Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 10, 2020

The North America oil and gas industry enters survival mode

The oil price collapse is rewriting the North America oil and

gas rulebook—forcing companies into survival mode. The

interconnectedness of the industry means impacts ripple throughout

the value chain. This downturn has some structural roots - global

spare capacity that's been building up over the last couple of

years to accommodate the rapid and enormous growth that we've seen

in the North American oil and gas production. When we add this

spare capacity onto the demand disruption created by the

Coronavirus and the oil price war, it means major challenges for

North America.

To hear more in-depth analysis directly from our experts, view the on-demand webinar from

April 2nd.

Unprecedented Demand Slowdown

While there's plenty of talk about when OPEC and Russia will resume

their collaboration, the reality is that it may not matter. Two

main factors may overwhelm what they can do. First, the magnitude

of the physical imbalance we're looking at in the second quarter,

globally, and in North America, and secondly, the distress and how

it's feeding from the physical side into the pricing side.

A majority of the pressure we are seeing is coming from demand

destruction. Obviously, there was a breakdown of the relationship

between Saudi Arabia and Russia earlier this month that led to an

all-out surge in production. But, when you look at the grand scheme

of the balance in the oil market globally, it's really a demand

crash—the scale of which we've never seen before.

To put the magnitude into perspective, in the 2008-09 recession, at

its worst in January and February of 2009, global oil demand had

contracted year-on-year by around 4 million barrels a day. The

scale of the demand collapse we're looking in the second quarter is

in the 15- 20 million barrels a day decline range—potentially

more than 20 million barrels a day decline in April. That's five

times larger in terms of a demand collapse than we had at the worst

of the financial crisis.

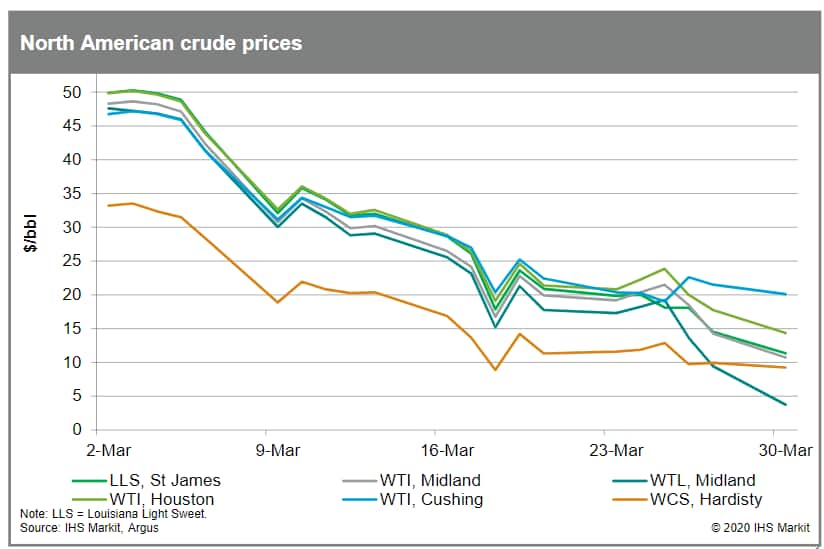

Figure 1: North American crude oil prices

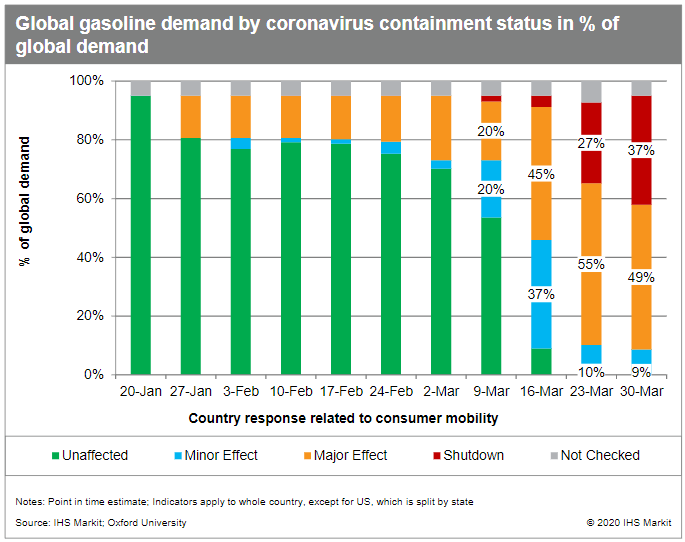

We've also analyzed the impact of country shutdowns in response to coronavirus. This orange and red in the below chart shows you that by the end of March around 86% of global gasoline demand was in countries that have severe or full shutdowns in effect. The global market is slowing down quite dramatically in terms of demand. That scale of a demand drop is creating a balance distress.

Figure 2: Global gasoline demand by coronavirus containment status

Another consequence of the oversupply is a strain on global

storage capacity. We expect to build inventories over the next few

months—storage hubs are nearly full and tankers are getting

chartered around the world for floating storage. Even more

important in the near term is that the daily global surplus exceeds

the capability to effectively flow into storage: storage

availability thousands of miles away is meaningless if you cannot

find a ship or lease the storage.

Operators Shift to Capital Preservation

Coming into this year, early January and February, we were looking

at moderate capex cuts compared to 2019—a 13% decline in capex

cost. Operators were obsessed with balancing production growth

against the cashflow and using any of the accessory cashflow to

give back to shareholders.

Now, with March now done, we've seen capex declines go from

moderate to significant. We expect now at least a 36% decline in

total capex spends in 2020. And, these numbers are going to

increase as oil prices continue to fall.

Instead of trying to balance production growth and cashflow

generation, we're seeing companies move to capital preservation.

That means reducing dividends and eliminating share buyback.

There's barely any excess cash out there, so they're not able to

give it back to shareholders.

Capital markets have tightened even further. Equity markets have

remained closed. And, if you look at yields on fixed income

securities for operators out there, they have spiked significantly

to abnormal levels. This means that companies, especially smaller

ones, are going to have a lot of trouble borrowing money.

The US Supply Trajectory

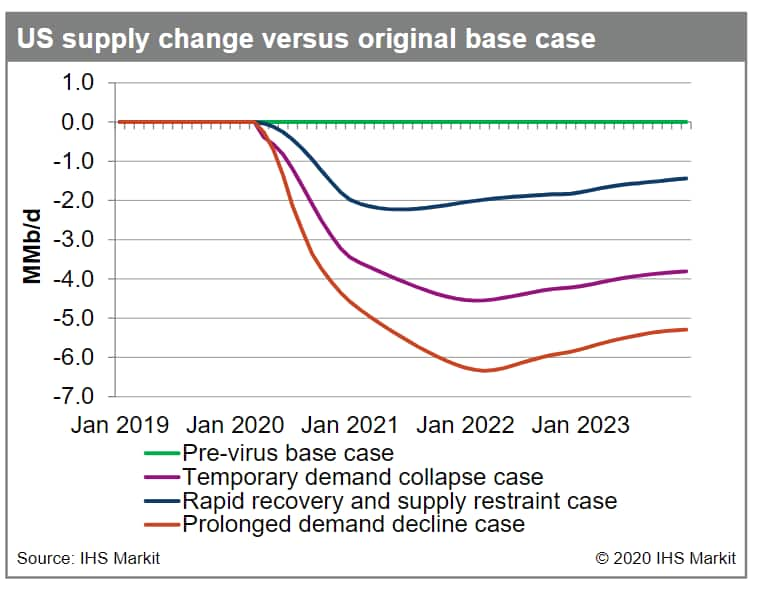

Given the uncertainty in the market, we've run multiple scenarios

for US oil production. Our original base case had supply growing

just in the first half of this year and then holding flat for the

next 18 months through the end of 2021. In short—we were

oversupplied already.

Now, we look at where we are coming in with this amazing

unprecedented demand disruption. Estimates are about a two and a

half million barrel a day drop this year compared to where we were

thinking, and then another million next year.

Figure 3: US supply change versus original base

case

Originally, our base case was growing a little bit. Now we're

looking at coming down to right around 9 million barrels a day by

the end of next year. So, the difference between our base case and

the current levels is about 4.5 million barrels a day.

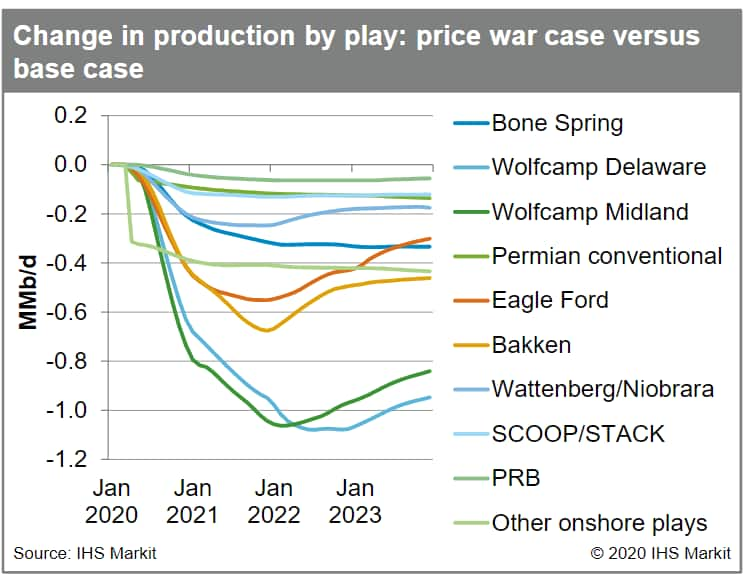

When we do a play-by-play comparison, the Permian plays register

the largest overall production drop by volume. The SCOOP/STACK,

Wattenberg, and Eagle Ford output fall at a far greater rate on a

percentage basis. Why does the Permian take it the hardest? First,

it's where the most activity is by percentage and it's also got a

very steep base decline. The Bakken and Eagle Ford have lower base

decline rates than the Permian. But the Permian also rebounds most

if/when prices come back.

Figure 4: Change in production by play

The Natural Gas Silver Lining and the LNG

Wildcard

The prospect for significant decline in associate gas production

has really changed the prospects for gas-focused operators. Our

expectation for US associated gas production for 2021 went from

about 2 BCF a day of growth to roughly 8 BCF a day of decline -- a

swing of around 10 BCF a day.

LNG liquefaction plants' gas demand has been all-time highs over

the past couple weeks, closing in on about 10 BCF a day. However,

the global gas market and LNG demand are not immune from the demand

destruction impacts of COVID-19. LNG demand growth is slowing, and

when we look around the globe, coal and gas switching as a result

of low gas prices is not expected to lead to enough immediate new

demand to achieve market balance.

Instead, the market is expected to balance on supply cutbacks. LNG

cutbacks are expected across the globe, but they're not all going

to be concentrated in the United States. Our current analysis

suggests that we could see US LNG exports averaging between 80 and

90% utilized in 2020 and 2021. This would indicate that the US

market is going to require a significant amount of dry gas

production to come back in 2021 to help balance the market, if that

associated gas production does fall off. In order for this to

occur, we're likely going to have to see gas prices rise to or

above $3, and maybe average about $3.50 for the year in 2021. At

these levels, we would expect gas demand from the power sector to

decline as coal generation would start to reenter the mix.

In the short-term for 2020, we see prices averaging under $2.00,

but expect prices to improve in 2021. How much is going to depend

on a lot of factors, including the extent to which associate gas

declines, the extent to which the domestic and demand LNG exports

decline, and how quickly dry natural gas production can

increase.

Midstream in the Crossfire

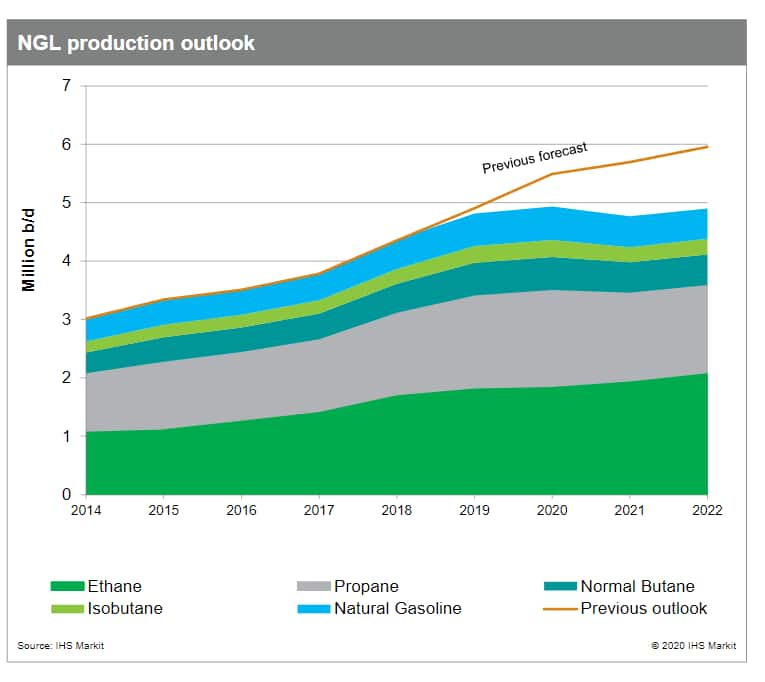

The NGL outlook shows a drastic drop in NGL supply. In 2018 and

2019, we saw double digit growth in NGL production since it is a

byproduct of crude and associated gas growth.

Figure 5: NGL production outlook

Post-Coronavirus, we still see some increase in NGLs in 2020, kind

of year over year growth. But 2021 is very different as NGL

production growth will hit the brakes when crude and gas production

reverses. Regionally, we expect a reduction from South and West

Texas while at the same time there should be some increases from

the Utica. Overall compared to our previous outlook, we believe

2021 will have a decline of about 0.9 million barrels a day, with

more in 2022.

Hear more in-depth insights about the North America oil and gas

outlook by viewing the on-demand

webinar.

Raoul LeBlanc is Vice President, Unconventionals

Research at IHS Markit.

Karim Fawaz is Director, Research and Analysis at IHS

Markit.

Hassan Eltorie is Director, Companies and Transactions

Research at IHS Markit.

Reed Olmstead is Director, North American Onshore Upstream

at IHS Markit.

Matthew Palmer is Director, North American Gas at IHS

Markit.

Veeral Mehta is Director, Midstream Consulting at IHS

Markit.

Posted 10 April 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-north-america-oil-and-gas-industry-enters-survival-mode-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-north-america-oil-and-gas-industry-enters-survival-mode-.html&text=The+North+America+oil+and+gas+industry+enters+survival+mode++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-north-america-oil-and-gas-industry-enters-survival-mode-.html","enabled":true},{"name":"email","url":"?subject=The North America oil and gas industry enters survival mode | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-north-america-oil-and-gas-industry-enters-survival-mode-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+North+America+oil+and+gas+industry+enters+survival+mode++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-north-america-oil-and-gas-industry-enters-survival-mode-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}