Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 13, 2019

The ESG framework - Adding value through corporate sustainability scores

Research Signals - May 2019

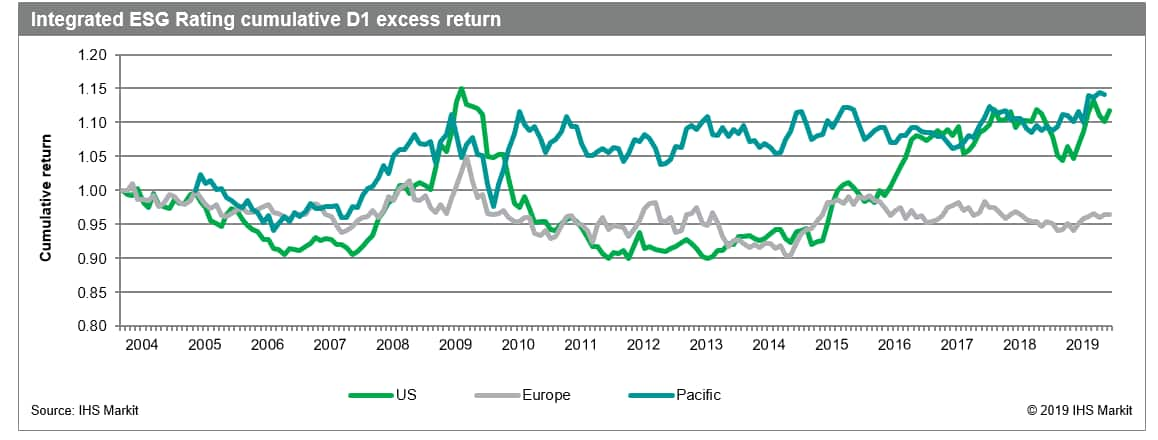

A range of environmental, social and governance (ESG) related themes have the potential to heavily impact the long-term viability of equity investments, from climate change and other environmental risks, to human capital management, compensation practices, supply chain impact and brand reputation. These value drivers extend well beyond those captured in traditional financial reporting, but are nevertheless fundamentally linked to shareholder returns. Using a set of specialty data (formerly the ASSET4 database) provided by Refinitiv, we confirm the ability to add value through ESG data, and propose possibilities for integration into traditional modeling processes. We first added ESG factors to our library in 2009 and at that time noted the limited use of ESG data by investment managers. Ten years later, we review performance of factors and screens, as well as extend our research to global markets, where the interest in ESG data is growing rapidly.

- ESG data offer uncorrelated insights into security performance and can provide a degree of outperformance from the highest ranked ESG companies over the lowest ranked names, as demonstrated by positive average 1-month spreads in US (0.16%), European (0.14%) and Pacific (0.06%) markets, with stronger performance over a 12-month investment horizon

- Based on a 25+ year backtest of our Value Momentum Analyst stock selection model over various holding periods, ESG's use as a screening criterion preserved the stand-alone model's positive top versus bottom quintile return spreads, though with expected weaker results as the underlying universe was significantly constrained

- We find more success using ESG as an overlay to our Value Momentum Analyst model, observing healthy returns from long intersection and exlcusion strategies, establishing viable applications of ESG factor overlays in long-only portfolio construction

IHS Markit provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fesg%2fs1%2fresearch-analysis%2fesg-framework-adding-value-through-corporate-sustainability.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fesg%2fs1%2fresearch-analysis%2fesg-framework-adding-value-through-corporate-sustainability.html&text=The+ESG+framework+-+Adding+value+through+corporate+sustainability+scores++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fesg%2fs1%2fresearch-analysis%2fesg-framework-adding-value-through-corporate-sustainability.html","enabled":true},{"name":"email","url":"?subject=The ESG framework - Adding value through corporate sustainability scores | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fesg%2fs1%2fresearch-analysis%2fesg-framework-adding-value-through-corporate-sustainability.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+ESG+framework+-+Adding+value+through+corporate+sustainability+scores++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fesg%2fs1%2fresearch-analysis%2fesg-framework-adding-value-through-corporate-sustainability.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}