Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 23, 2024

Eurozone flash PMI shows economy gaining recovery momentum in April

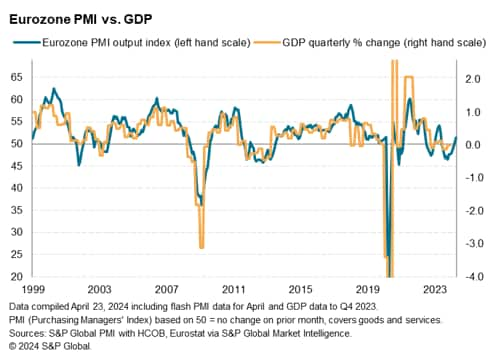

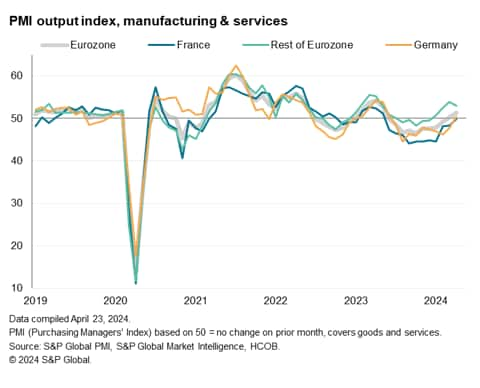

Business activity in the euro area grew at the fastest rate for nearly a year in April, according to provisional PMI® survey data. The improvement indicates that the region continues to pull out of the recent downturn, albeit growing only at a pace equivalent to GDP rising at a modest quarterly rate of just 0.1% amid divergent sector performances. Increasingly robust service sector growth was nevertheless accompanied by signs of a further moderation of the manufacturing downturn. Jobs growth also accelerated as business confidence remained elevated by recent standards.

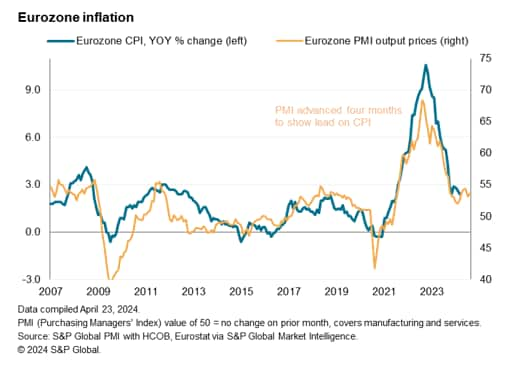

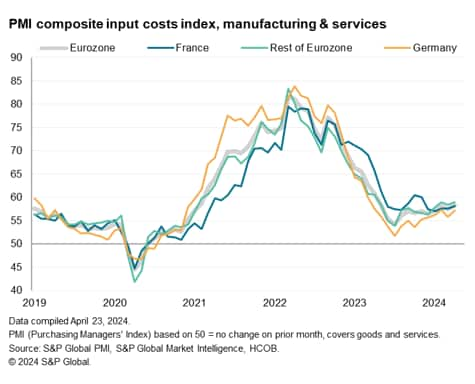

However, price pressures also picked up across the eurozone, often linked to higher wage bills. Input costs and average selling prices both rose at faster rates, reflecting stubbornly elevated price pressures in the service sector.

Economic recovery gains momentum

The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, rose from 50.3 in March to 51.4 in April. The latest reading signals a second successive month of rising output after a continual decline over the nine months to February. The April expansion was the strongest since May of last year, though was only modest and well below the pace seen this time last year.

At its current level, the PMI is broadly indicative of eurozone GDP growing at a quarterly rate of 0.1% in April, representing an improvement on the 0.1% decline signaled for the first quarter.

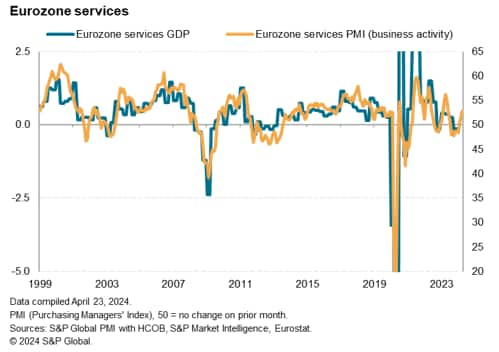

Although service sector output grew for a third successive month, with the rate of increase having gained momentum to register the fastest rise for 11 months, manufacturing output fell across the eurozone for a thirteenth straight month in April to act as a drag on the overall economy. The rate of decline in factory output eased, however, to the weakest for 12 months.

Sector variations were driven by underlying demand conditions. New orders for services rose in April at the fastest pace since May of last year, up for a second straight month, but new orders for manufactured goods fell at an increased rate. The latter have now fallen continually for two years.

Germany back in growth territory

By country, Germany notably edged back into growth territory for the first time in ten months as resurgent growth in the service sector was accompanied by a cooling of the manufacturing downturn. France meanwhile reported only a marginal contraction of output, the weakest recorded over the past 11 months, as the first rise in service sector activity since last May helped offset a persistent manufacturing decline. It was the rest of the region which collectively saw the best performance, however, despite growth slowing slightly, as output rose for a fourth consecutive month in April in response to robust growth in the service sector and near-stable manufacturing output.

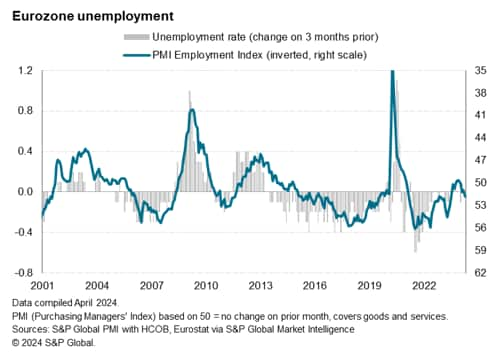

Employment

Employment increased across the eurozone for a fourth month in a row in April after two months of marginal declines at the end of 2023. The rate of net job creation accelerated to the highest since last June, commensurate with broadly steady unemployment, which currently stands at an all-time low for the single currency area of 6.5%.

A ten-month high rate of employment growth in the service sector drove the increase, though the pace of headcount reduction in the manufacturing sector also eased to the slowest in seven months.

Jobs growth was recorded in France, with the rate of increase reaching a nine-month high, alongside a marginal return to growth in Germany and sustained solid hiring in the rest of the region.

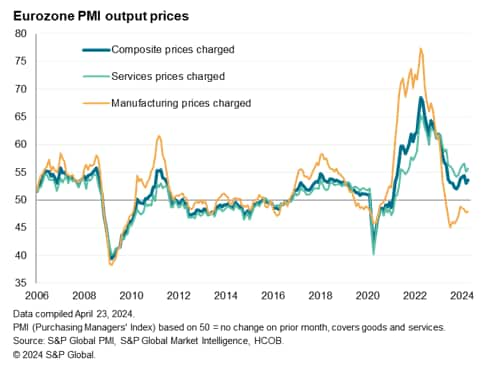

Prices

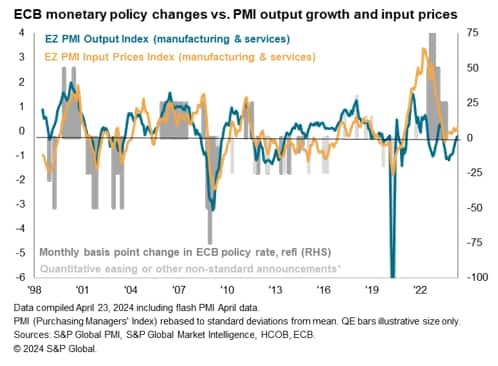

Price pressures intensified slightly in April, remaining elevated by pre-pandemic standards, with higher rates of inflation seen for both input costs and average selling prices.

Selling price inflation revived from March's four-month low to run well-above the pre-pandemic long-run average and hint at stubborn inflation pressures. While rates charged by manufacturers fell for a twelfth month in a row, prices levied by service providers rose at an increased rate, continuing to climb at a strong pace by historical standards.

Measured overall, PMI survey selling price inflation is running at a rate indicative of consumer price inflation moderately above the European Central Bank's (ECB) 2% target in the coming months.

Average input costs across the goods and service sectors also re-accelerated in April after having cooled in March, recording the joint-fastest increase seen over the past year. Although manufacturing input prices continued to fall, helped by improved supply conditions, the decline was the smallest recorded over the past 14 months. The rate of service sector cost inflation meanwhile edged higher, albeit remaining below the recent highs seen at the start of the year, with companies often reporting higher wage rates as a key inflation driver alongside greater energy and fuel costs. Especially strong cost growth was seen in the German service sector.

Future expectations show growing convergence

Looking ahead, business expectations about the coming 12 months cooled slightly compared to March but was the second-highest recorded over the past 14 months. A pull-back in service sector confidence, to a three-month low, contrasted with improved optimism in the manufacturing sector, where output expectations rose their highest since February of last year. While sentiment nevertheless remained relatively more upbeat in the service sector compared to manufacturing, the gap is now the narrowest for just over two years.

Recent months have seen business confidence improve in response to the expectation of lower interest rates, a moderating cost of living squeeze and signs of recovering household and corporate demand. Manufacturing has also been buoyed by signs of the global inventory cycle starting to become more supportive to demand. However, geopolitical uncertainty and financial market volatility subdued optimism about the year ahead outlook at some firms in April.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-shows-economy-gaining-recovery-momentum-in-april-apr24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-shows-economy-gaining-recovery-momentum-in-april-apr24.html&text=Eurozone+flash+PMI+shows+economy+gaining+recovery+momentum+in+April+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-shows-economy-gaining-recovery-momentum-in-april-apr24.html","enabled":true},{"name":"email","url":"?subject=Eurozone flash PMI shows economy gaining recovery momentum in April | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-shows-economy-gaining-recovery-momentum-in-april-apr24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+flash+PMI+shows+economy+gaining+recovery+momentum+in+April+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-shows-economy-gaining-recovery-momentum-in-april-apr24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}