Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 16, 2014

UK inflation falls to 1.5%, but house prices rise at fastest rate for seven years

UK inflation eased to the joint-lowest seen over the past five years in August, dropping further below the Bank of England's 2% target. The downturn in inflation provides policymakers with greater leeway to keep interest rates on hold for longer while the economy continues to recovery.

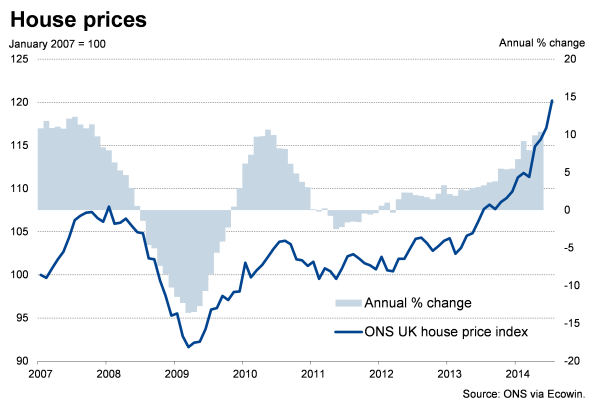

However, the housing market will remain something of a concern to the Bank of England, where a further marked jump in prices on a year ago will add to worries that the property market poses a key risk to financial stability, and that macroprudential tools may be insufficient to cool the housing market without an accompanying rate hike.

Data from the Office for National Statistics showed consumer prices rising at an annual rate of 1.5% in August, down from 1.6% in July and matching the four-and a half year low seen back in May.

Other data, also published by the ONS today, showed the official measure of UK houses price up 11.7% on a year ago in July, the fastest rate of increase seen for seven years.

Benign outlook

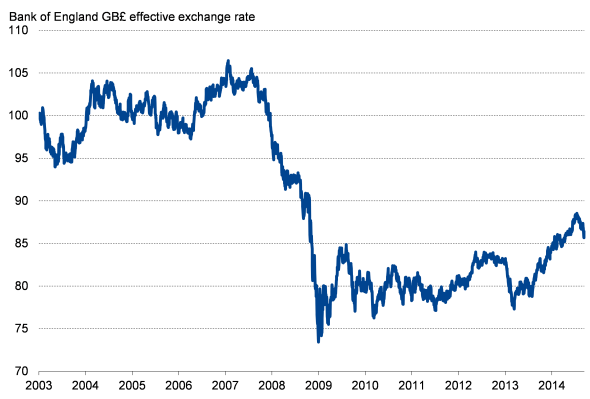

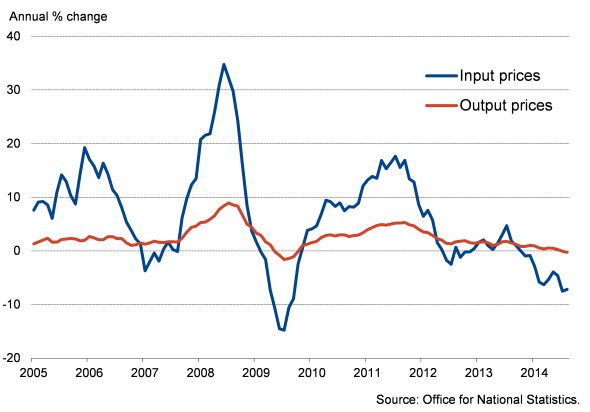

There are good reasons to expect inflation to remain subdued in coming months. Sterling's appreciation since last year has helped bring down the cost of imports, and global commodity prices are also being kept down by historically weak demand, especially from previously-booming emerging markets such as China. Global oil prices have also proved resistant to recent geopolitical concerns, kept low in part due to greater supply from the US. Data from the ONS confirmed these trends, showing factory gate prices falling 0.3% on a year ago in August - the steepest decline since September 2009.

At home, supermarket prices wars are keeping the average bill at the checkouts down, and utility prices should benefit from the lower oil prices, although with concerns growing about energy supply this winter, there may be some inflationary pressures coming through.

Finally, the latest available official data showed pay pressures running at the lowest seen since records began. Regular pay was up just 0.6% on a year ago in the three months to June, and was down 0.2% when bonuses are included in the calculations.

Pay growth key to policy

However, there are signs that pay pressures could soon pick up again. Some sectors, such as retail and manufacturing, are already seeing real pay growth, and survey data show starting salaries rising sharply as the labour market tightens.

Policymakers will also be concerned about a recent upturn in inflation expectations.

While the latest inflation data therefore buys time for interest rates to remain on hold, policymakers will be keeping a keen eye on the pay, housing market and inflation expectations data to ensure that any hike in interest rates is not delayed too long.

Exchange rate

Producer prices

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092014-UK-inflation-falls-to-1-5-but-house-prices-rise-at-fastest-rate-for-seven-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092014-UK-inflation-falls-to-1-5-but-house-prices-rise-at-fastest-rate-for-seven-years.html&text=UK+inflation+falls+to+1.5%25%2c+but+house+prices+rise+at+fastest+rate+for+seven+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092014-UK-inflation-falls-to-1-5-but-house-prices-rise-at-fastest-rate-for-seven-years.html","enabled":true},{"name":"email","url":"?subject=UK inflation falls to 1.5%, but house prices rise at fastest rate for seven years&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092014-UK-inflation-falls-to-1-5-but-house-prices-rise-at-fastest-rate-for-seven-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+inflation+falls+to+1.5%25%2c+but+house+prices+rise+at+fastest+rate+for+seven+years http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092014-UK-inflation-falls-to-1-5-but-house-prices-rise-at-fastest-rate-for-seven-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}