Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 23, 2021

Australia economy expands at faster rate as restrictions ease, but price pressures persist as costs surge higher

A further easing of COVID-19 restrictions in Australia enabled private sector growth to accelerate in November according to flash PMI™ data. That said, supply chain issues persisted, contributing to continued price increases while reports of labour shortages remained evident from the latest survey.

Pent-up demand unleashed with further easing of COVID-19 restrictions

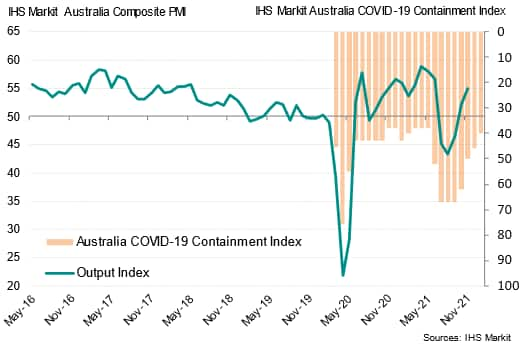

The latest IHS Markit Flash Australia Composite PMI™* revealed that growth momentum in the private sector accelerated in November, with economic confidence and activity boosted by the further reopening of the Australian economy. This is consistent with the trend observed from the IHS Markit Australia COVID-19 Containment Index, which pointed to the lowest degree of resrtiction since May.

IHS Markit Flash Australia Composite PMI

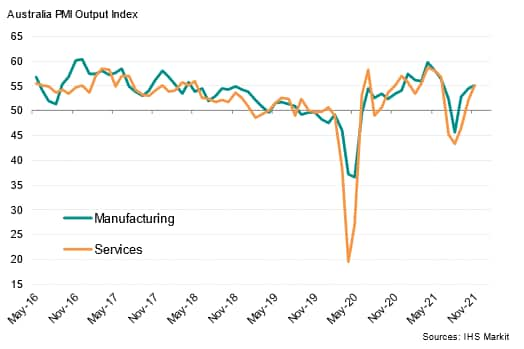

Both manufacturing and services output growth were comparable in November, rising in each case to the fastest since June, which was prior to the latest COVID-19 Delta wave hit to the economy. Growth momentum was also shown to have yet to peak at the current juncture.

Business confidence notably also improved to signal rising expectations among private sector firms for output and activity to continue expanding in the coming 12-months, according to the Future Output sub-index indication.

Output by sector

Employment conditions improve but labour shortages woe remains

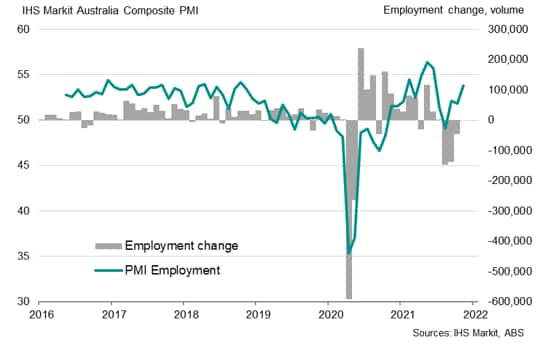

Employment levels rose in tandem with demand and output into November, with services employment growth outstripping that of manufacturing in line with reopening trends. While official employment data continued to suffer a hit in the latest October release, the outlook as suggested by the PMI data and easing of COVID-19 containment measures point to potentially positive news ahead for the official employment gauge.

Employment PMI vs employment change

That said, signs of labour shortages continued to present themselves as evident through anecdotal evidence across both manufacturing and services. Vaccination requirements in particular were frequently cited as reasons for a fall in employment levels for private sector firms. Indeed, skill shortages and mismatches owing to COVID-19 related restrictions had been a risk expected by our economics team and the translation to any earlier than expected wage growth will be closely monitored by the Reserve Bank of Australia (RBA) and markets alike. The latest update on November 22 for vaccinated students and workers to enter Australia may provide some relief which we will be studying with upcoming PMI releases.

Reopening shaped by further price pressures

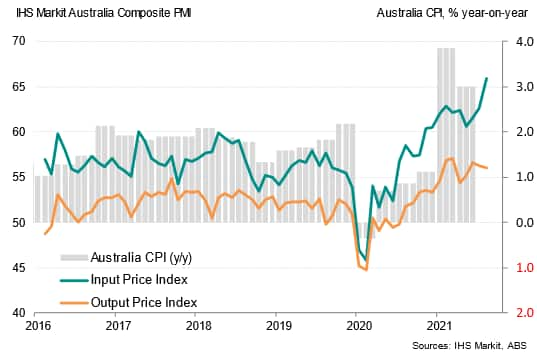

Another side effect of economic reopening has been a boost to prices, with Australia's core inflation rate having touched a six-year high in Q3. Headline CPI printed 3.0% year-on-year (y/y) and can be seen moving in line with the trend of the PMI price sub-indices. Anecdotal evidence suggested that the increase in input prices had been attributed to an assortment of costs such as higher raw materials and shipping prices. These reinforced the view that the current surge in prices had been pandemic-led and may eventually ease as supply constraints clear.

Nevertheless, with input price inflation having surged to a survey record in the latest flash November survey, the situation appears to only be aggravating in the short-term. Any shift in inflation expectations alongside persistent inflation pressures could compel the RBA to act earlier, though IHS Markit economists continue to pencil in a late 2023 first rate hike for Australia.

Composite Prices Indices vs Australia CPI

*The IHS Markit Flash Australia Composite Output Index is a GDP-weighted average of the IHS Markit Flash Manufacturing Output Index and the IHS Markit Flash Services Business Activity Index. Flash indices are based on around 85% of final survey responses and are intended to provide an advance indication of the final indices.

Jingyi Pan, Economics Associate Director, IHS Markit

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-economy-expands-at-faster-rate-as-restrictions-ease-Nov21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-economy-expands-at-faster-rate-as-restrictions-ease-Nov21.html&text=Australia+economy+expands+at+faster+rate+as+restrictions+ease%2c+but+price+pressures+persist+as+costs+surge+higher+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-economy-expands-at-faster-rate-as-restrictions-ease-Nov21.html","enabled":true},{"name":"email","url":"?subject=Australia economy expands at faster rate as restrictions ease, but price pressures persist as costs surge higher | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-economy-expands-at-faster-rate-as-restrictions-ease-Nov21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Australia+economy+expands+at+faster+rate+as+restrictions+ease%2c+but+price+pressures+persist+as+costs+surge+higher+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-economy-expands-at-faster-rate-as-restrictions-ease-Nov21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}