Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 18, 2019

Understanding the GHG intensity of Crude Oil: The challenge of averages

Interest in understanding GHG emissions that result from the extraction, through to end-use of crude oil has been increasing. Often discussions and comparisons of the GHG intensity of crude oil are often presented as some sort of average of a given play, region, or country. There are reasons for this occurrence: the availability of sufficient high-quality data, a simplification to overcome the difficulty of modeling every asset within each play, or for ease of comparisons between plays. However, caution should be taken when interpreting these results. In undertaking comprehensive analysis of key plays—modelling all operating assets in the play rather than a subset— IHS Markit has found a high degree of variability of GHG emission intensity within each play. This situation implies that no matter how robust an average may be, caution is in order since an average can misrepresent the GHG profile of a specific facility or set of assets.

Understanding the GHG intensity of crude oil: The challenge

of averages

Investors and stakeholders are increasingly prioritizing the environmental, social, and governance performance of oil and gas companies. The GHG intensity of crude oil (whether just from production or through to and including end use) has become of particular interest. However, there are challenges that exist in estimating and comparing the GHG intensity of crude oil. IHS Markit has documented some of these challenges around corporate emissions disclosure and the estimating of GHG intensity of crude oil in the past. However, caution should also be exercised in comparing the intensity of oil assets.

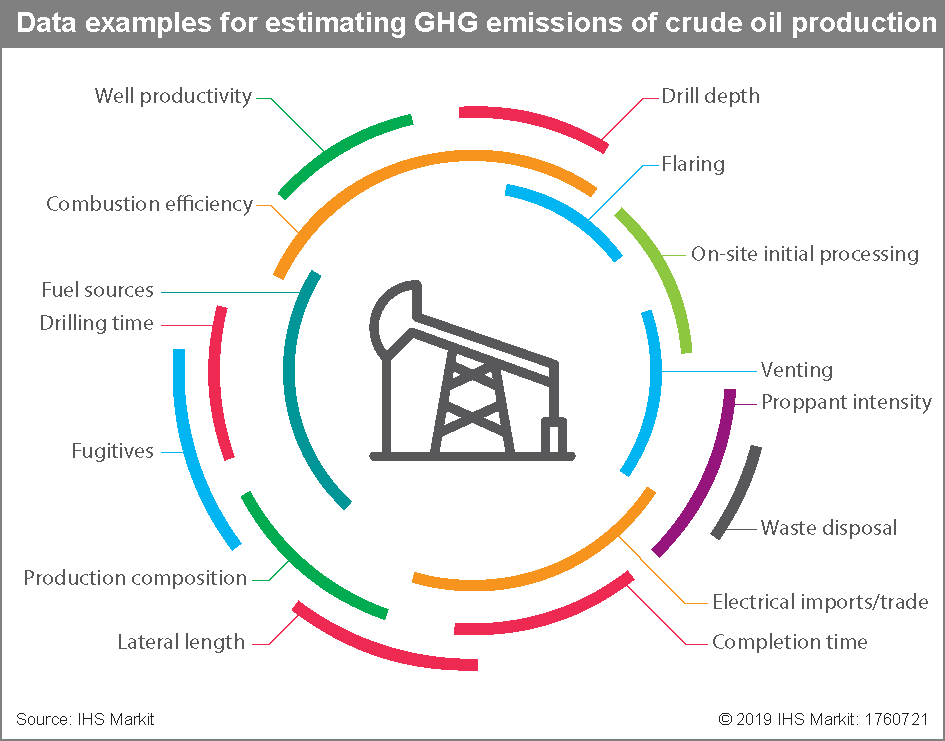

To date, estimates of the GHG intensity of crude oil have been dominated by averages or weighted averages. This result is generally true whether the estimates are focused solely on upstream production-related emissions or all the way through to include downstream and end-use emissions—known as life-cycle emissions. Examples of averages include estimates of the GHG intensity for a given play, region, or country. To a large degree, this is the result of breadth and complexity of the data and modeling required. This point cannot be understated. For example, as shown in Figure 1, to make a single high-quality estimate of the upstream, production-related emissions for just one oil or gas producing asset requires considerable inputs. Moreover, one can imagine how multiplicative these requirements can become if one considers that within a given play there can be hundreds of individual assets or even thousands of producing wells. In addition, each estimate requires considerable human capital to understand and model the unique extractive technologies as well as develop the GHG estimation methodology.

Because of these complexities, it is reasonable to expect some averaging or some simplifications—modeling an average of the key inputs of a set or sample of the producing assets or wells, some compilation of the latest extractive process, or of individual operations rather than the entirety of a play. Consequently, studies on the GHG intensity of crude oil typically show some sort of average or attempt at a representative sample. These results are presented in various forms, including by technology in a given play (i.e. oil sands mining), by play (i.e. North Sea offshore, which uses various forms of offshore technology), by region (i.e. US Permian), or by country (i.e. Norway). The risk of using averages, however, is that an average may not do a good job at representing any one player or asset—masking poor performers from best in class.

IHS Markit is seeking to take a more comprehensive approach to estimating upstream GHG intensity of crude oil by attempting to model—through the use of more complete data sets, detailed analytics, and machine learning tools—the full range of GHG emission intensities that can occur. In other words, IHS Markit is modeling the entirety of all the producing assets within a field, region, or basin. Our results to date have found great variability in GHG intensities within a given play.

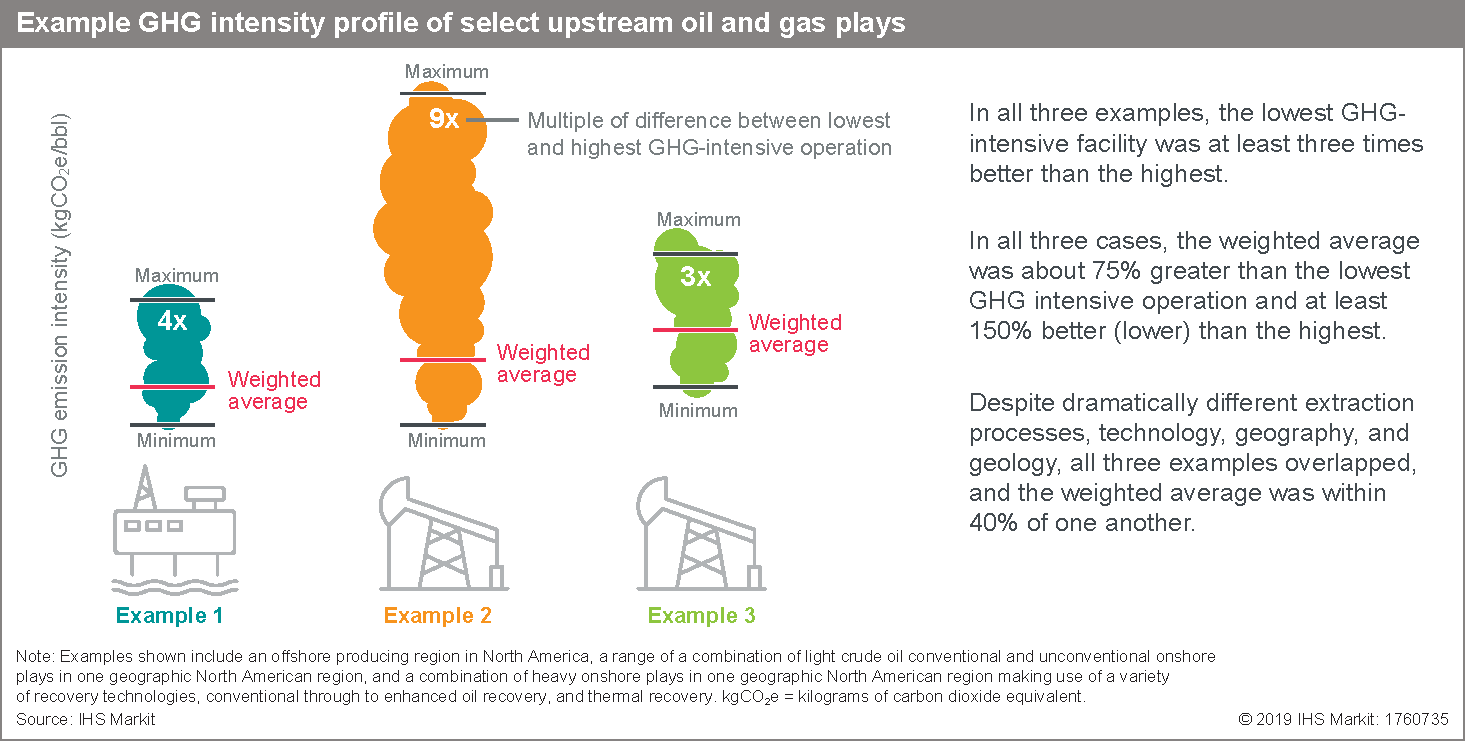

The figure below presents some of the findings of three recent studies that modeled the full range of assets in three large producing basins: one is onshore light oil, one is offshore light oil, and one is onshore heavy unconventional. There is a high degree of variability. In each example, the weighted average of each play does not align with the full range of intensities and the most GHG-intensive operation is at least three times that of the least intensive.

Although the examples provided are anecdotal, they seem to be consistent across the plays IHS Markit has analyzed. These findings have numerous implications for understanding the GHG intensity of crude oil and understanding risks associated with energy transition. These findings point to the need to be cautious in interpreting emission estimates. IHS Markit analysis indicates that although averages can provide guidance on comparing various plays, regions, basins, or even national level intensity estimates of crude oil, they may be an inadequate indicator of the relative performance of any individual oil producing asset.

All of these findings warrant more analysis. IHS Markit is investing in a more sustained and meaningful way of understanding the GHG intensity of crude oil, launching a dedicated team for GHG estimation and accounting. IHS Markit is advancing an initiative to develop " The Right Measure." We will be partnering with industry and financial institutions to take stock of the current state of GHG emission accounting and estimation. By shedding light on challenges and best practices, we aim to improve the shared understanding of GHG emissions associated with crude oil as well as increase transparency around estimate reliability. IHS Markit aims for this initiative to play a critical role in shaping the future of life-cycle GHG accounting.

Learn more:

Download Brochure

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2funderstanding-the-ghg-intensity-of-crudeoil.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2funderstanding-the-ghg-intensity-of-crudeoil.html&text=Understanding+the+GHG+intensity+of+Crude+Oil%3a+The+challenge+of+averages+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2funderstanding-the-ghg-intensity-of-crudeoil.html","enabled":true},{"name":"email","url":"?subject=Understanding the GHG intensity of Crude Oil: The challenge of averages | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2funderstanding-the-ghg-intensity-of-crudeoil.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Understanding+the+GHG+intensity+of+Crude+Oil%3a+The+challenge+of+averages+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2funderstanding-the-ghg-intensity-of-crudeoil.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}