Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 27, 2017

A difficult tradeoff for buyers: How a NAFTA withdrawal would affect supply chains

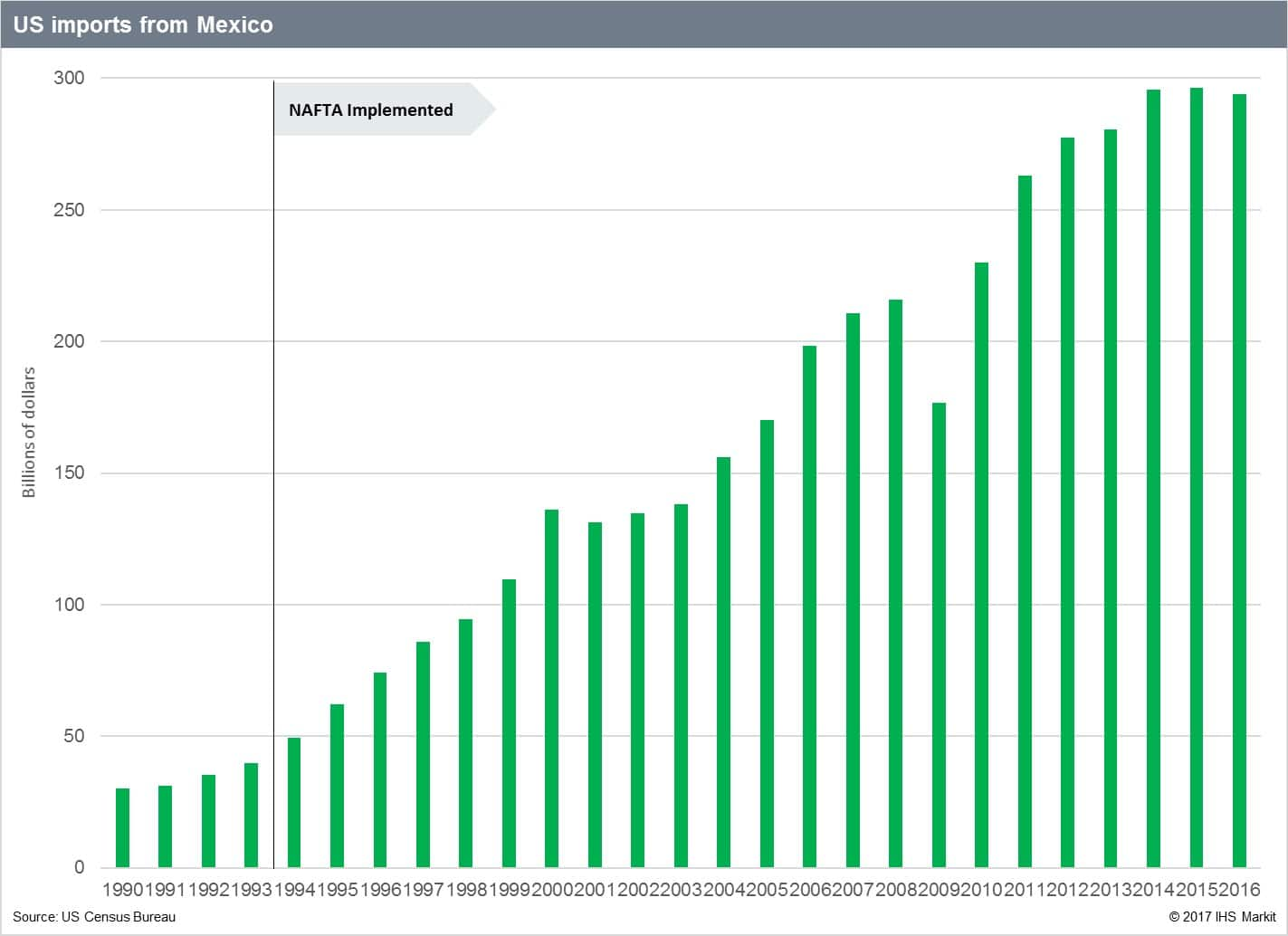

With the United States, Canada, and Mexico renegotiating NAFTA, the future of the trade deal hangs in the balance. As the Trump administration makes demands that Mexico and Canada have deemed "nonstarters." it is not a given that negotiators will strike a deal. The possibility of a discontinuation of NAFTA adds considerable upside risk to supply chains. Thus, purchasers are advised to put in place contingencies for a possible US withdrawal from NAFTA.

The effects of a withdrawal from NAFTA are examined below using the three industries with the highest value of imports from Mexico in 2015: motor vehicles, electrical equipment, and machinery. We analyzes how prices will move, all other things being equal, using the following items: how much of the good is imported from Mexico, the percentage of costs that are passed through to buyers for the good, and what percentage of global imports come for the good come from Mexico.

The United States and Canada have a free-trade agreement that predates NAFTA, so I will focus on trade flows between the United States and Mexico, as they will undergo the most dramatic disruptions should NAFTA talks fail. Under NAFTA, tariffs on goods coming from Mexico are essentially zero. If the Trump administration were to leave the agreement, tariffs for most goods coming from Mexico would be 3.5%-the tariff rate placed on imported goods from countries with Most Favored Nation status.

Each industry is examined within the context of our price forecasting equation and data available from US input-output tables. Within our model, price formation is viewed as a function of cost, end-market demand, and other relevant seasonal or institutional factors. In our price model, the regression coefficient on the cost term estimates how much a change in input prices (i.e., costs) gets pushed through into final product prices. Input-output data can be used to identify how much a certain US industry relies on imported goods and services in its production process, while our Global Trade Atlas specifies the value of imports from Mexico. For simplicity, this analysis is static; thus, price effects may be slightly understated, as it does not reflect changes in upstream costs should producers be forced to move to higher cost locations after a NAFTA withdrawal.

<<b>Motor vehicles: Biggest import from Mexico

In terms of absolute value, motor vehicles are the largest product group that the United States imports from Mexico. Despite the large absolute value ($74.6 billion), imports from Mexico account for just over one-quarter of global imports in the United States, leaving buyers with other sourcing options. When factoring in production by American motor vehicle manufacturers, motor vehicle imports account for a mere 8.0% of domestic supply. Thus, the price effects on motor vehicles would be less noticeable than in industries that rely more heavily on Mexican imports.

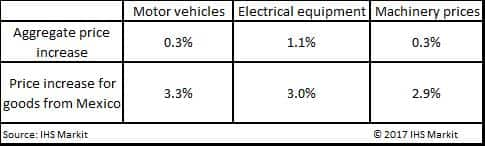

Cost pass through is high for motor vehicles-our model indicates that 93% of all cost increases are ultimately passed onto buyers-meaning the added costs due to tariffs would mostly be borne by buyers. Motor vehicle prices in aggregate will increase by only 0.3% for buyers should the United States withdraw from NAFTA, as the share of domestic supply imported from other countries would not be affected; meanwhile, buyers that purchase only motor vehicles imported from Mexico will see price increases of 3.3%.

Electrical equipment: An industry heavily reliant on imports from Mexico

Electrical equipment is another major product group imported from Mexico. In terms of total value imported, only motor vehicles surpass it; however, imports from Mexico make up a disproportionate percentage of total electrical equipment imports in the United States, coming in at nearly 70% in 2015. Additionally, Mexican imports account for more than 36% of the domestic supply of electrical equipment in the United States; thus, electrical equipment would be the product group most exposed to price spikes should the United States withdraw from NAFTA.

When costs increase for electrical equipment, buyers absorb most of the burden-our model indicates that 85% of costs are passed through to buyers of electrical equipment. Consequently, should NAFTA break down, buyers would see a price increase of 1.1% in aggregate for electrical equipment in the United States; meanwhile, buyers whose purchases consist of only electrical equipment imported from Mexico would face price increases of 3.0%.

Machinery: High import value, modest share of domestic supply

The United States imported roughly $49 billion worth of machinery in 2015, marking it the third largest imported product group by absolute value-this accounts for roughly one-third of global imports to the United States. When factoring in domestic production of machinery, Mexican imports account for roughly 11% of supply in the United States; consequently, a withdrawal from NAFTA would force prices up in machinery markets, though not to the extent that would occur in markets more reliant on imports from Mexico for total supply.

Costs are largely passed through to buyers for machinery, similar to the other product groups that we have analyzed; our model indicates that when costs increase for machinery, buyers pick up 84% of the tab. This cost pass-through, in addition to the total exposure of machinery markets to imports from Mexico, indicate that prices in the United States would increase by a mere 0.3% for machinery in aggregate. Alternatively, machinery products coming straight from Mexico would increase in price by a more sizable 2.9%.

Bottom line: A US withdrawal from NAFTA would surely disrupt supply chains, with buyers that import goods directly from Mexico the most exposed. Supply chain disruptions due to a poor outcome from ongoing NAFTA negotiations is something buyers cannot ignore. We advise devising contingencies to prepare for this possibility.

Cole Hassay is an Economist for the Pricing and Purchasing services at IHS Markit

Posted 28 November 2017

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-difficult-tradeoff-for-buyers-how-a-nafta-withdrawal-would-affect-supply-chains.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-difficult-tradeoff-for-buyers-how-a-nafta-withdrawal-would-affect-supply-chains.html&text=A+difficult+tradeoff+for+buyers%3a+How+a+NAFTA+withdrawal+would+affect+supply+chains","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-difficult-tradeoff-for-buyers-how-a-nafta-withdrawal-would-affect-supply-chains.html","enabled":true},{"name":"email","url":"?subject=A difficult tradeoff for buyers: How a NAFTA withdrawal would affect supply chains&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-difficult-tradeoff-for-buyers-how-a-nafta-withdrawal-would-affect-supply-chains.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=A+difficult+tradeoff+for+buyers%3a+How+a+NAFTA+withdrawal+would+affect+supply+chains http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-difficult-tradeoff-for-buyers-how-a-nafta-withdrawal-would-affect-supply-chains.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}