Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 24, 2014

Ireland leads global business sentiment

There appears to be little sign of the recent growth spurt in Ireland coming to an end, according to the latest Markit Business Outlook survey. Optimism among businesses in Ireland regarding the year-ahead outlook for company performance is the highest of all countries covered by the survey, with sentiment strengthening from the summer in both the manufacturing and service sectors.

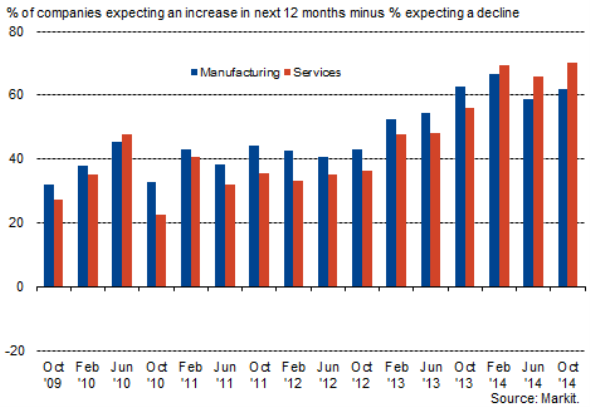

Business Activity outlook

The composite net balance of firms expecting an increase in business activity in the next 12 months is +67%, up from +63% in June and the second-highest on record. That compares with a global average of +28%.

Irish companies expect to be able to take advantage of improving economic conditions to launch new products and enter new markets, helping to expand their operations over the coming year. The domestic market looks set to be one source of growth, while the main areas in which businesses hope to secure new export orders are the UK and US.

Opportunities for growth

Threats to the outlook include the potential for deteriorating economic conditions in the rest of the eurozone. On this theme, optimism across the euro area has dropped to the lowest since mid-2013 in the latest survey.

Meanwhile, manufacturers predict that a strengthening of the euro, particularly with regard to sterling, would have a negative impact on their operations.

Threats to the outlook

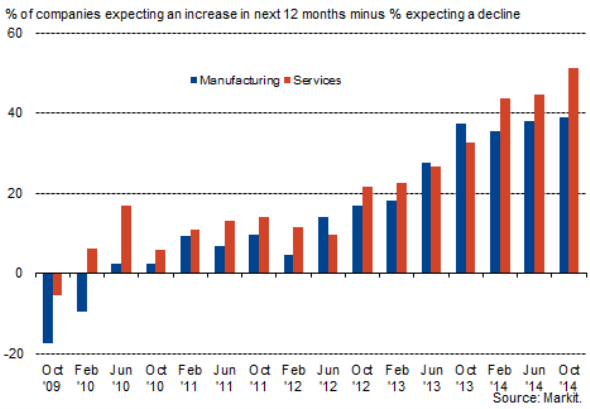

Optimism regarding workloads has led companies to predict further rises in employment and capital expenditure over the coming year. Sentiment regarding future staffing levels in Ireland is by far the strongest in the eurozone, with services companies at their most optimistic since the survey began in April 2006.

Employment outlook

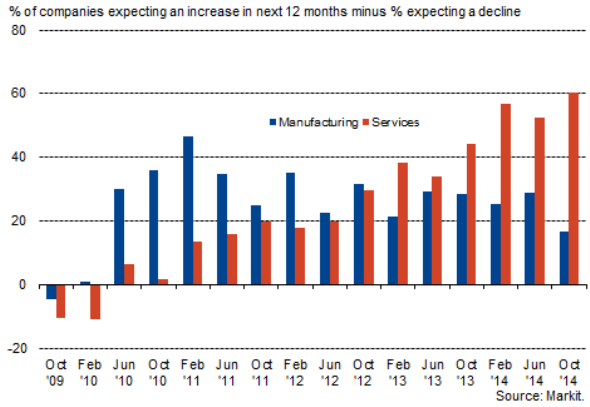

Another area where the outlook in Ireland has diverged from the rest of the eurozone has been prices. Both the input prices and output prices net balances in Ireland are much higher than those seen in other eurozone nations, the former due to a record-high net balance at services companies.

Looking specifically at the service sector shows that staff costs are likely to be the main driver of overall inflation, and a number of firms report that higher wage costs are a threat to growth going forward. Expectations of difficulties in finding skilled staff are also mentioned.

Input Prices outlook

On balance, companies in Ireland appear confident that growth can continue in spite of any deteriorations in the rest of the eurozone, with signs of improvement in the domestic market and alternative sources of export demand set to support expansions in activity over the coming year.

For more information on global business outlook data please contact economics@markit.com.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112014-economics-ireland-leads-global-business-sentiment.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112014-economics-ireland-leads-global-business-sentiment.html&text=Ireland+leads+global+business+sentiment","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112014-economics-ireland-leads-global-business-sentiment.html","enabled":true},{"name":"email","url":"?subject=Ireland leads global business sentiment&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112014-economics-ireland-leads-global-business-sentiment.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Ireland+leads+global+business+sentiment http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112014-economics-ireland-leads-global-business-sentiment.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}