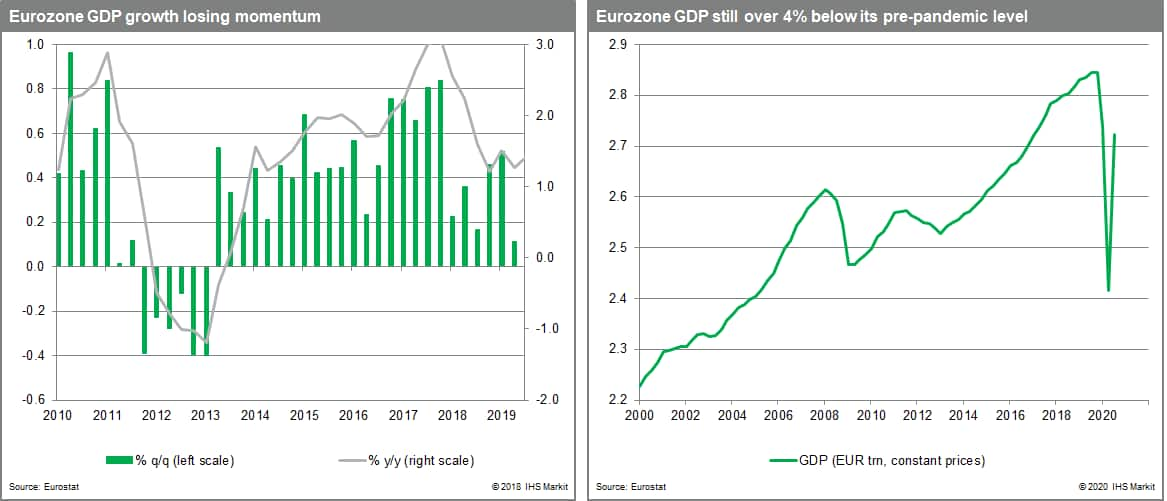

Despite Q3's record rise, GDP remained 4.3% below its pre-pandemic level back in Q4 2019 given the exceptionally large prior declines in the first half of the year. Moreover, estimates for Q4 (at least) are having to be radically downgraded to reflect recent COVID-19 trends, related restrictions and their adverse impact on economic activity, in the service sector especially.

…overtaken by subsequent events

The initial strong "mechanical" rebound in activity from May to July had already started to fade in August and with containment measures reintroduced across the eurozone thereafter, upcoming "hard" activity data are likely to deteriorate markedly, in line with signals from recent leading indicators.

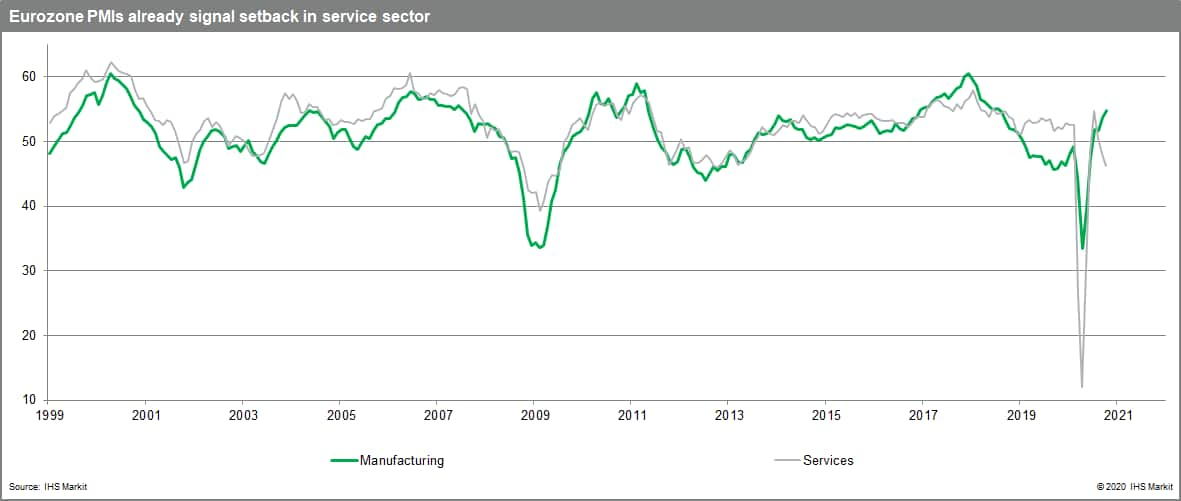

For example, IHS Markit's composite PMI output index for the eurozone dropped for the third straight month in October, falling back below the 50 expansion level for the first time since June. Forward-looking sub-indices including new orders and output expectations both suggest more weakness to come, as do higher frequency indicators including Google mobility indices.

Containment indices and PMIs signal Q4 contraction

Our COVID-19 containment indices for the eurozone also point to more weakness ahead. Based on our current index for the eurozone as a whole, the composite PMI output is likely to fall significantly further before year-end, to a level of around 40.

In the past, an average quarterly level of the PMI of this order of magnitude has been consistent with q/q GDP contractions in the eurozone of around 2% q/q. This currently looks like a fair bet for the actual outcome in Q4, though with uncertainty about the evolution of COVID-19 so high, it is very difficult to predict with any accuracy at this juncture.

Technical recession could be avoided…

The same goes for Q1 next year. Using Ireland as a template, where the national lockdown appears to have been relatively successful, there is a good chance that some restrictions will be eased before the critical Christmas period, generating a positive carry over for Q1 growth. But Q1's performance is highly vulnerable to an extension of restrictions.

Another "technical" recession (i.e. successive q/q contractions in GDP) cannot be ruled out, therefore, though our inclination at present is towards a modest pick-up in Q1. Either way, the key point is that it is going to be a very long time before some parts of the economy return to anything like normal and GDP "crossovers" (i.e. a return to pre-pandemic levels) are likely to be several years away in some of the more vulnerable economies in the periphery of the eurozone: e.g. the most services-sensitive, with the least policy space, including Italy and Spain.

…but higher unemployment won't be

The first estimate of Q3 employment will be released on 13 November. Q2 saw a record q/q decline of almost 3% and while business surveys like the PMIs suggest that the rate of contraction in jobs has eased, the unemployment rate across the eurozone has a long way further to rise.

It was stable at 8.3% in September, just over a percentage point above its cycle low at the start of the year. Lags between output and employment losses can be long in the eurozone. During the Global Financial Crisis, the eurozone economy hit rock bottom in Q1 2009 but the unemployment rate did not peak until Q2 2010.

This time around, given the various labour support schemes in place, the lags will be even longer still, though the unemployment rate will still have to rise nonetheless as a return to pre-COVID-19 levels of output is not feasible any time soon. This will lean down on the pace of the subsequent recovery following the imminent GDP contraction.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-recovery-and-covid19-heading-for-a-double-dip.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-recovery-and-covid19-heading-for-a-double-dip.html&text=Eurozone+recovery+and+COVID-19+%e2%80%94+heading+for+a+double+dip+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-recovery-and-covid19-heading-for-a-double-dip.html","enabled":true},{"name":"email","url":"?subject=Eurozone recovery and COVID-19 — heading for a double dip | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-recovery-and-covid19-heading-for-a-double-dip.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+recovery+and+COVID-19+%e2%80%94+heading+for+a+double+dip+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-recovery-and-covid19-heading-for-a-double-dip.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}