Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 12, 2020

Djibouti contract and tax risks

Our sources reported on 4 February that Djibouti's minister of budget, Abdoulkarim Aden Cher, was discussing proposals to increase taxes on a variety of basic imported goods. The tax increases are viewed as necessary to reduce sizeable annual budget deficits - at 11.2% of GDP in 2018, according to our data - and meet servicing costs associated with a growing external debt burden, which increased from 96.8% of GDP in 2016 to 121.1% in 2019, according to official figures.

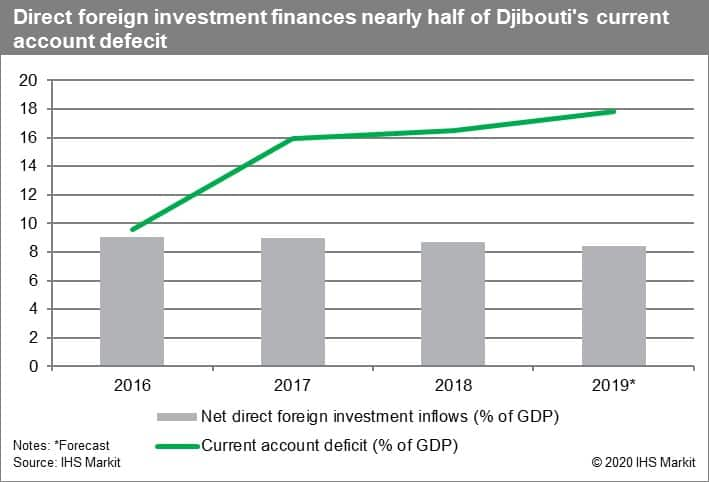

Although the budget deficit is likely to decline substantially in line with reduced spending on Djibouti's two main infrastructure projects - a railway and a water pipeline - during 2019-20, we assess that the external debt burden is likely greater because major projects financed by Chinese policy banks use circular arrangements not subject to Paris Club monitoring. Additional budgetary pressure stems from the government likely needing to safeguard continued levels of foreign direct investment to finance its current-account deficit by paying a large USD385-million compensation bill - representing just over half of Djibouti's annual budget - that was ordered by the London Court of International Arbitration over its cancellation of Dubai Ports World's contract to operate Doraleh Container Terminal.

Significance

An increase in import duties for basic foodstuffs is very unlikely to be implemented in full. This is because President Ismail Omar Guelleh probably perceives that this would motivate an increase in the frequency of anti-government protests ahead of the 2021 presidential election, which have been triggered since November 2019 by the arrest of opposition party members representing the Afar, Djibouti's numerically largest ethnic group. Additionally, President Guelleh would likely be reluctant to reduce revenues obtained through import companies monopolised by his patronage network.

Overall, the discussions indicate that fiscal receipts still need to be raised, most likely by levying arbitrary corporate tax and royalty demands against operators in the logistics and port sector, with Chinese state-owned companies now less likely to receive special treatment. Other likely targets are European renewable energy projects and other telecommunication operators. Specifically, our sources report that the Ministry of Energy is trying to expedite development of the USD250-million Ghoubet Djibouti Windfarm Project. If the project is not operational within six months, it is likely to be cancelled and new tenders issued to Chinese or Turkish companies.

Separately, the Djiboutian government will probably encourage fertiliser exporters to use the Tadjourah to Balho transport corridor inaugurated in December 2019, with a view to increasing customs revenues collected at the border with landlocked Ethiopia. If the state-owned telecommunications company is privatised under a new legal framework finalised in mid-2019, it will indicate that the fiscal balance is increasingly unsustainable.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdjibouti-contract-and-tax-risks.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdjibouti-contract-and-tax-risks.html&text=Djibouti+contract+and+tax+risks+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdjibouti-contract-and-tax-risks.html","enabled":true},{"name":"email","url":"?subject=Djibouti contract and tax risks | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdjibouti-contract-and-tax-risks.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Djibouti+contract+and+tax+risks+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdjibouti-contract-and-tax-risks.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}