Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 12, 2023

UAE’s expansive upstream ambitions in the spotlight at COP28

UAE's expansive upstream ambitions in the spotlight at COP28

The launch of COP28 in Dubai on Nov. 30 is drawing attention to the UAE's efforts to balance its ambitious climate policies with efforts to expand hydrocarbon production led by the Abu Dhabi National Oil Company (ADNOC). These twin goals are reflected in the UAE's domestic energy strategy, which is focused on maximizing oil and gas rents while decarbonizing production and diversifying both its energy capacity and economic base.

Emissions reduction a national priority

On the climate side, the UAE has among the most ambitious emissions reduction targets in the Middle East (see table). The UAE was the first state in the Middle East and North Africa to announce a net-zero pledge in 2021, setting out a 2050 target date. The UAE also revised its Nationally Determined Contribution (NDC) to the UN Framework Convention on Climate Change (UNFCCC) in July, establishing a stronger, absolute emissions reduction target.

To help meet these medium- and long-term goals, the UAE is investing heavily in nuclear and renewables to displace use of oil and gas domestically. The government's July update to its National Energy Strategy raises the country's 2030 renewable capacity goal to 14 GW, with an aim of generating 30% of the country's energy from clean sources by 2031. The update provides for the removal of coal from the 2050 power mix — previously envisioned to provide 12% of generation — but still allows for the continued use of natural gas.

The UAE is also focused on transition opportunities, developing a low-emission hydrogen sector with an eye to exports; the UAE's hydrogen strategy aims to transform the nation into a global top 10 hydrogen producer by 2031. The government is targeting low-carbon hydrogen production of 1.4 million metric tons per annum (MMtpa) by 2031 (consisting of 1 MMtpa of green and 0.4 MMtpa of blue hydrogen), 7.5 MMtpa by 2040 and 15 MMtpa by 2050. Notably, the UAE is largely pursuing these targets and technologies not via new regulations or incentive/tax schemes — the approach in the EU and North America — but by setting mandates for state firms and encouraging partnerships with international companies.

ADNOC will continue to drive national goals

At the same time, the UAE remains reliant on oil and gas exports to fund the budget, as any significant reduction in fossil fuel production by the UAE would drive a sharp loss in rents accruing to the state — even if it becomes an important player in blue/green hydrogen and other clean energy technologies.

ADNOC is a critical player in both the UAE's energy and decarbonization plans. In late July, ADNOC brought forward its own target for net-zero scope 1 and 2 greenhouse gas (GHG) emissions to 2045, from a previous goal of 2050 (scope 1 refers to direct emissions, e.g., from fuel burning or gas flaring, and scope 2 to indirect emissions, e.g., from the production of electricity used by the company. In contrast, scope 3 refers to emissions produced further down the value chain, e.g., by the consumers that burn the oil and gas). The company committed to cut carbon intensity of produced hydrocarbons by 25% by 2030 and reach upstream methane intensity of 0.15% by 2025 (ADNOC estimated emissions from current operations in 2022 to be 24 MM metric tons of CO2e, with an upstream carbon intensity of around 7 kg of CO2e per barrel of oil equivalent, among the lowest in the world). In October, the company doubled its carbon capture and storage (CCS) target to 10 MMtpa by 2030.

Changes to ADNOC's organizational structure, spending, and portfolio reflect these targets. At the end of 2022, the company established a Low Carbon Solutions and International Growth vertical focused on renewable energy, clean hydrogen, and carbon capture and storage as well as international investments in gas, LNG, and chemicals. In January, ADNOC earmarked $15 billion for decarbonization initiatives, including carbon capture, electrification, and hydrogen and renewables (compared with total planned capital spending of $127 billion in 2022-26), and has indicated that spending could rise even further given the accelerated net-zero target. The company is also experimenting with new carbon sequestration technologies, including carbonate saline aquifer and CO2 mineralization.

Oil and gas are still the core business

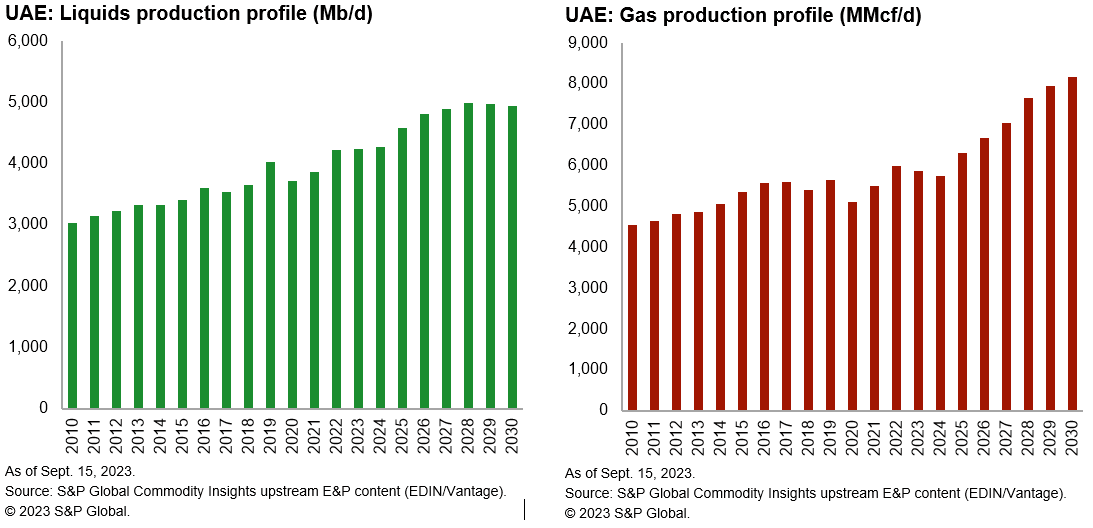

At the same time, ADNOC is accelerating plans to expand oil and gas production capacity — now aiming for 5 MMb/d of liquids by 2027 and gas self-sufficiency by 2030. An update on ADNOC's website in September indicated that oil production capacity has reached 4.65 MMb/d. New upstream projects will likely come with higher related costs and energy needs. Two examples reflecting the deviation from business-as-usual costs are ADNOC's $3.6-billion plan to electrify offshore operations, and new CCS capacities to reduce emissions from core oil and gas activities. ADNOC's unconventional gas ambitions, centered around developing 1 Bcf/d of capacity in the Ruwais Diyab Concession, will require substantial quantities of water for operations, which will be generated through high-cost and energy-intensive desalination operations.

ADNOC is also seeking to grow its international portfolio — reflected in the "International Growth" part of the new Low Carbon Solutions and International Growth vertical — after decades of focusing its upstream activities domestically. In August, ADNOC announced that it is acquiring a 30% stake in Azerbaijan's Absheron gas field in the Caspian Sea, which began producing in July, alongside SOCAR and TotalEnergies. In partnership with BP, ADNOC is also seeking to purchase a stake in Israel's NewMed Energy.

International partnerships a critical piece of the puzzle

The UAE's (and ADNOC's) determination to simultaneously achieve significant emissions reductions while increasing oil and gas production belies a strong faith in technological solutions, notably CCS, that are expensive and as-yet unproved at scale. ADNOC and other state-owned enterprises in the energy sector will therefore continue to leverage international partnerships to advance efforts on several fronts — creating a swathe of new investment opportunities for international oil companies and clean technology innovators alike.

Learn more about our coverage of climate policies by visiting Upstream Transformation Service.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fuaes-expansive-upstream-ambitions-in-the-spotlight-at-cop28.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fuaes-expansive-upstream-ambitions-in-the-spotlight-at-cop28.html&text=UAE%e2%80%99s+expansive+upstream+ambitions+in+the+spotlight+at+COP28+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fuaes-expansive-upstream-ambitions-in-the-spotlight-at-cop28.html","enabled":true},{"name":"email","url":"?subject=UAE’s expansive upstream ambitions in the spotlight at COP28 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fuaes-expansive-upstream-ambitions-in-the-spotlight-at-cop28.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UAE%e2%80%99s+expansive+upstream+ambitions+in+the+spotlight+at+COP28+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fuaes-expansive-upstream-ambitions-in-the-spotlight-at-cop28.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}