Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 16, 2018

Currency crises in emerging markets – how to assess the risk

The trouble for emerging market currencies started when the US Federal Reserve (Fed) began tightening monetary policies, unwinding the accommodative conditions that started in late 2008 when the Fed adopted quantitative easing to combat the financial crisis and pushed US interest rates to extremely low levels. Low US interest rates lured emerging market economies to borrow more heavily in dollar-denominated debt. In addition, many of these emerging market countries run chronic current-account deficits, which means their domestic spending consistently exceeds income. Worse, some of these countries rely on volatile portfolio investment, particularly debt, to finance their current-account deficits.

The combination of these factors has made these emerging market economies susceptible to balance-of-payments crises. The higher external financing costs due to Fed policy tightening has diminished investors' confidence in the emerging markets' ability to repay their external debt. This could lead to an abrupt suspension of foreign financing that would force a drastic reduction in current-account deficits. Countries facing this "sudden stop" would reduce their current-account deficit by either curtailing domestic demand (cutting spending) or boosting exports (lifting income). Since boosting exports takes time, most countries adjust in the near term by curtailing demand, which leads to recession.

How should we assess emerging markets' vulnerabilities to balance-of-payments crises?

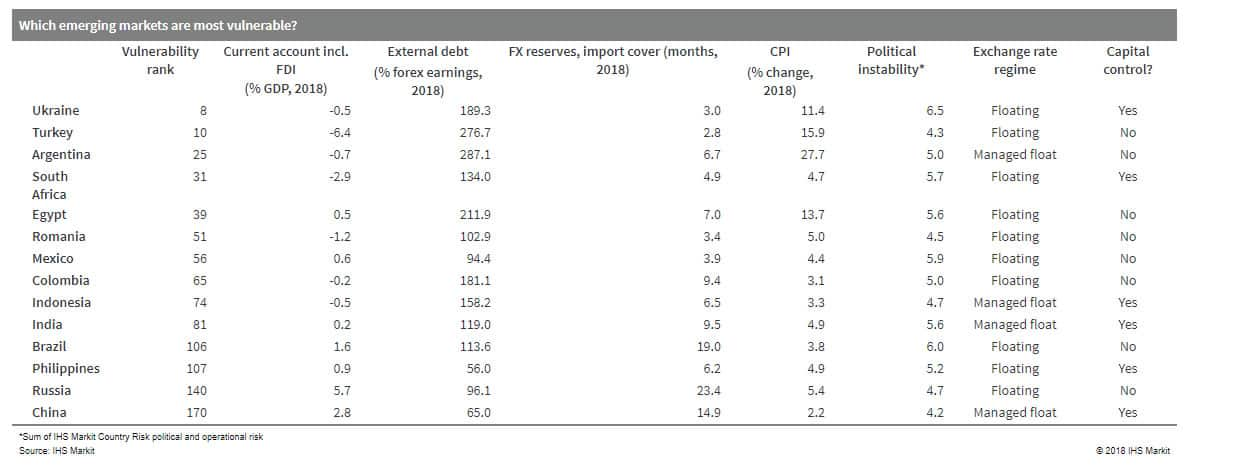

The standard measures include the current-account balance, external debt exposure, foreign exchange reserves, and inflation. Macroeconomic policy prudence and political risk should be considered as well. Countries' foreign exchange systems are also important-rigid exchange rate regimes and open borders to capital movements would typically intensify market pressure on currencies under duress. We can also adjust two of the standard measures to improve their effectiveness. The size of foreign direct investment (FDI) inflow should be considered when assessing current-account deficits, given FDI is a much more stable source of foreign financing than portfolio investment inflows. External debt should be scaled by the size of foreign exchange earnings to account for debt payment ability.

Could this trigger a global financial crisis?

There are concerns the current turmoil in emerging markets could turn into a crisis like the Asian financial crisis of the late 1990s; however, we do not believe this is likely. One key difference is the evolution of emerging market economies' exchange rate regimes. The emerging market countries highlighted in the following table all have either a floating or managed float exchange rate compared with the countries that operated under currency pegs in the Asian financial crisis. Moreover, many emerging market countries have built up their foreign exchange reserves war chest after the Asian financial crisis. All countries in the table have markedly expanded their foreign exchange reserves in import cover terms since 1997, except Argentina, Egypt, and Mexico. Some of the reserve build-ups are quite remarkable. Brazil and Russia had foreign exchange reserves covering 8.3 and 1.8 months in 1997, respectively. By 2017 these countries' foreign reserves import cover rose to 20.1 months and 25.3 months, respectively.

The table summarizes these measures for the notable emerging market economies based on our projections for 2018.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcurrency-crises-in-emerging-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcurrency-crises-in-emerging-markets.html&text=Currency+crises+in+emerging+markets+%e2%80%93+how+to+assess+the+risk+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcurrency-crises-in-emerging-markets.html","enabled":true},{"name":"email","url":"?subject=Currency crises in emerging markets – how to assess the risk | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcurrency-crises-in-emerging-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Currency+crises+in+emerging+markets+%e2%80%93+how+to+assess+the+risk+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcurrency-crises-in-emerging-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}