Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 26, 2017

The Permian pumps on

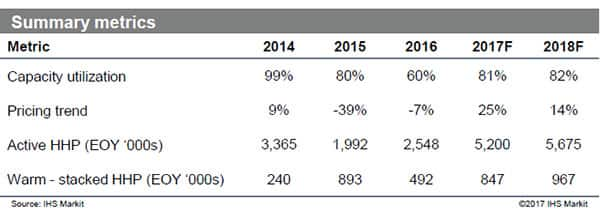

Despite an expected slowdown in drilling activity in 2018, IHS Markit forecasts an uptick in frac demand as built-up drilled uncompleted (DUCs) wells from 2017 are completed and begin to produce. The Permian, Haynesville, and Eagle Ford are expected to see the largest absolute increases in horsepower demand during 2018.

The Permian will account for 40% of US onshore rigs in 2018 with an estimated 360 rigs in the fourth quarter of 2017. IHS Markit projects the Permian region to increase horizontal rig count by 35% by 2022. Lower-cost, in-basin proppants could drive proppant mass per well levels higher; this could serve as a catalyst for increasing frac horsepower demand.

Capacity numbers will remain low in 2018 and only the Permian is forecast to have a significant increase.

Various plays within the Permian have excellent economics and are attracting investors. Most of the capacity additions in the Permian have come from established players while there have been limited evidence of new players in the market. Reportedly, frac crews remain utilized through the beginning of the second quarter of 2018. Crew utilization is expected to be uneven with spikes in utilization due to the long lead times in components for frac equipment.

Figure 1: Permian Basin Economics

Proppant

Three key regions - Eagle Ford, Permian and Appalachia expected to account for the majority of proppant demand in North America in 2018. However, it is the Permian that is expected to increase its market share significantly over the next five years.

Sand is the proppant of choice among operators; it was used in 98% of wells frac'ed in the third quarter of 2017. North American frac sand demand is forecast to increase over 10% per year 2018 and 2019.

Frac sand capacity will grow as well with new mines in Texas. IHS Markit estimates only two new frac sand mines in Texas are currently operational, with the majority of new mines still under construction.

As new mines come online in Texas, proppant costs are expected to go down for Permian operators that shift to using "in-basin" sand. Because all-in transportation and handling costs account for over 65% of total delivered cost, the use of "in-basin" sand could have a significant impact.

However, last mile trucking is an immediate bottleneck in the frac sand sector, while rail car availability could be an issue in the medium-term. DUC build-up has also caused bottlenecks in sand logistics.

Frac sand supply remains highly fragmented from a supplier point of view. Ten sand suppliers account for 58% of total frac sand capacity in North America.

Direct sourcing of frac sand looks to be a structural change. As operators' familiarity in managing the frac sand supply chain has increased it has given them confidence to continue sourcing sand directly. Other proppants play a lesser role in the proppant market. RCS and ceramic are not as widely used compared to frac sand.

The Permian and Eagle Ford consume the most RCS in North America, accounting for a combined market share of 54% in 2018. IHS Markit expects RCS prices to rise beyond 2017 due to higher demand from natural gas plays. RCS remains a concentrated market, with top-5 RCS suppliers accounting for 87% of total capacity.

The ceramic proppant market has been severely hit during the downturn as operators moved to cheaper proppants to fulfill their needs. The Bakken continues to represent majority of ceramic consumption in North America.

See more US onshore insights and analysis from our team of experts.

Divya Parambi is a Principal Consultant at IHS Markit.

Posted 27 December 2017

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-permian-pumps-on.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-permian-pumps-on.html&text=The+Permian+pumps+on","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-permian-pumps-on.html","enabled":true},{"name":"email","url":"?subject=The Permian pumps on&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-permian-pumps-on.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Permian+pumps+on http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-permian-pumps-on.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}