Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 05, 2017

Kenyan economy suffers following interest rate cap

PMI survey data indicating a contraction of business activity raise concerns about the impact of recent bank lending regulations.

Last September, Kenyan policy makers implemented a cap on the rate at which commercial banks can lend at 4% points above the Central Bank Rate, which currently stands at 10%.

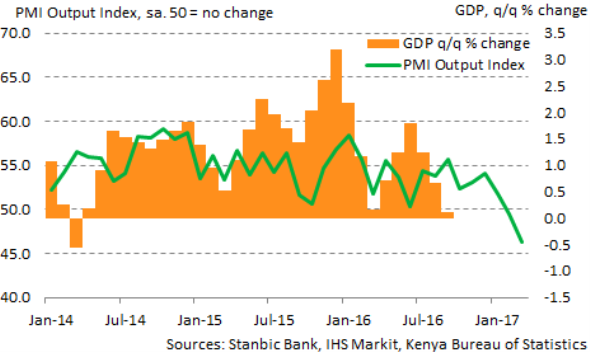

Stanbic Bank PMI data, produced by IHS Markit, reveal that three years of sustained improvements in business conditions came to an end in March. The Banking Amendment Act was reported by companies to have contributed directly to the contraction in Kenyan private sector business conditions.

Companies responding to the PMI survey have mentioned the lending rate cap as having a detrimental impact on business in early-2017 as customers faced financial constraints and weaker demand conditions. The PMI data suggest that there is a strong likelihood that GDP could fall in the first quarter of the year.

Order book growth wanes

March PMI data also pointed to a slowdown in new order growth to the weakest since the survey began at the start of 2014. This represents a marked turnaround from the end of 2016 when sharp expansions in new orders were being recorded.

Threat to the economy

Evidence on the impacts of the lending cap are also beginning to show through in official data. Credit growth to the private sector was much slower at the end of 2016 than had been seen earlier in the year, tracking at around the lowest since the end of 2003.

Meanwhile, analysis by the Kenyan central bank suggests that loan approvals declined by 6% between December 2016 and February 2017.

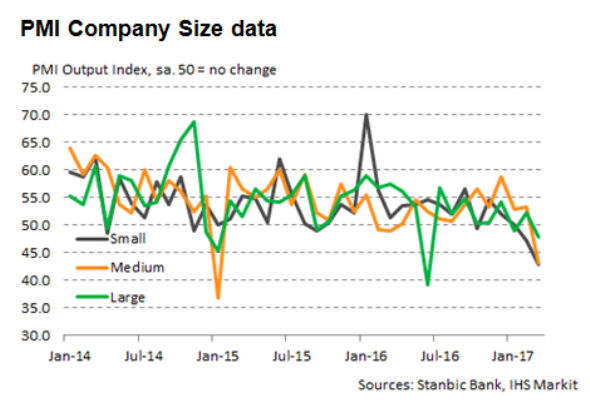

The minutes from the central bank's recent Monetary Policy Committee meeting also suggested that small and medium enterprises have been disproportionately affected. This is believed to be a consequence of rigid credit standards, with banks gravitating towards lending to safer borrowers, such as the government or large corporations rather than small riskier borrowers.

The PMI data back up these findings. Small and medium-sized companies recorded much sharper reductions in output during March than larger firms, according to the PMI data, with small companies performing worst over the first quarter as a whole.

It will be interesting to see if policymakers take note of the negative economic impacts of the rate cap and reassess the policy going forward. The release of official GDP estimates for the end of 2016 and opening quarter of 2017 will provide additional important information with regards to the impact of credit growth and bank lending.

The PMI will meanwhile continue to provide the latest information on how the economy is faring as we head into the second quarter of the year. PMI data covering data for April will be released on May 4th.

Aashna Dodhia

Economist, IHS Markit

Tel: +44 149 1461 003

Email: aashna.dodhia@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-Kenyan-economy-suffers-following-interest-rate-cap.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-Kenyan-economy-suffers-following-interest-rate-cap.html&text=Kenyan+economy+suffers+following+interest+rate+cap","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-Kenyan-economy-suffers-following-interest-rate-cap.html","enabled":true},{"name":"email","url":"?subject=Kenyan economy suffers following interest rate cap&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-Kenyan-economy-suffers-following-interest-rate-cap.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Kenyan+economy+suffers+following+interest+rate+cap http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-Kenyan-economy-suffers-following-interest-rate-cap.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}