Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 05, 2015

Global factory growth hits slowest for nearly two years

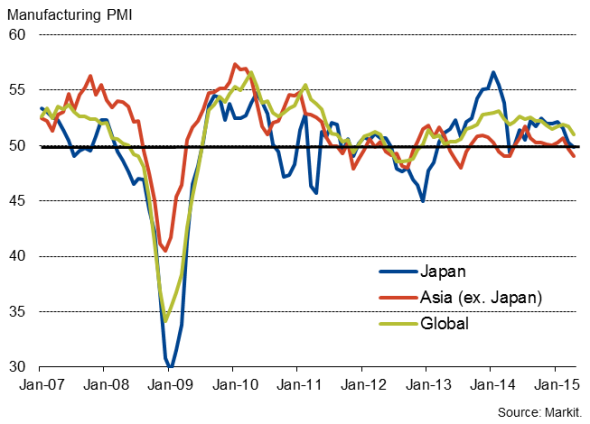

The global manufacturing economy expanded at the slowest rate for almost two years in April. The JPMorgan Manufacturing PMI, compiled by Markit from its worldwide business surveys, fell from 51.7 in March to 51.0, its lowest since July 2013.

Global factory output and new orders grew at the weakest rates for almost two years amid a near-stagnation of export orders, which in turns pointed to a slump in world trade flows.

Global factory headcounts also barely rose, highlighting a widespread reluctance among producers to take on more staff in the face of growing economic uncertainty and weak demand.

Lower global commodity prices meanwhile helped reduce producers input costs, which fell marginally, down for the third time in the past four months. Average selling prices also fell, dropping for the sixth time in the past seven months to point to an ongoing absence of inflationary pressures in the global goods-producing economy.

Global manufacturing output

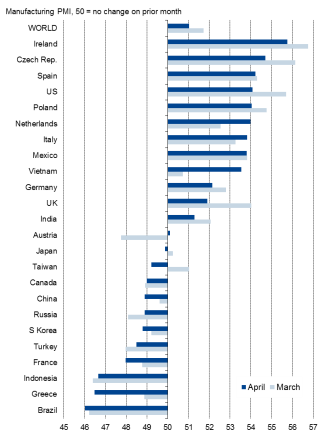

Manufacturing PMI ranking

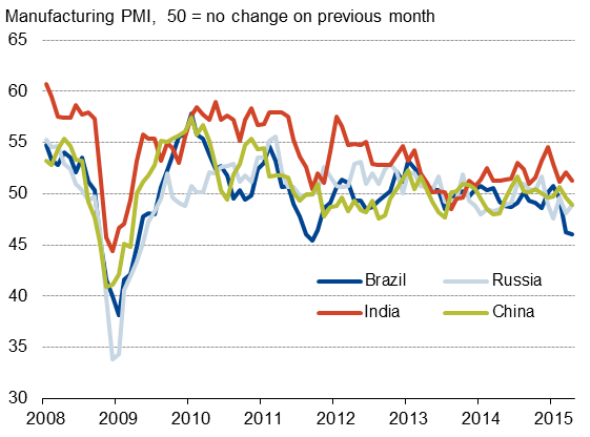

Emerging market contraction

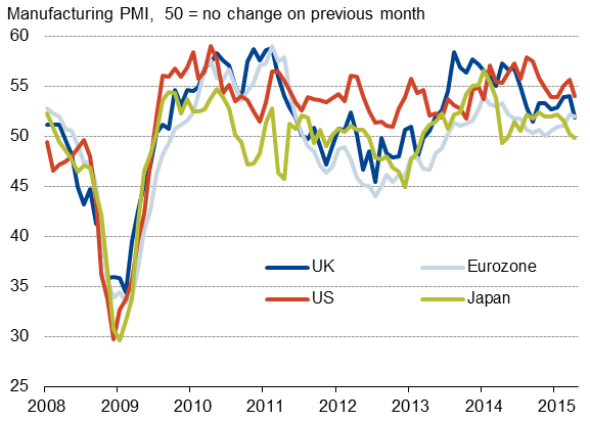

Renewed weakness was evident in the developed and emerging worlds alike, but especially the latter. The PMI surveys for the emerging markets signalled a contraction for the first time in a year. Developed world manufacturing continued to grow, led largely by the US, but the expansion was the weakest since July 2013.

In the emerging markets, China's manufacturing economy contracted for the fourth time in the past five months, with the PMI hitting a 12-month low.

Worst performing among the four largest developed economies was Japan, where the PMI signalled the first (albeit marginal) contraction for 11 months, but growth also edged lower in the US, UK and eurozone.

Emerging markets

Ireland heads rankings for third straight month

Eurozone weakness was by no means broad-based across the region, however, with Ireland holding the top spot in the global manufacturing growth rankings for the third month running in April. Spain was in third place and Italy rose to seventh position, highlighting the so-called periphery's recent resurgence.

Developed world

Russia bucks trend of Eastern Europe expansion

The Eastern European economies of the Czech Republic and Poland continued to fare well, holding second and fifth places in the global rankings respectively, but Russia continued to see an ongoing contraction of its manufacturing economy, albeit with the pace of decline easing.

Brazil retains bottom place in rankings

Bottom place in the rankings was again held by Brazil, whose manufacturing sector is undergoing the steepest downturn since 2011. The next-weakest performer was Greece, where the PMI is signalling a return to recession and the fastest rate of decline for nearly two years as the country continues to do battle with its creditors.

Asian malaise spreads

In total, 11 of the 24 countries surveyed reported a deterioration in their manufacturing economies in April, up from ten in March. Although Austria stabilised, both Japan and Taiwan joined South Korea in decline as malaise continued to spread through Asia. The PMI surveys showed Asian manufacturing contracting for a second successive month in April (with Asia excluding Japan also in decline for a second straight month).

Asian downturn

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-Economics-Global-factory-growth-hits-slowest-for-nearly-two-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-Economics-Global-factory-growth-hits-slowest-for-nearly-two-years.html&text=Global+factory+growth+hits+slowest+for+nearly+two+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-Economics-Global-factory-growth-hits-slowest-for-nearly-two-years.html","enabled":true},{"name":"email","url":"?subject=Global factory growth hits slowest for nearly two years&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-Economics-Global-factory-growth-hits-slowest-for-nearly-two-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+factory+growth+hits+slowest+for+nearly+two+years http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-Economics-Global-factory-growth-hits-slowest-for-nearly-two-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}