Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 09, 2020

The Upstream Capital Costs Index (UCCI) will decline as its underlying markets react to a drastically lower oil price and weaker global economy caused by COVID-19.

Recent developments involving OPEC and COVID-19 have caused historic downturns in global oil prices and national economies. This situation has led the major players in the oil and gas industry to cut their spending budgets drastically for the coming few years, in turn delaying or cancelling many upcoming projects.

While it would be reasonable to assume that costs in the markets that depend on this upstream spending will decrease, our research reveals they will all react differently, in timing, severity and perhaps even directionality, depending on several factors.

We performed this research under three scenarios and the base case assumes, among other conditions, that new, global COVID-19 cases will peak by mid-second quarter 2020 and that Brent crude prices will generally be in the $10-$30/bbl range for the rest of 2020, rising to $30-$40/bbl in 2021 as demand growth returns.

Even though the presence of a base case inherently implies we have modeled a lower scenario, our foundational assumptions are still bearish. Using the previous 2014-2015 downturn as a benchmark, we expect overall costs to drop by a fifth of the drop seen during that time, with variability by region and by market.

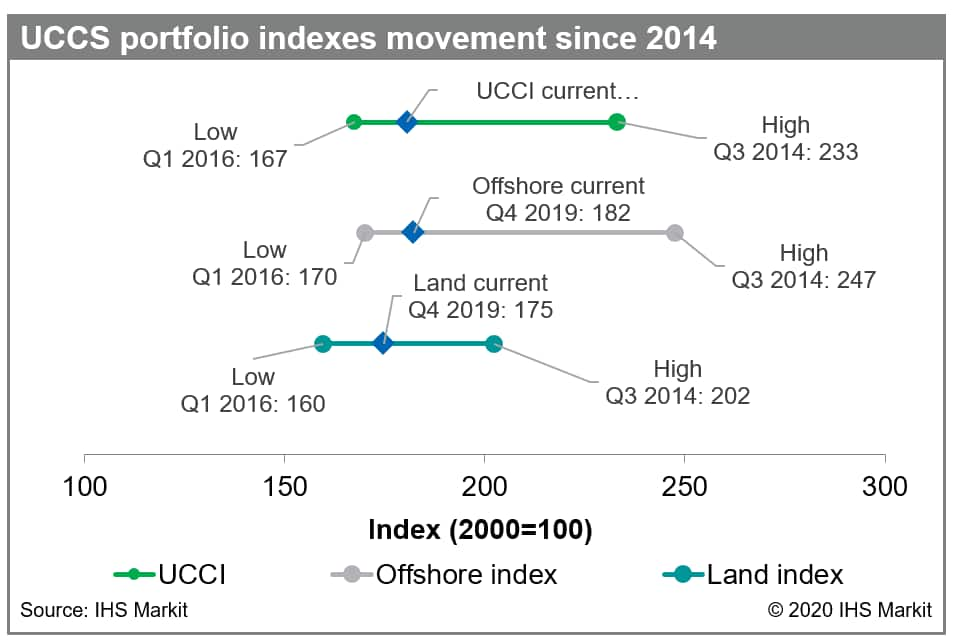

This translates to about an 8% drop overall from the current, Q4 2019 index value of 181 (figure 1); if that seems muted given the historic drop in oil prices, it's due to suppliers and contractors still not having recovered from the slump in the middle of the last decade.

Since suppliers and contractors are in far worse financial positions this time around, we expect market consolidations to occur more through bankruptcies than through merger and acquisition (M&A) activity.

We have summarized the state of the various markets in the UCCI below and full assessments are in the latest report.

- Steel: Market fundamentals were already weak with too much supply and falling demand. The current situation will only exacerbate the imbalance and we do expect mills to shut down some production as a result.

- Offshore rigs: Demand will fall significantly if oil prices remain below $40/bbl since operators will be conserving cash and some planned offshore developments are not viable at this price.

- Equipment: Lead times on future orders could increase as a result of supply-chain disruptions around the world. However, most equipment can be sourced from multiple, global locations, lessening the overall impact of disruptions in any given place.

- Bulk materials: Price declines are likely to be more severe for materials such as asphalt and paint because they are dependent on crude oil derivatives.

- Offshore vessels: Minor day-rate decreases may occur, in line with any gains recently won by vessel owners. These will vary by region but are unlikely to exceed 10% even in the most extreme cases.

- Land rigs: In the United States, rig contracts will be cancelled. Internationally, drilling contractors will place rigs on standby rates so they do not have to shut down support facilities.

- Engineering and project management: Even if oil prices recover by the end of the first half of 2020, activity is not expected to return until the end of 2020 or 2021.

- Labor: Construction hiring and wages will likely decline if depressed oil prices continue throughout 2020 and into 2021. A decrease in direct and indirect wages is unlikely to fully materialize until after the first quarter.

- Subsea equipment: The subsea market will see further declines as investment in deep water projects is delayed, and activity will decline throughout 2020 if oil prices remain under $40/bbl as expected.

Figure 1: UCCS portfolio indexes movement since 2014.

Find out more about Upstream Costs & Expenditures

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fupstream-capital-costs-index-ucci-will-decline-covid19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fupstream-capital-costs-index-ucci-will-decline-covid19.html&text=The+Upstream+Capital+Costs+Index+(UCCI)+will+decline+as+its+underlying+markets+react+to+a+drastically+lower+oil+price+and+weaker+global+economy+caused+by+COVID-19.+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fupstream-capital-costs-index-ucci-will-decline-covid19.html","enabled":true},{"name":"email","url":"?subject=The Upstream Capital Costs Index (UCCI) will decline as its underlying markets react to a drastically lower oil price and weaker global economy caused by COVID-19. | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fupstream-capital-costs-index-ucci-will-decline-covid19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Upstream+Capital+Costs+Index+(UCCI)+will+decline+as+its+underlying+markets+react+to+a+drastically+lower+oil+price+and+weaker+global+economy+caused+by+COVID-19.+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fupstream-capital-costs-index-ucci-will-decline-covid19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}