EU renewable energy enters an era of transition

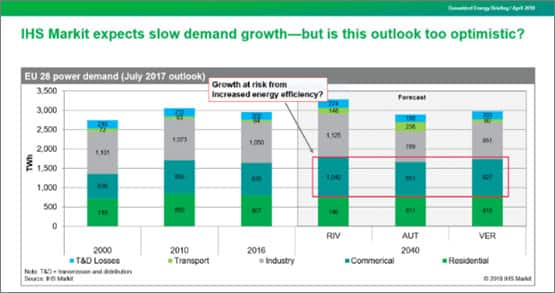

S&P Global predicts significant growth in European renewable energy by 2030, despite an undefined coal phaseout and EC policies in flux. In the absence of community agreement, EU member state policies remain the key drivers to shape the power market. Changes vary widely on a country-by-country basis, with the UK reduction in energy demand raising concerns for energy producers about the long-term outlook. A surprising high carbon price rise warrants closer examination of any potential risks.

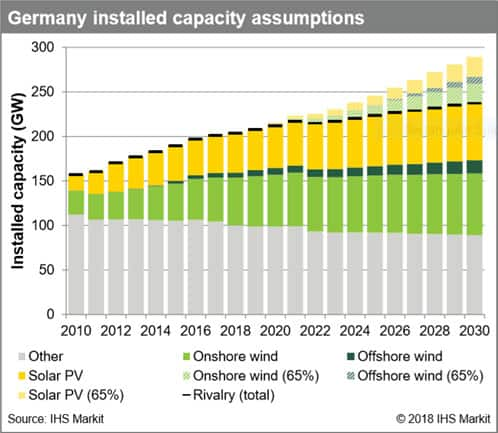

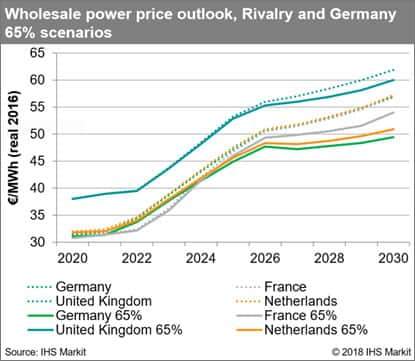

On the positive end of the equation, the potential for rapid offshore wind expansion is a hot topic closely intertwined with new German targets to move to 65% RES-E in 2030, which would significantly increase exposure for both thermal and renewables generation. Some scenarios reveal that more than 95W of wind and solar additions might be needed to meet the ambitious EU renewable energy targets. The scale of risk depends upon cross-border interconnection additions to absorb potential oversupply, instead of dampening prices or requiring curtailments.

S&P Global assists energy and power market participants to assess which business models/technologies will be robust and deliver financial returns in the new European renewables environment given a wide range of future scenarios.

Key issues under examination include:

- Electricity demand growth

- Factors shaping the power market

- Carbon price rise and downside risks

- Impact of commodity prices on wholesale prices

- Exposure to market change from a 65% RES-E target for 2030