Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 30, 2020

“Water is not the exception” – Historical drop in oil prices negatively affect the oilfield water management market

The recent drop in oil prices has created controversy about the future of most of the E&P and services companies, but how will this affect the oilfield water management market specifically? At the end of 2019, IHS Markit estimated that the oilfield water management market was going to grow 5% in 2020, mainly driven by the increase in activity in the Permian Basin with WTI prices projected to be between low-fifties to mid-forties per barrel. However, a few months after our publication, the industry conditions look completely different and so our view of the oilfield water management market has changed.

Following this price collapse, E&P companies quickly began to revise and reduce capital spending for the remainder of 2020. The E&P response indicates that the industry could reach spending around 2016 levels, which means a reduction of drilling and completion (D&C) activity by at least 40% during 2020 when compared to 2019.

The services sector will be highly affected not only by the decrease in D&C activity, but also by the potential pricing reductions that some operators are demanding. In the oilfield water management market, sourcing water and flowback water services will be the segments most affected by the decrease in D&C activity; sourcing water will feel the most pain compared to other segments in the water market as operators continue to reduce the use of fresh water and brackish water, while recycling continues to increase per well. However, the new market conditions will decelerate the total growth of recycling water in the short term as a result of decrease in activity in areas of high recycling.

Based on our D&C activity projections, IHS Markit estimates that frack water demand will decrease 47% during 2020. This is mainly driven by a decrease in Permian activity which significantly reduces the water services needed during completions operations. With the current recycling rates in the industry and the decrease of frack water demand, we expect to see the source water market value decrease more than 60% compared to the previous year, and we believe this segment will be almost fully replaced by recycling water in the next 5 years.

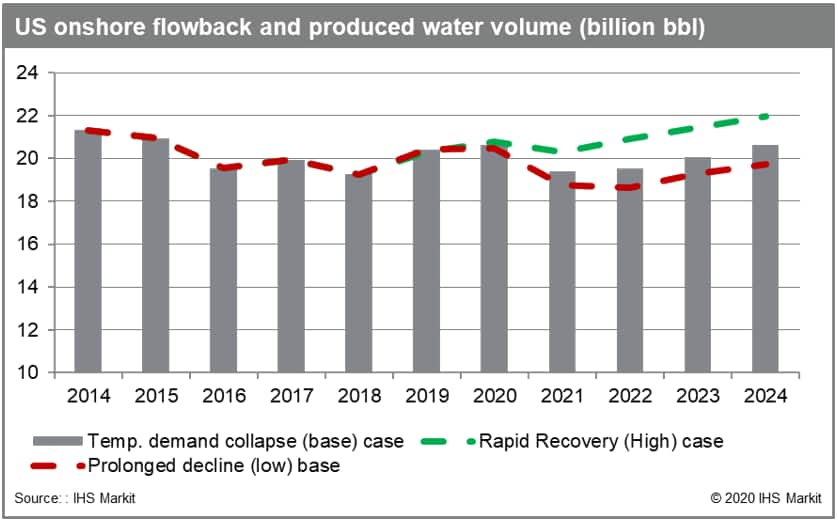

On the other hand, produced water will see a much "smoother" behavior compared to other segments in the industry as its volume is expected to peak for few months (+1%) during 2020. Although the Permian basin has some of the highest water-to-oil ratios in the market, this will not be enough to offset the effect that the dramatic decrease in activity will have on produced water volumes going into 2021.

Graphs

Figure 1: United States onshore flowback and produced water

volume (billion bbl)

Figure 2: Frac water demand by case (billion bbl)

For some operators the disposal of produced water is the largest lease operating expense (LOE), especially in plays with high water-to-oil ratio. While we expect to see a short-term spike in disposal volumes as a result of the decrease in recycling, on the long term we are expecting to see a reduction of volumes as low oil prices are expected to remain until 2022. The decrease of produced water volumes will reduce LOE for some E&P's, for others the reduction of LOE associated to water could be more difficult as some E&P's have signed contracts with volume requirements for multiple years.

There are various options to achieve the cost reductions needed in the market. On one hand, E&P companies with in-house water disposal will have to focus on efficiency optimization in their produced water supply chain to achieve the cost reductions needed in the current market; this could potentially increase the collaboration among operators to reduce logistics cost. On the other hand, E&P companies using third-party disposal services could negotiate pricing reduction, but those companies with contracts signed might have less flexibility for negotiation.

Integrated third party companies offering water disposal, logistics and recycling will be the best positioned to respond to the market needs, since these organizations potentially stand to gain new clients if they provide attractive pricing to E&P companies looking for cost reductions. IHS Markit estimates that these companies will be focusing on maintaining market share while slowing down infrastructure investments planned for 2020 as a result of the collapse in oil prices. We believe that those with the weakest hand in the water industry will be small to medium companies with a focus on the completions side of the business, offering sourcing and flowback water services.

To summarize, the water management market will feel the ripple effects of the oil price decrease, but the difference with other segments is that the produced water volumes will cushion the drastic decrease in D&C activity. Although produced water is expected to decrease, this segment still has room for efficiency optimizations and new collaboration opportunities between companies and operators.

For more information on these findings, feel free to contact us and learn more about our Onshore Services & Materials publications.

Paola Perez Pena is a Principal Research Analyst on the Upstream Cost and Technology team at IHS Markit.

Posted 30 March 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwater-is-not-the-exception-historical-drop-in-oil-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwater-is-not-the-exception-historical-drop-in-oil-prices.html&text=%e2%80%9cWater+is+not+the+exception%e2%80%9d+%e2%80%93+Historical+drop+in+oil+prices+negatively+affect+the+oilfield+water+management+market+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwater-is-not-the-exception-historical-drop-in-oil-prices.html","enabled":true},{"name":"email","url":"?subject=“Water is not the exception” – Historical drop in oil prices negatively affect the oilfield water management market | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwater-is-not-the-exception-historical-drop-in-oil-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=%e2%80%9cWater+is+not+the+exception%e2%80%9d+%e2%80%93+Historical+drop+in+oil+prices+negatively+affect+the+oilfield+water+management+market+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwater-is-not-the-exception-historical-drop-in-oil-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}