Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 21, 2023

Eurozone flash PMI signals strong start to second quarter thanks to resurgent service sector

Eurozone business activity growth accelerated to an 11-month high in April according to the latest flash PMI survey data, indicating that the economy has gained further growth momentum at the start of the second quarter.

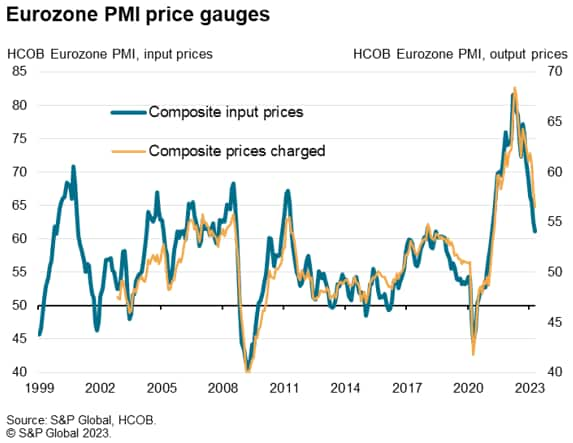

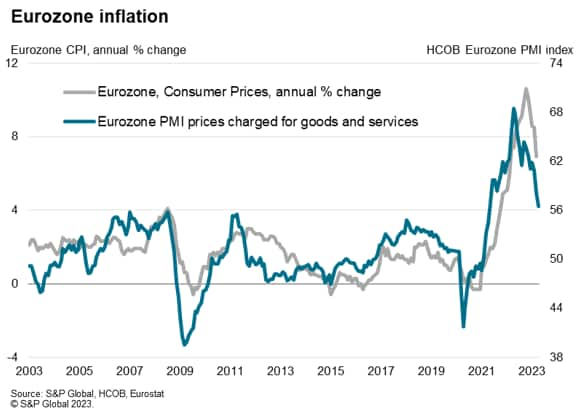

The upturn was driven by reviving demand and was accompanied by the largest increase in employment for nearly a year. Inflation pressures meanwhile moderated further, with input prices falling at an increased rate in manufacturing amid a record easing of supply constraints to help drive the overall rate of selling price inflation down to the lowest for two years. Business confidence in the outlook has also remained resilient, well above last year's lows, despite recent banking sector stress.

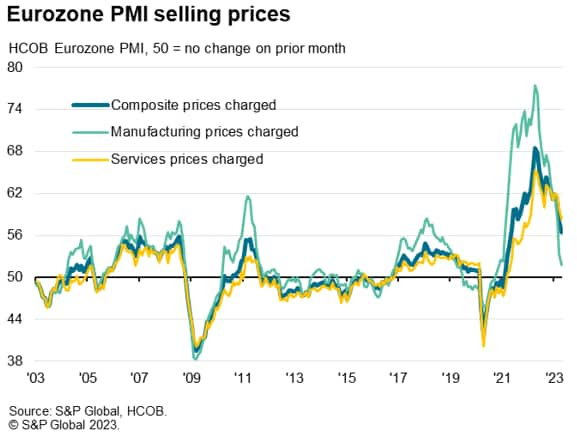

Less positively, growth has become increasingly unbalanced, driven solely by the service sector as manufacturing output has fallen back into decline amid slumping demand for goods. Furthermore, despite easing further, overall input cost and selling price inflation rates remain elevated by historical standards, especially in the service sector.

Output growth accelerates

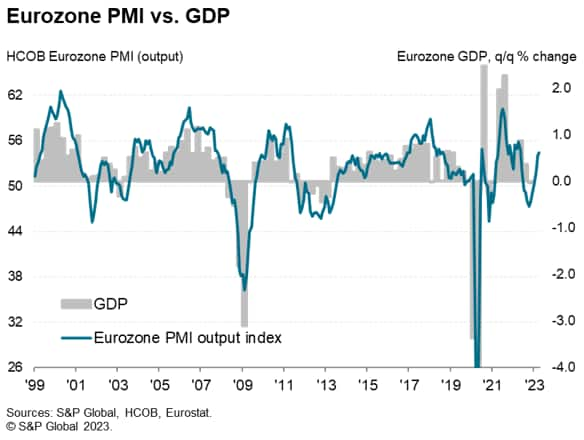

The HCOB Flash Eurozone Composite PMI Output Index, compiled by S&P Global, rose for a sixth consecutive month in April, up from 53.7 in March to 54.4, its highest since May of last year. The latest reading indicated a fourth consecutive month of growth with the rate of expansion having accelerated throughout the year to date, contrasting with the six-month period of decline seen in the second half of 2022.

At its current level, the PMI is consistent with GDP growing at a quarterly rate of 0.5%, building on a 0.3% rise signalled for the first quarter.

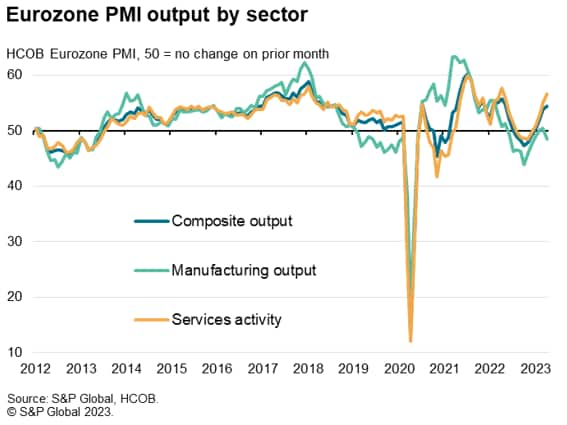

Increasing service sector dependence

Growth became increasingly uneven in April, however, with the service sector reporting its strongest expansion for a year whereas manufacturing output contracted at the sharpest rate since December, falling back into decline after two months of marginal growth. The resulting outperformance of services relative to manufacturing was the widest seen since early-2009, and the survey has not yet previously recorded such a strong service sector expansion at a time of manufacturing decline.

The improved performance was driven in part by faster growth of new orders. Measured across manufacturing and services, new orders rose for a third successive month in April, expanding at the steepest rate since May 2022. However, while growth of new business in the service sector hit the highest since April 2022, new orders in the manufacturing sector fell at the steepest rate for four months.

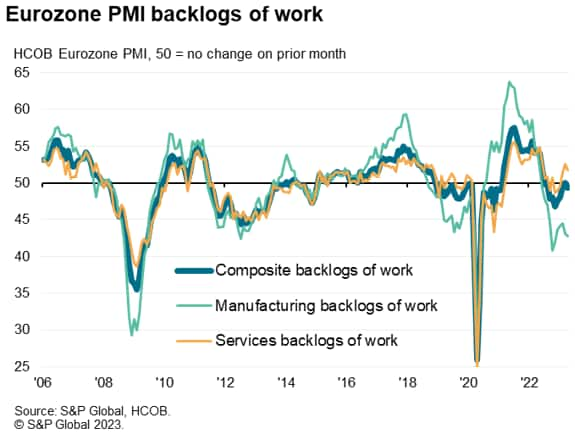

Order book growth nevertheless lagged that of output, the relatively faster pace of output growth being supported by companies fulfilling orders placed in prior months, causing backlogs of work to fall, albeit exclusively in manufacturing.

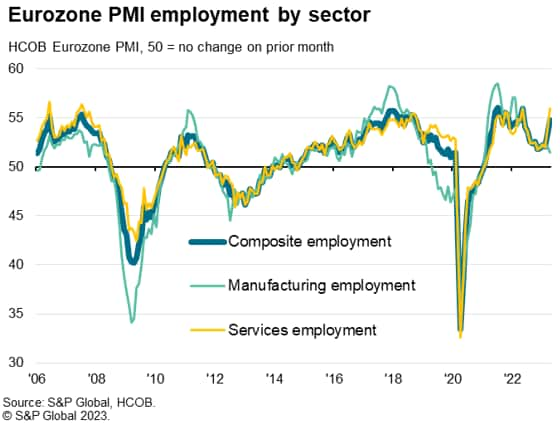

Employment spikes higher

Whereas falling backlogs in factories point to lower manufacturing production requirements in coming months, an increase in backlogs in the service sector indicates a shortage of operating capacity. Hence employment growth in manufacturing slowed to the lowest seen over the past 27 months, but service sector jobs growth picked up to the fastest since July 2007. The resulting overall increase in employment was the largest for 11 months.

Prices

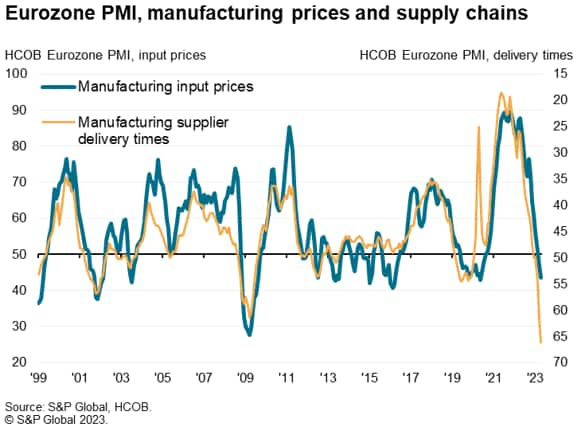

Inflation trends also varied markedly by sector. Input costs in the goods producing sector fell for a second straight month and at the sharpest rate since May 2020, pulled lower by reduced costs for energy in particular as well as for a wide variety of other inputs.

In contrast, service sector input costs continued to rise sharply, the rate of increase remaining elevated, often linked to higher staff costs. Service sector input cost inflation nevertheless moderated slightly to the lowest since October 2021. Measured across goods and services, input cost inflation consequently sank to the lowest since February 2021, cooling for a seventh straight month yet remaining well above the survey's long-run average.

Average prices charged for goods and services also continued to rise at a pace well above the survey's long-run average, though the rate of increase moderated sharply to the lowest for two years. Despite hitting a 15-month low, service sector charge inflation remained especially strong and higher than anything recorded by the survey prior to the pandemic. But manufacturing charges rose only modestly, registering the smallest increase since November 2020, the rate of inflation having eased sharply from the strong pace seen at the start of the year.

Improving supply chains

Besides lower energy costs, a key driver of cooling price pressures in manufacturing has been the recent easing of supply chain shortages coupled with slumping demand, the latter exacerbated by a further trend towards inventory reduction. April saw a second successive record improvement in supplier delivery times, indicating a shifting of pricing power from the seller to the buyer. The amount of inputs bought by manufacturers meanwhile fell sharply in April, dropping at the steepest rate since last November, while inventories of inputs fell to the greatest extent since November 2020, down for a third month in a row.

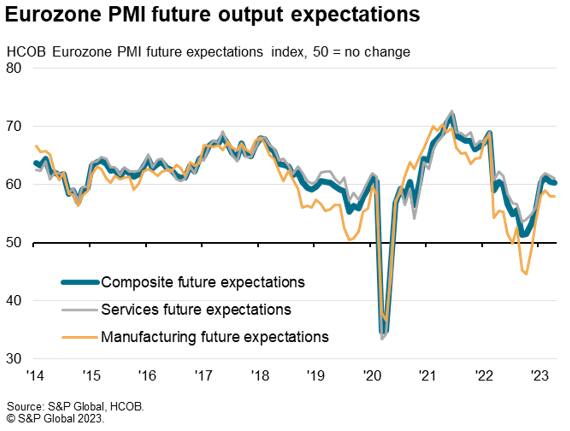

Future expectations remain upbeat

Finally, optimism about the year ahead dipped further from February's 12-month high, down slightly in both manufacturing and services, but remained among the highest seen over the past year. Sentiment has improved considerably since the lows seen late last year, attributed by survey respondents to fewer energy market concerns, lower recession risks, improved supply chains, and a peaking of inflation pressures.

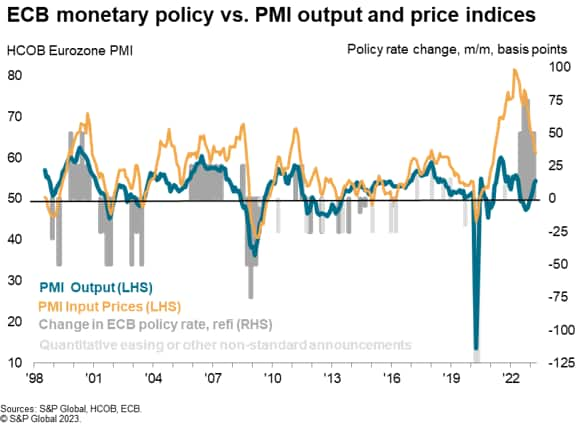

Business confidence is therefore so far showing encouraging resilience in the face of further interest rate hikes and the uncertainty caused by recent banking sector stress.

However, although inflation gauges continue to moderate, stubborn inflationary pressures, fueled primarily by the service sector and rising wage costs, will be a concern to policymakers and suggests that more work may be needed in terms of bringing inflation down to target. Note that, although headline inflation cooled sharply from 8.5% in February to 6.9% in March, thanks principally to energy inflation downshifting from +13.7% to -0.9%, core inflation rose to a new all-time high, up from 5.6% in February to 5.7%.

The ECB has hiked rates by 50 basis points at each of its past six meetings, taking its deposit rate to 3.0%. Speculation had grown that it looks to slow the pace of tightening to 25 basis points at its May meeting, in part due to concerns regarding the resilience of the banking system in the higher interest rate environment. However, the upbeat PMI data, in terms of faster growth, solid confidence, increased hiring and still-elevated service sector price pressures - a key element of core inflation - could drive expectations of more aggressive policy tightening in the months ahead.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-signals-strong-start-to-second-quarter-thanks-to-resurgent-service-sector-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-signals-strong-start-to-second-quarter-thanks-to-resurgent-service-sector-2023.html&text=Eurozone+flash+PMI+signals+strong+start+to+second+quarter+thanks+to+resurgent+service+sector+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-signals-strong-start-to-second-quarter-thanks-to-resurgent-service-sector-2023.html","enabled":true},{"name":"email","url":"?subject=Eurozone flash PMI signals strong start to second quarter thanks to resurgent service sector | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-signals-strong-start-to-second-quarter-thanks-to-resurgent-service-sector-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+flash+PMI+signals+strong+start+to+second+quarter+thanks+to+resurgent+service+sector+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-signals-strong-start-to-second-quarter-thanks-to-resurgent-service-sector-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}