Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 25, 2014

Tight oil test: US output at lower oil prices

How will lower oil prices affect growth of US tight oil? Most US tight oil additions are resilient at WTI prices of $70/barrel.

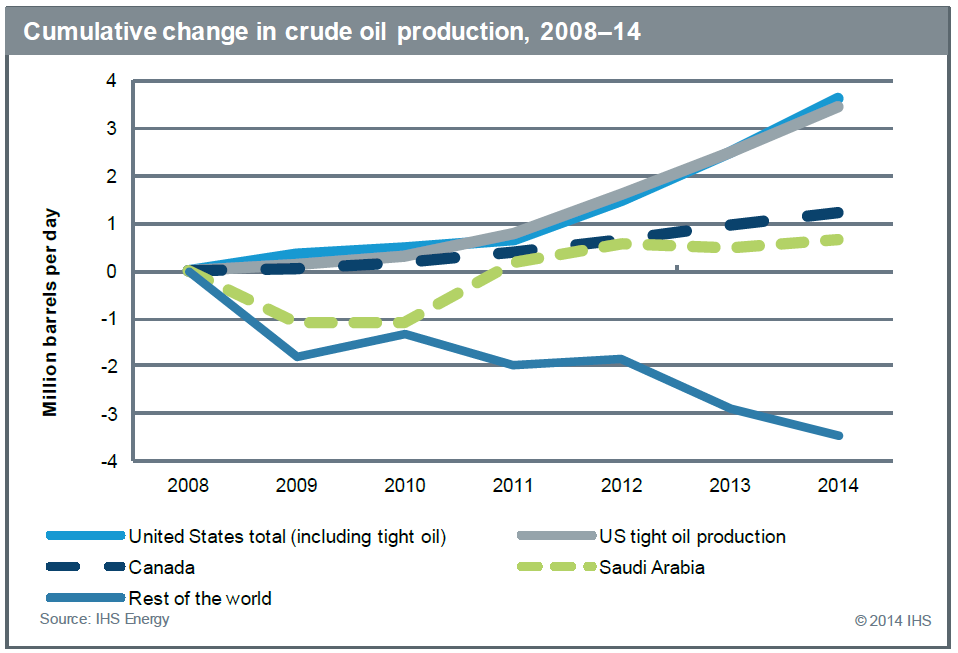

How will lower oil prices affect growth of US tight oil production? The focus on US tight oil is warranted because it accounts for most of the growth in world supply in recent years. The impact of lower prices on tight oil production is central to the global discussion about what is ahead for the world oil market. The question that will now be answered is the one we posed more than a year ago-is the United States, inadvertently, the new swing producer for world oil?

- Most US tight oil production capacity additions are resilient at West Texas Intermediate (WTI) prices as low as $70 per barrel (bbl). About 80% of potential gross US tight oil capacity additions in 2015 have a break-even WTI price of $50 to $69/bbl. This price covers capital and operating costs and generates a 10% rate of return.

- Our estimate of 2015 US tight oil production growth at our revised WTI price of $77/bbl is around 700,000 barrels per day (b/d). This is significant growth but represents a slowdown from the nearly 1 million barrels per day (MMb/d) of tight oil growth in 2014. Total US crude oil and condensate production growth (tight oil, onshore conventional, and offshore) is projected at 1 MMb/d in 2015. For 2016, total US growth slips to 0.65 MMb/d.

- Expectations of the future-and the trajectory of oil prices-mean that prices do not need to fall to the break-even price before psychology, investment, and thus output are affected. Productivity gains and the growth imperative support further growth. But if oil price expectations-not to mention actual prices-dim further, then the impact on production would become more significant.

Learn more about IHS Crude Oil Market Service and North America Supply Analytics.

Jim Burkhard, VP and Head of Market Research, IHS

Posted 25 November 2014

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ftight-oil-test3a-us-output-at-lower-oil-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ftight-oil-test3a-us-output-at-lower-oil-prices.html&text=Tight+oil+test%3a+US+output+at+lower+oil+prices","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ftight-oil-test3a-us-output-at-lower-oil-prices.html","enabled":true},{"name":"email","url":"?subject=Tight oil test: US output at lower oil prices&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ftight-oil-test3a-us-output-at-lower-oil-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Tight+oil+test%3a+US+output+at+lower+oil+prices http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ftight-oil-test3a-us-output-at-lower-oil-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}