Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 19, 2018

Economic collapse in Syria revealed

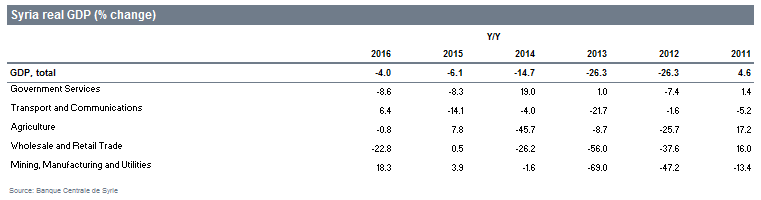

- Syria's real GDP decline during 2012-2016 period was mainly due to the double-digit contraction recorded by the mining, manufacturing and utilities, and wholesale and retail Trade contraction; however, it is important to note that all the sectors recorded a contraction during the period.

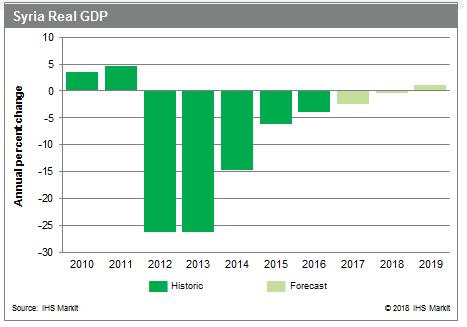

- We expect Syria to register a mute GDP growth in 2018 as the government takes control of more territory with the support of Iran and Russia.

- However, we could see an expansion which will depend on the economic support from the government's main international supporters (Iran and Russia).

Although the turmoil in Syria started on March 2011 when several protests took place, following the wave of protest in other countries around the region, Syria still managed to record a strong GDP growth of around 4.6% during 2011. This growth was mainly driven by the wholesale and retail trade sector which offset the strong contraction recorded by mining, manufacturing and utilities sector. However, this quickly changed in the subsequent years, and the country recorded deep contractions in all sectors of the economy.

Economic collapse

Syria's real GDP contracted by 53.7% from the level recorded in

2011 to 2014. The main driver of this steep decline was wholesale

and retail trade (WRT) which recorded a 79.8% plunge. The second

most important driver was the mining, manufacturing and utilities

(MMU) sector which witnessed activity decrease by a higher rate

(83.9%), but given its smaller share in the economy, its impact was

not as important as the one from the WRT. Meanwhile the agriculture

sector became the third most important driver behind the headline

GDP contraction, with a 63.2% nosedive. It worth noting that all

the sectors, but the government services, recorded a contraction

during 2011-14, with the government sector recording a

comparatively meager 11.3% expansion during the period.

Recession continues

The Syrian economy crash didn't stop but it did slow down during

the period 2015-2016 with a 9.9% contraction. The sectors that

recorded the steepest decline during this period changed

significantly in compared with the ones from the former period,

with the government services being the main reason behind the

contraction of the headline GDP, most likely thanks to the dip

suffered by the global oil prices and disruption to production from

the crisis. Moreover, the finance and insurance sector recorded the

strongest contraction (44.6%), while the WRT did repeat its place

in the top three most affected sectors by recording a 22.4% decline

in activity. Nonetheless, it is important to highlight that MMU and

agriculture expanded during the period, the former by more than

20%.

All in all, the Syrian economy suffered substantially during the 2011-2016 period, with MMU, WRT, and Agriculture being the worst performers. It is important to note that the government services sector was the only one that did not register a double-digit contraction during the period.

Outlook and implications

For the year 2017, IHS Markit estimates that Syria's economic

contraction continued but at slower rate, around 2.3%, due to its

already substantially weaker base and that the country was still

deep in its civil war. However, the new information seems to

suggest that the country's MMU sector is expected to expand as it

has been largely unaffected by the civil war for the last couple of

years, while the transport and communication sector should have

recorded growth due to the governments capture of important areas

by the government and its allies. The WRT is likely to have

recorded a more moderate contraction during 2017 as well.

Meanwhile for the 2018, although the Syrian government with the support of Iran and Russia has taken huge steps to secure most of the most important cities, IHS Markit is still cautious of how strongly the economy will stabilize and expand given the infrastructure damage and the huge amount of funds needed to make this infrastructure operational. As a result, we are forecasting a mute growth rate of -0.3% for the current year; however, we do think it is possible to see growth for the current year with the proper support from Iran and Russia, which could be partly affected by the US withdrawal from the nuclear deal with Iran and as result the imposition of sanction to the Islamic Republic's economy.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-collapse-syria-revealed.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-collapse-syria-revealed.html&text=Economic+collapse+in+Syria+revealed++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-collapse-syria-revealed.html","enabled":true},{"name":"email","url":"?subject=Economic collapse in Syria revealed | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-collapse-syria-revealed.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Economic+collapse+in+Syria+revealed++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-collapse-syria-revealed.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}