Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 23, 2021

Upstream oil and gas meeting its challenges through innovation

The upstream oil and gas sector is under increasing pressure to reduce costs and increase efficiencies so it can remain competitive in an evolving energy landscape. This statement might read like déjà vu from the most recent 2014-15 downturn when the industry faced a similar set of challenges. But this time is different. Capital constraints are more firmly in place, there are fewer dollars to wring from an already stressed supply chain, and scrutiny is rising on greenhouse gas (GHG) emissions from core oil and gas operations. Effectively managing these multiple demands, while respecting emerging operational and fiscal constraints, requires fundamentally new approaches to developing and operating oil and gas assets. IHS Markit sees technology and broader forms of innovation at the heart of these efforts.

Oil companies delivered during the last downturn. Between 2014 and 2016, the industry collectively reduced unit costs in such key resource classes as unconventionals and deepwater by an impressive 35% to 40%. A closer examination of these results, however, reveals that they may be difficult to replicate today. IHS Markit analysis indicates that roughly two-thirds of those cost reductions were achieved through supplier price concessions, with some key cost segments (e.g., offshore rigs and installation vessels, equipment, and steel) seeing 20% to 30% drops. (The other third was realized through such things as standardization and simplification of well and facility designs.) It will be difficult to mine this vein once again though, as additional IHS Markit analysis suggests that key supplier segments can only bear additional price cuts in the low- to mid-single digits under today's market conditions.

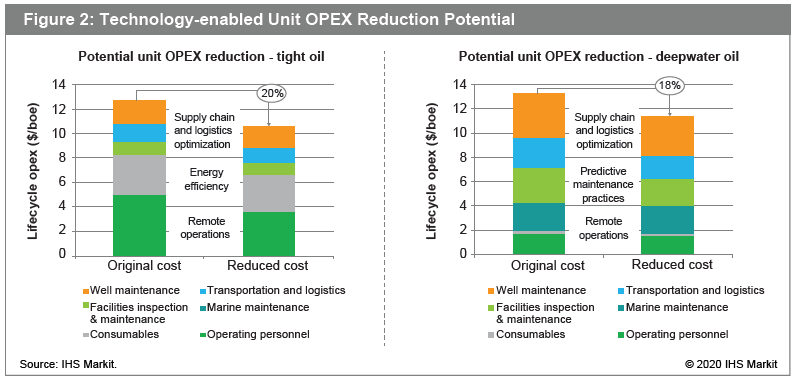

If new approaches for developing and operating hydrocarbon assets hold the greatest promise for driving future cost and efficiency gains, where should the industry focus first? A growing number of project delays coupled with a significant reduction in drilling activity points the needle squarely at operating expenditure (OPEX) reductions that can directly and materially impact the cash flows needed to fund the business. Refining the potential opportunity scope even further, the need for near-term results, an ability to scale solutions rapidly across an organization, and limits on additional capital investments are well-aligned with what digitalization and automation technologies can offer. That makes these technologies good candidates for initial deployments. With these guidelines in place, IHS Markit lays out a set of initiatives that companies might pursue to deliver results:

- Remote operations: By leveraging advances in sensor technologies, communication and control networks, and IT infrastructure, oil companies can shift onsite work to remote support (see Figure 1). This shift goes beyond basic surveillance tasks that have been underway for years and toward more complex activities such as complete asset control, true visit-by-exception, facility inspection, and remote maintenance support.

- Equipment performance and reliability: Taking advantage of greater access to real-time asset performance data and the development of advanced analytical tools, technical staff can better spot suboptimally performing equipment or impending failures, and then take early corrective actions. Not only do such activities increase asset productivity and uptime, they also reduce maintenance expenses and the use of consumables (such as fuel and glycol).

- Supply chain and logistics optimization: Periods of low commodity prices often expose inefficiencies in how companies manage their logistics and transportation networks. Through integrated planning, improved vehicle utilization, and route and speed optimization, oil companies have demonstrated 10% to 30% reductions in overall transportation costs.

- Energy efficiency: Power and fuel consumption are a significant cost component of many resource classes, especially maturing assets and offshore oil and gas. By proactively monitoring critical equipment and overall production systems to ensure optimal energy use - and taking steps when they fall outside such windows (without negatively impacting production) - even industry-leading companies have been able to reduce consumption by 5% to 15%.

IHS Markit investigates industry-leading deployments of such technology-related initiatives to identify the technical and organizational factors enabling their success, along with the performance improvements that oil companies are achieving through their efforts. Taking the midpoint of such performance uplifts and then applying them to the major operating cost components of key asset classes offers a realistic view of the near- and medium-term unit cost reduction potential. We estimate that oil companies could realize reductions of 20% and 18% in tight oil and deepwater oil, respectively (see Figure 2).

As mentioned earlier, stakeholder pressure is intensifying on oil companies to reduce the GHG emissions associated with their operations. But won't efforts to shrink the carbon footprints of oil and gas assets necessarily increase the expenses associated with developing and operating them? IHS Markit views reducing costs or reducing emissions as a false choice. Instead, we see a strong correlation between the most efficient operators and those doing the most to lower the carbon intensity of their assets. As evidence, most of the digitalization- and automation-related initiatives outlined above offer benefits in both areas. Here's how:

- Supply chain and logistics optimization coupled with remote operations minimize both the number of trips taken and the number of miles traveled to perform necessary work. The 20% to 40% efficiency improvement potential documented by IHS Markit would be accompanied by a similar reduction in vehicular emissions, with electrification of the fleet decreasing it even further.

- The carbon-reducing benefits of energy efficiency are

self-evident, with a direct correlation between the number of BTUs

consumed and carbon volumes emitted. A 5% to 15% improvement in

energy

efficiency would thus lead to an equivalent reduction in CO2 emissions. - The same technologies used to identify and predict equipment failures can also be applied to monitor and mitigate unintended methane releases. Fixed sensors along with mobile ones installed on drones, airplanes, and satellites can alert operations staff to existing or impending methane releases and then link to maintenance management systems that automatically initiate repair activities.

As every oil and gas asset has its own carbon emissions profile, so too will each have a unique set of initiatives that offer the greatest impact on lowering that profile. IHS Markit analysis indicates that for most assets, however, some combination of the above can reduce total GHG emissions on the order of 20% to 30%.

It is probably not too strong a statement to say that the oil and gas industry is at a critical juncture. With modest commodity prices projected for years to come and mounting climate-change concerns, industry players must find ways to lower their cost structures even further while substantially reducing the carbon footprints of their assets. A portfolio of digitalization- and broader technology-related solutions is increasingly available to get companies at least partway there.

The oil and gas sector is under increasing pressure to reduce costs, raise performanceand lower GHG emissions associated with its operations to remain competitive in anevolving energy landscape. Technology and broader forms of innovation are centralto these efforts and IHS Markit experts study the practical application and strategicimplications of such solutions to deliver on the industry's aspirations.Find out more: ihsmarkit.com/upstream-technology-and-innovation

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fupstream-oil-and-gas-meeting-its-challenges-through-innovation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fupstream-oil-and-gas-meeting-its-challenges-through-innovation.html&text=Upstream+oil+and+gas+meeting+its+challenges+through+innovation+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fupstream-oil-and-gas-meeting-its-challenges-through-innovation.html","enabled":true},{"name":"email","url":"?subject=Upstream oil and gas meeting its challenges through innovation | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fupstream-oil-and-gas-meeting-its-challenges-through-innovation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Upstream+oil+and+gas+meeting+its+challenges+through+innovation+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fupstream-oil-and-gas-meeting-its-challenges-through-innovation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}