Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 22, 2019

Using historical E&P data to identify and evaluate play opportunities and secure future oil

In this first of a three-part series on conventional opportunities in an unconventional world, Mark Savery, Executive Director Upstream Product Management at IHS Markit sits down with Thomas G. Harris, President & CEO at BlackRock Exploration & Production to discuss the importance of historical data in today's energy landscape.

Mark Savery:

Tom, is it short-sighted to focus only on resource play trends over the last 5-10 years?

Tom Harris:

When I entered the energy industry in the mid 1970's, the experts declared we were at peak oil and running out of natural gas. The US government even mandated new power generation plants be coal-fired. Since then the industry has risen to the occasion. Natural gas is no longer a land-locked commodity, and we have an ample supply of gas for our current needs domestically and internationally. There are TCF's of stranded natural gas supplies worldwide. Oil is a different matter.

The world consumes about 100 million barrels of oil per day, and with predicted demand it is "all hands-on-deck" for identifying and securing future oil resources. The low hanging fruit has been plucked. Globally, we need both conventional and unconventional oil resources. With today's technology and prices, tight oil resource plays in North America provide less than 10% of world demand. Resource plays alone cannot supply all the world's current and future thirst for oil.

I am and have been an advocate for resource plays. They have gained market share in the energy industry and remain attractive because:

- The dry hole geological risk has been materially reduced

- The fluid types (oil vs. gas) are generally known and more predictable

- Both the public and private financial community is supportive due to the opportunity to provide large amounts of capital for the "Low Cost Producer"

- The industry has demonstrated its ability to safely provide these resources with proven technology developed and improved since WWII

This last point was a big shock to our European friends and the international community 10 years ago. They thought fracking was a recent "shale" phenomenon. They were surprised to learn that over one million wells had been fracked prior to 2009 in the US alone. I think this helps to illustrate why there is a need for legacy data to be maintained and reviewed.

Mark Savery:

Where does legacy well data come into play and why is it important?

Tom Harris:

There are over 700 sedimentary basins worldwide. Most of them have seen some level of exploration and not all are frontier. The industry needs to take advantage of this prior knowledge. For example, as an evaluator or investor, it is paramount to know if the acreage you are evaluating has been drilled (proven or condemned) by historical activity. I have experienced situations where the legacy well data is materially deficient from one vendor to another across areas of investigation.

Now, let me explain the importance of data from another experience I've had. When I was at Canadian Hunter Exploration in Calgary, Canada, the co-founders, John Masters and Jim Gray had framed portraits of mentors for the company on the walls in the main conference room. One of those mentors, Wallace Pratt, was the first geologist for Humble Oil (now Exxon-Mobil) over 100 years ago. He is celebrated within the geological community for a quote he made about "Oil is first found in the minds of men."

Think about that. Geologists don't just imagine it or conjure up an idea out of thin air. They examine the evidence before them, in this case historical well data, first to identify clues and potential indicators for new hydrocarbon areas, further inspect those clues, and then draw conclusions from them to support confirmation of the existence of new oil or gas deposits. Legacy data is also key to asset teams working together to develop hypotheses and test them; petrophysics, geophysics, geology and reservoir engineering working in tandem provides a unique lens on where we are as an industry, and where we're headed.

Mark Savery:

Tom, what do you look at when evaluating other play opportunities?

Tom Harris:

Mark, let me try to answer it by describing a three-step geoscientific process that has been successful for me when I focus on a formation.

I begin by defining an area of interest and generate a "Penetration - Show" Map. This is a base map across the area that spots all drilled wells with industry accepted well symbols.

Next, I superimpose another layer that highlights in bold black well symbols, all the wells that penetrate (partially or completely) the formation of interest. This allows me to see what kind of well control I can work with for the target horizon against a sea of historical drilling information.

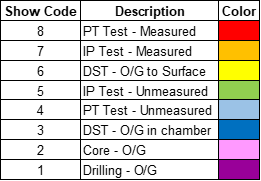

Then I superimpose a show map (color and symbols) for each of those identified wells penetrating the target horizon. It may depict the type of show encountered and recorded in the legacy data. Typically, I rank the show codes from a low value of 1 (reported driller show, "i.e. oil sheen on mud pit") to a higher value of 8 (measured Production test) as depicted in the table below:

Figure 1: Show Map for Identified Wells

These are the initial clues I use to identifying the presence or absence of a petroleum system for the target formation within the area of interest. Many years ago, we even contoured the numeric show code values to define the producing areas (field outlines) and offset acreage that may extend known field boundaries with a closer look.

In the absence of production, I might examine the fluid type (oil vs. gas) across the area to discern prospective oil trends or fairways. Additionally, I have extracted the API gravities from the measured legacy IP, DST, or core data to perhaps focus on high value light or gassy oils. This is where I might start.

Once a penetration show map is generated, I typically create structure and isochore/isopach maps for the target formation. This illustrates how deep and thick the target is and may help focus the investigations into sub regions across the trend.

After selecting an area to study, I need to understand what type of data is available to work with. IHS Markit acts as a custodian of this data, ensuring it is cohesive and complete across my area of interest from well data to mineral rights. I begin my data investigation by generating map layers of wells that indicate the presence of different log types, cores, cuttings, well tests, etc. across the target formation. At a high level for log types, I would usually like to note the presence of porosity devices (sonic, density, neutron). This helps me develop a subsurface model based on integrated petrophysical analysis of core, logs, and fluid data. Additionally, knowing the location and presence of sonic data (compression and shear) allows me to construct synthetics for seismic integration.

Check back next week for part two in this series, Conventional opportunities in an unconventional world: Subsurface models, bleeding cores and quantifying in-place fluid volumes.

Posted 22 January 2019

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fusing-data-to-identify-and-evaluate-play-opportunities.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fusing-data-to-identify-and-evaluate-play-opportunities.html&text=Using+historical+E%26P+data+to+identify+and+evaluate+play+opportunities+and+secure+future+oil+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fusing-data-to-identify-and-evaluate-play-opportunities.html","enabled":true},{"name":"email","url":"?subject=Using historical E&P data to identify and evaluate play opportunities and secure future oil | S&P Global&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fusing-data-to-identify-and-evaluate-play-opportunities.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Using+historical+E%26P+data+to+identify+and+evaluate+play+opportunities+and+secure+future+oil+%7c+S%26P+Global http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fusing-data-to-identify-and-evaluate-play-opportunities.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}