Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 03, 2015

PMI surveys signal steepest economic downturn for 6" years

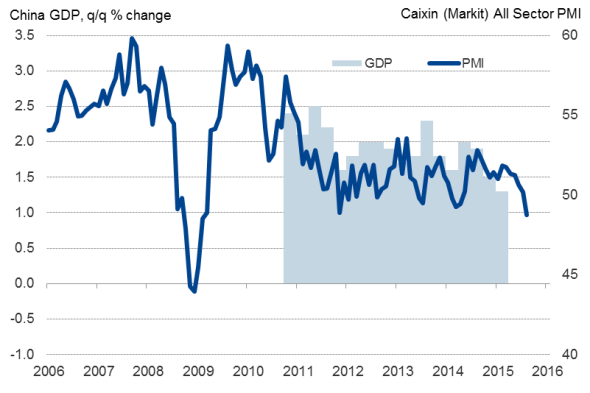

China's economy contracted at the steepest rate for six-and-a-half years in August, according to survey data. The Caixin China Composite PMI (which covers both manufacturing and services), compiled by Markit, indicated the largest drop in output since the height of the global financial crisis in February 2009. The "all sector' output index slipped to 48.8 from 50.2 in July.

Economic growth

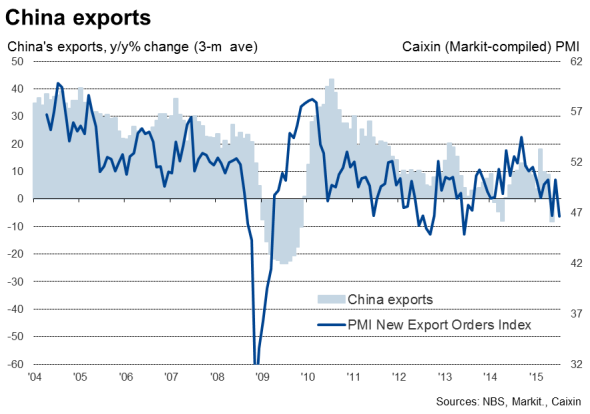

The slowest growth of service sector business activity for just over a year was accompanied by the steepest drop in manufacturing output since November 2011. Factory output has now fallen for four successive months due to a combination of weak domestic demand and deteriorating exports. Goods export orders fell in August at one of the steepest rates seen over the past three years.

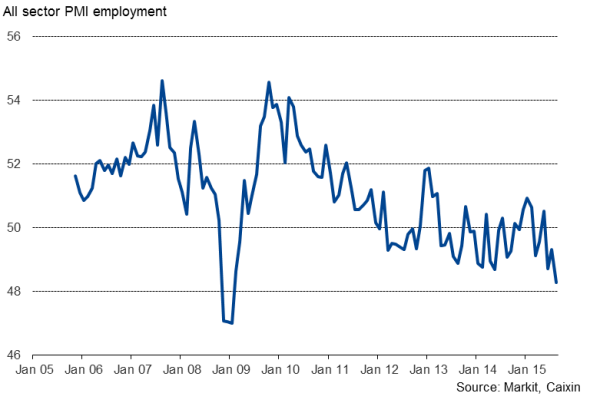

Job cutting accelerates

The downturn continued to feed through to the labour market, with employment across the two sectors declining at a rate not seen since January 2009. Increased job shedding in manufacturing was joined by a near-stagnation of staffing levels in the services economy.

Further weakness of production and employment trends look likely in September, as overall inflows of new orders fell in August for the first time since April of last year, led by an increasingly marked downturn in manufacturing orders.

Employment

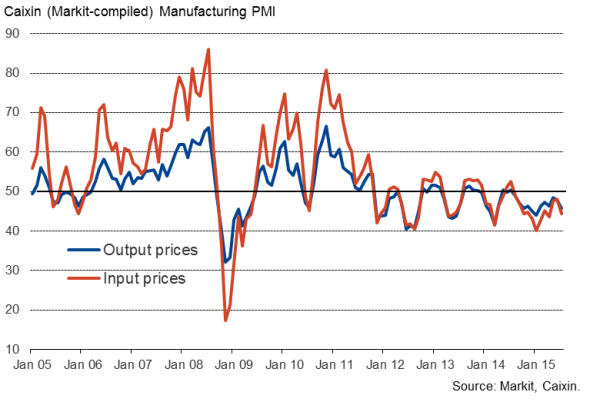

Price discounting

Prices continued to fall in August, highlighting the current weakness of demand, subdued wage pressure and low global commodity prices. Average input costs fell at a rate close to July's pace, while average prices charged fell at the fastest rate since April.

Prices

Broad based measures to support growth

The average PMI reading for the third quarter so far of 49.5 is down from 51.1 in the second quarter, suggesting that the pace of economic growth is likely to have slipped from the 7.0% annual rate (1.3% quarterly rise) indicated by official GDP for the three months to June.

The downturn piles more pressure on the authorities to boost the economy and help cool recent financial market volatility. The authorities have already cut interest rates and banks' borrowing requirements, as well as injected money directly into stock markets, depreciated its currency and brought forward infrastructure spending plans to help stabilise the economy. As yet, the survey data suggest the measures take to date have had little impact.

Further rate cuts and stimulus therefore look likely if China is serious about meeting its 7% growth target for the year. After a succession of trims on recent months, the main lending rate still stands at 4.6%, having been cut five times since November, and there remains scope to cut reserve ratio requirements further.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-Economics-PMI-surveys-signal-steepest-economic-downturn-for-6-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-Economics-PMI-surveys-signal-steepest-economic-downturn-for-6-years.html&text=PMI+surveys+signal+steepest+economic+downturn+for+6%22+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-Economics-PMI-surveys-signal-steepest-economic-downturn-for-6-years.html","enabled":true},{"name":"email","url":"?subject=PMI surveys signal steepest economic downturn for 6" years&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-Economics-PMI-surveys-signal-steepest-economic-downturn-for-6-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+surveys+signal+steepest+economic+downturn+for+6%22+years http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-Economics-PMI-surveys-signal-steepest-economic-downturn-for-6-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}