Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 18, 2014

Discounts fuel fastest UK retail sales growth for over a decade

UK retail sales surged higher in November, boosted by 'Black Friday' discounting and an increasing feel-good factor among households.

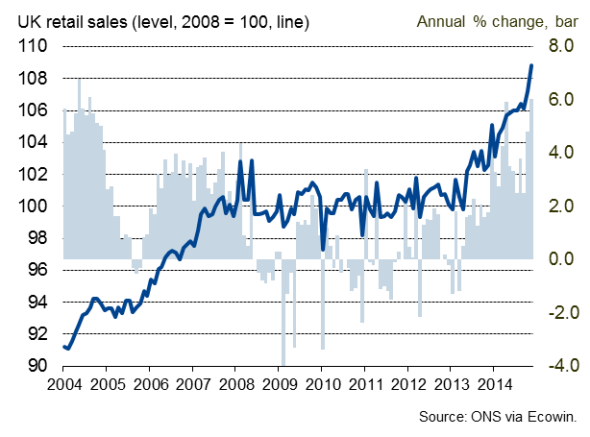

Sales volumes rose 1.6% in November, up some 6.4% on a year ago. This is the strongest year-on-year rise seen since May 2004, according to the Office for National Statistics. The increase builds on a strong 1.0% rise in October to indicate that sales are on a firm upward trend. The improvements mean sales in the fourth quarter are so far running some 1.7% higher than the third quarter.

UK retail sales

Questions will of course be asked as to whether the Black Friday discounts merely mean spending has been brought forward ahead of the usual Christmas spree (electrical stores, for example, saw sales rise almost one-third above a year ago, a record increase, linked to early Black Friday discounts) but at the moment it certainly looks like retail sales are on a firm upward trend.

The outlook for consumer spending is certainly one of the best that we've seen since the recession struck. Wages are finally showing signs of a meaningful pick up, and are at last growing faster than inflation. Survey data from the recruitment industry suggest that we can expect wages growth to accelerate in coming months. Rising employment also means that more people are in work and earning. Inflation has meanwhile fallen sharply and is set to drop further due to lower oil prices and intense competition among retailers.

This upbeat outlook is supported by the survey data. Markit's Household Finance Index showed that consumers are the most upbeat about their future finances than at any time since the financial crisis in December, buoyed by lower inflation and the prospect of rising incomes.

There are of course factors which could halt the rise in consumer spending, such as the possibility of further house prices falls and a stalling in the pace of economic growth and job creation. The housing market is already cooling, and the PMI surveys are indicating that business activity has so far expanded at a slower pace in the fourth quarter compared to earlier in the year.

However, the main threat to further growth of consumer spending is of course higher interest rates, but in that respect the outlook looks favourable, with the Bank of England indicating that rate hikes are unlikely to occur until the second half of next year, and even then for borrowing costs to rise only very gradually.

On balance, it therefore looks like consumer spending and retail sales will continue to rise over the coming year, with growth perhaps fading as interest rates start to rise later in 2015.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-Economics-Discounts-fuel-fastest-UK-retail-sales-growth-for-over-a-decade.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-Economics-Discounts-fuel-fastest-UK-retail-sales-growth-for-over-a-decade.html&text=Discounts+fuel+fastest+UK+retail+sales+growth+for+over+a+decade","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-Economics-Discounts-fuel-fastest-UK-retail-sales-growth-for-over-a-decade.html","enabled":true},{"name":"email","url":"?subject=Discounts fuel fastest UK retail sales growth for over a decade&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-Economics-Discounts-fuel-fastest-UK-retail-sales-growth-for-over-a-decade.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Discounts+fuel+fastest+UK+retail+sales+growth+for+over+a+decade http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-Economics-Discounts-fuel-fastest-UK-retail-sales-growth-for-over-a-decade.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}