Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 24, 2020

Country Risk Month Ahead: October 2020

Our country risk team provides a snapshot of the events shaping country risk in October.

- G20 debt relief extension: 14 October

- Future UK-EU relations: 15 October

- New Zealand, Australia policy direction: 17 October

- Bolivia's postponed general election: 18 October

- South Africa's COVID-19 recovery budget: 26 October

G20 debt relief extension

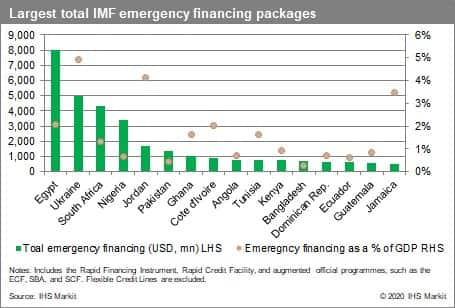

Against the backdrop of the International Monetary Fund's (IMF) and the World Bank's annual meetings on 12-18 October, finance ministers from the Group of Twenty (G20) leading economies will meet on 14 October. The delegation will decide whether to extend the Debt Service Suspension Initiative (DSSI) for International Development Association-eligible borrowing countries and Angola into 2021. According to the Paris Club of official creditors, 39 of 73 eligible countries have applied, with 31 finalising debt suspensions - mostly in sub-Saharan Africa. The extension is supported by the US Treasury, and World Bank President David Malpass stated on 19 August that he also supports an "agreement to actually do haircuts and write-downs". However, private creditor uptake remains negligible: there are no proposals to introduce a non-voluntary commitment or provide an effective framework to co-ordinate the diverse range of market participants who, in any case, have strong fiduciary obligations to their clients. The G20 likely will also decide on increasing the IMF's Special Drawing Right (SDR) quotas for the lowest-income countries, which would facilitate the expansion of coronavirus disease 2019 (COVID-19)-related emergency financing packages.

Indicators to watch:

- Chinese authorities oppose classifying state-backed banks as official lenders under the DSSI - most notably in the case of Angola - thereby undermining US support for extending debt relief into 2021.

- US President Donald Trump criticises proposed IMF reforms as benefitting Iran and Venezuela, indicating that an increase in SDR quotas for low-income countries is unlikely.

Bolivia's postponed general election

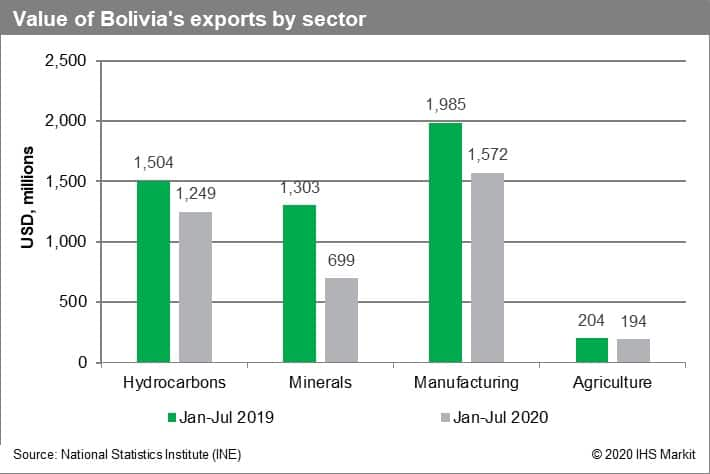

Bolivia holds presidential and legislative elections on 18 October that were postponed due to the COVID-19 virus pandemic, with a potential second round being held in November. The previous October 2019 election result was annulled due to alleged electoral fraud. The resulting resignation of former president Evo Morales caused a political vacuum and social unrest in November 2019. Continued political polarisation suggests that the election result will be contested again. Bolivia's next president faces several economic challenges: IHS Markit is projecting the economy to contract by 7.7% of GDP in 2020, with low commodity prices pushing down natural gas revenues (which account for 20% of total government revenues), and rising unemployment. Furthermore, the lack of exploration for new gas and mining reserves under the previous administration has limited growth prospects. Leading candidates Luis Arce and Carlos Mesa are proposing greater industrialisation of natural resources to reduce export dependence. However, this process will take several years and will not address fiscal revenue losses and greater social spending outlays associated with COVID-19. Consequently, IHS Markit expects the fiscal deficit to exceed 10% of GDP in 2020, with any new president requiring additional multilateral financial support in 2021.

Indicators to watch:

- The election results are contested, delaying the new administration taking control and hindering the policy implementation that will be necessary for economic recovery.

- The largest opposition party MAS wins a legislative majority but not the presidency, indicating policy paralysis over key issues like multilateral funding terms.

Other events to watch in October

- Chile's referendum on new constitution, 25 October. Voters will also choose what type of constituent body should draft the constitution: one formed by only elected members, or a body that is half composed of elected members and half parliamentarians. If "yes" wins, the process will take at least two years. Key issues include the state's role in the economy and property rights.

- Quad meeting between Australia, India, Japan, and the United States, late October. Foreign ministers of the four Quadrilateral Security Dialogue (Quad) members are expected to meet, indicating their increased intent to formalise the grouping. Key areas of co-ordination will probably include defence and commercial collaboration.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcountry-risk-month-ahead-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcountry-risk-month-ahead-october-2020.html&text=Country+Risk+Month+Ahead%3a+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcountry-risk-month-ahead-october-2020.html","enabled":true},{"name":"email","url":"?subject=Country Risk Month Ahead: October 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcountry-risk-month-ahead-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Country+Risk+Month+Ahead%3a+October+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcountry-risk-month-ahead-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}