Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 14, 2016

Bank of England policy on hold until post-referendum picture revealed

The Bank of England held policy unchanged at its July meeting, choosing to not rush a knee-jerk reaction to the UK's vote to leave the EU and instead await new data on the post-referendum economic situation.

However, the minutes from the latest Monetary Policy Committee meeting highlight how a cut in interest rates to a new record low of 0.25% appears to be on the cards for August, as is the possibility of further measures, widely mooted to include the extension of the Funding for Lending scheme and the expansion of the Bank's asset purchase programme.

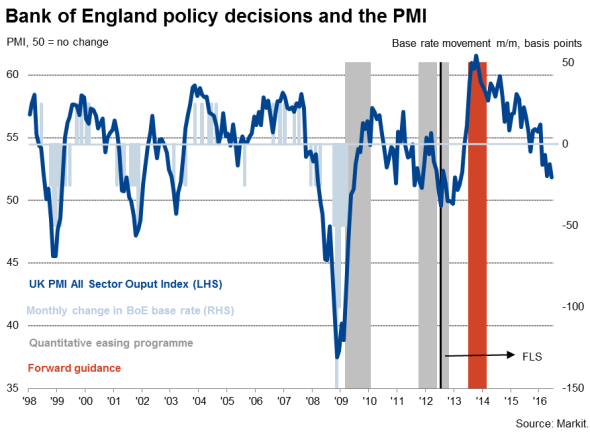

The minutes noted that "most members of the Committee expect monetary policy to be loosened in August", and further stimulus certainly seems likely to be warranted. A slowdown in the economy was already severe enough to raise the possibility of monetary stimulus before the June 23rd vote, according to surveys of business activity. Throughout the second quarter, PMI data had fallen to levels which have typically been commensurate with the Bank of England injecting more stimulus in the past.

Recent survey evidence has also shown that the number of companies citing the UK vote to leave the EU as being detrimental to their businesses outnumbers those expecting to benefit by some nine-to-one. It therefore seems highly likely that the reality of the Leave vote will put further downward pressure on the pace of economic growth in the short-term at least.

However, the extent to which any central bank action, and especially lower interest rates, can have any material impact on the economy remains in doubt.

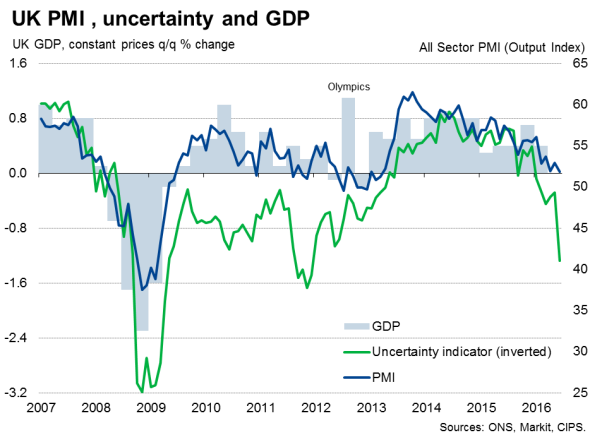

When it comes to stimulating growth, the worry is that lowering the cost of credit will prove ineffectual without an associated increase in demand for borrowing by households and companies. Demand for loans relies to a large extent on confidence in the economic outlook, which currently remains highly uncertain. A composite gauge of economic uncertainty, which pulls together various measures of financial market, real economy and sentiment indicators has risen to its highest since 2011.

Policymakers will therefore need to do a lot more to shore up confidence and keep the gears of the economy turning in the coming months. In the lead up to the August meeting, the focus shifts to the new government's 'Brexit' plans and any potential fiscal boost to the economy in order to get further clarity on the economic outlook.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072016-Economics-Bank-of-England-policy-on-hold-until-post-referendum-picture-revealed.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072016-Economics-Bank-of-England-policy-on-hold-until-post-referendum-picture-revealed.html&text=Bank+of+England+policy+on+hold+until+post-referendum+picture+revealed","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072016-Economics-Bank-of-England-policy-on-hold-until-post-referendum-picture-revealed.html","enabled":true},{"name":"email","url":"?subject=Bank of England policy on hold until post-referendum picture revealed&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072016-Economics-Bank-of-England-policy-on-hold-until-post-referendum-picture-revealed.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+of+England+policy+on+hold+until+post-referendum+picture+revealed http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072016-Economics-Bank-of-England-policy-on-hold-until-post-referendum-picture-revealed.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}