Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 27, 2023

The Kurdistan region: Oil forecasts following pipeline shutdown

Eight months following the unprecedented closure of Kurdistan's only export route, the region's end-of-year crude production is anticipated to decline by over 60%, compared to initial forecasts. The path towards reconciliation is advancing but at an arduously slow pace. In this article, VantageTM from S&P Global Commodity Insights sheds light on the interregional tensions affecting crude exports from the Kurdistan region of Iraq, and offers valuable insights on the impact this has had on the various entities involved.

The Iraq-Turkey pipeline agreement

In a landmark ruling on March 25, 2023, the International Court of Arbitration judged Turkey to have breached the pipeline transit agreement it had entered with Federal Iraq in 1973. The historic verdict addresses the longstanding dispute of the semi-autonomous Kurdistan Regional Government (KRG) independently exporting over 400,000 barrels per day (b/d) of crude through the Iraq-Turkey Pipeline (ITP) to the port of Ceyhan in Turkey.

The ITP comprises two 570-mile pipelines across Turkey; a 40-inch diameter line inaugurated in 1976, followed by a 48-inch pipeline completed in 1987. The infrastructure provides a strategic alternate route for crude exports, enabling access to the wider Mediterranean market and bypasses the politically sensitive Strait of Hormuz. The agreement, which has been amended on several occasions, runs until 2026 and promises mutual economic benefits for both Federal Iraq and Turkey.

Historically, one of the forms of access to the Mediterranean market was via the Kirkuk-Banias Pipeline, constructed in the 1930s and 1940s, which provided an export route from northern Iraq's Kirkuk oil field to the Mediterranean port of Banias in Syria. The ownership and operation of the pipeline was under the exclusive control of Federal Iraq, but this was eventually abandoned in 2003.

Furthermore, due to prolonged disruption and significant geopolitical shifts in the region, including the seizure of parts of northern Iraq and Kirkuk by the Islamic State, the ITP was also severely affected. In response, the KRG constructed a new pipeline in 2014 known as the Kurdistan Iraq Crude Export (KICE) pipeline. KICE now effectively serves as the primary export route for the KRG to transport oil to the Mediterranean through Turkey, independent of Federal Iraq. Controversy surrounds the question of rightful operatorship and administration of crude exports to Turkey, with differing views on whether KICE should fall under the control of Federal Iraq or the KRG.

Oil exports form the backbone of Kurdistan's economy, which is heavily reliant on KICE and the ITP as its only viable export option. Meanwhile, gas production remains limited by infrastructural constraints and legal disputes, as explored in depth in 'What is the Key to Kurdistan's Gas Conundrum?'

A history of divided opinion

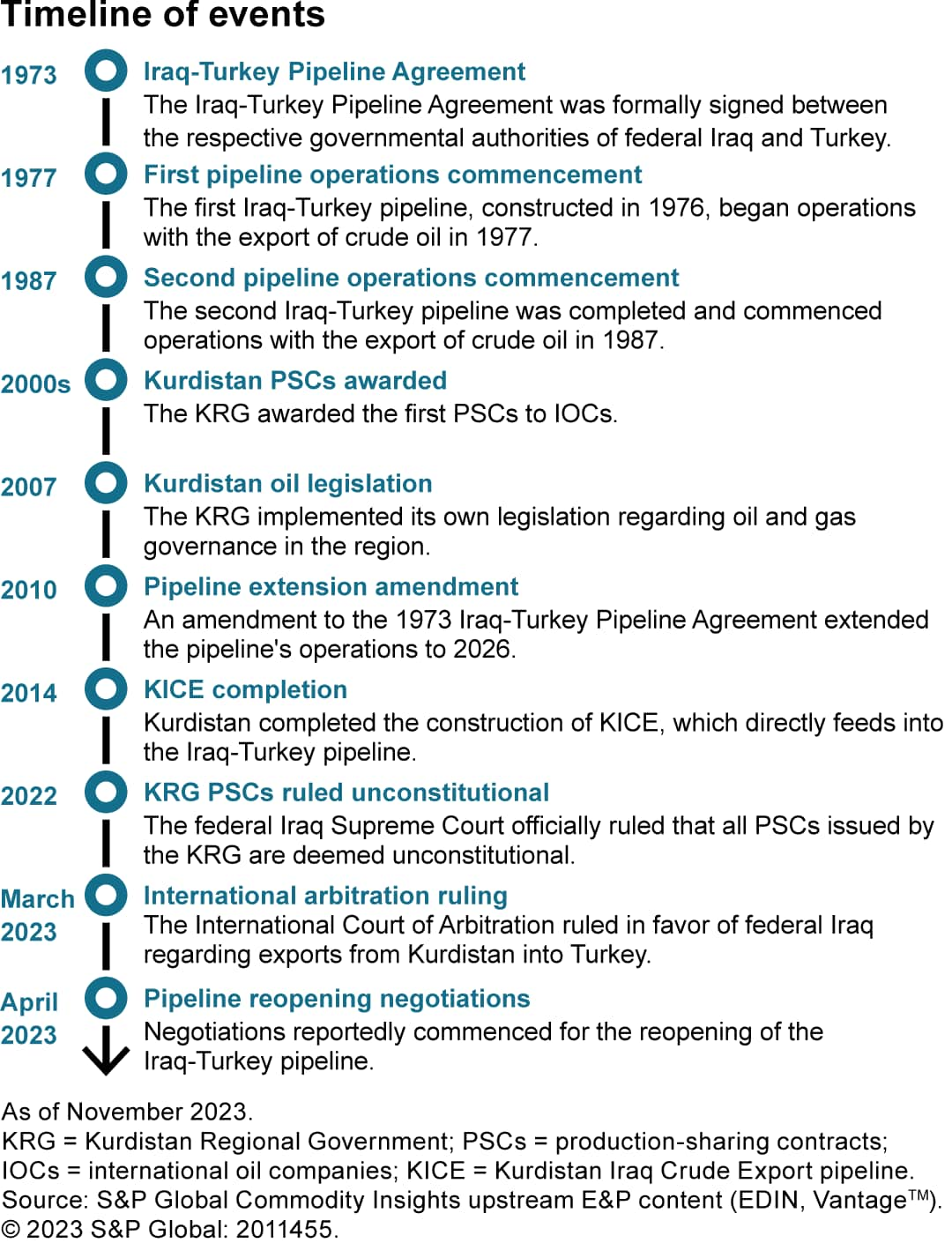

Figure 1. Timeline of events leading to the pipeline shut in.

The historic relationship between Kurdistan and Federal Iraq is deep-rooted and predates the recent international arbitration efforts, as depicted in Figure 1. Friction has intensified since the early 21st century when Kurdistan awarded Production Sharing Contracts (PSCs) to international oil companies. This was in stark contrast to the more conservative Technical Service Contracts awarded by Federal Iraq, which operate on a fixed fee basis. The Federal Iraq government has persistently challenged the legal validity of the PSCs issued by the Kurdistan Ministry of Natural Resources.

This was further exacerbated in 2007 when Kurdistan unilaterally passed its own petroleum legislation, leading to conflicting interpretations between the two governments. However, it was not until February 2022, that the Federal Iraq Supreme Court officially delivered a verdict that all PSCs issued by Kurdistan were to be deemed unconstitutional and to be relinquished. Despite the ruling, the KRG's petroleum sector temporarily continued business as usual. Nevertheless, the current cessation of the ITP has significantly altered this, and VantageTM now provides its assessment of the potential impacts.

The VantageTM outlook

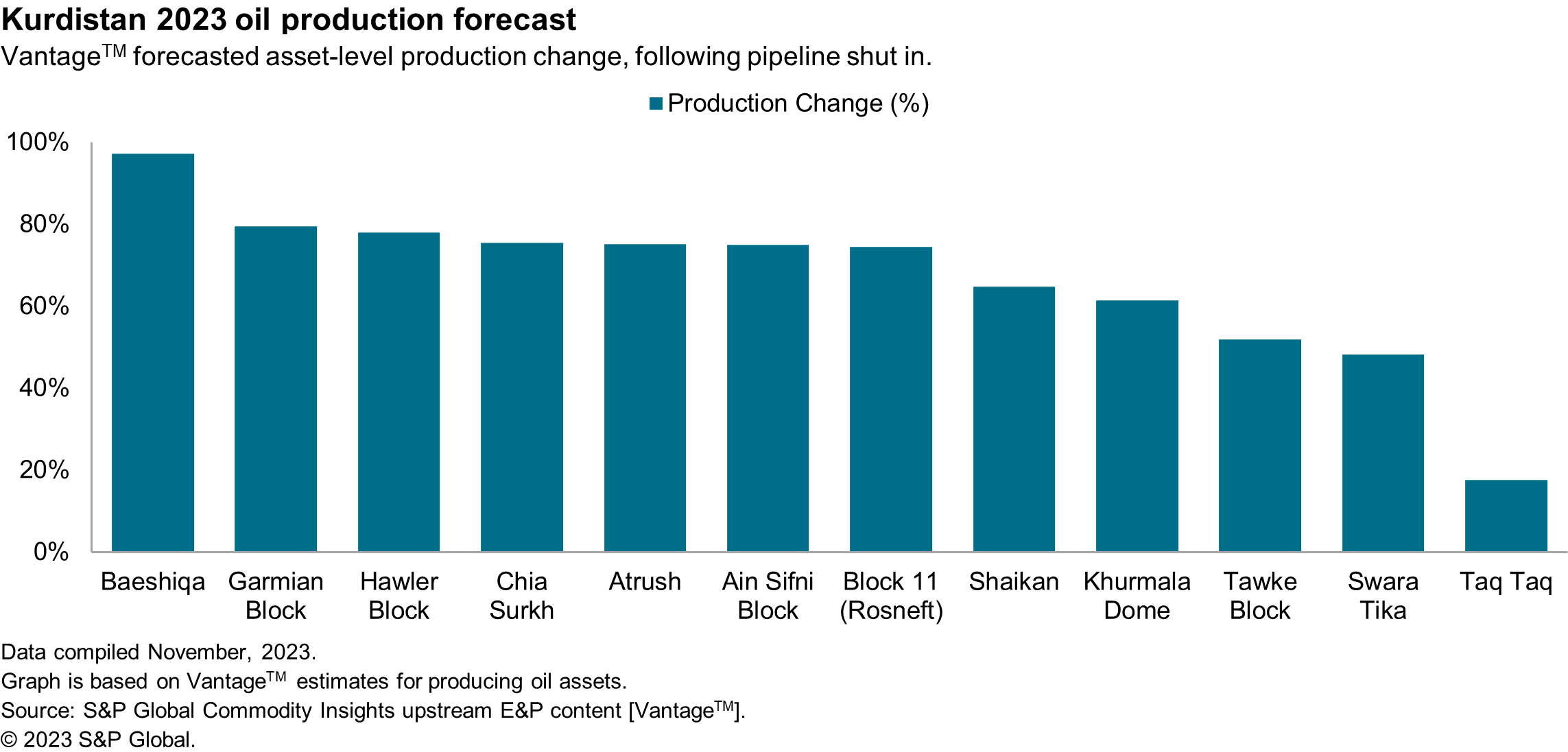

Figure 2. VantageTM forecast showing production change as a percentage for assets, following pipeline shut in.

Commodity Insights has generated a forecast illustrating the percentage change for asset-level production in Kurdistan following the pipeline shutdown. The data reveals an average decrease of 61% across these assets. It is crucial to highlight that production activity remained largely unaffected during most of the first quarter, as the pipeline closure only took place on March 25, 2023. This underlines the closure's drastic and immediate impact on production.

Several oil assets have recommenced operations, albeit at extremely diminished capacities. Initially, output was redirected to storage reserves but subsequently, production has been scaled down, with the reduced volumes being consumed by the domestic market. Assets including Atrush, Swara Tika and the Tawke block report sales ongoing on an ad hoc basis. However, it appears that local demand is reaching, if not already at, saturation point. For assets such as Baeshiqa which had recently come onstream, production has been temporarily halted, and further development plans reduced.

From a financial perspective, the KRG holds a predetermined agreement with the Federal Iraq government, stipulating the provision of 400,000 b/d of its oil production. The crude is transacted with Federal Iraq's State Organization for Marketing of Oil (SOMO) and exported via the ITP in exchange for a share of the national budget. Nonetheless, the pipeline closure has caused complications resulting in substantial deferrals in the payment schedule. Prior to this disruption, the KRG was already in arrears with several operating companies in the region. This has placed additional financial strain on operators, particularly those with portfolios producing exclusively in Kurdistan such as Gulf Keystone Petroleum and Genel Energy.

Final remarks

Kurdistan's economy, heavily dependent on its crude exports through the ITP, has encountered significant setbacks due to the pipeline's shutdown. The situation has had immediate impacts on production, financial income, and investor attractiveness for the region. There is a general consensus from the KRG and current oil operators that the pipeline will return to full operation with high-level discussions ongoing, however, the timeline remains uncertain. The challenge will undoubtedly test the resilience of all parties involved but ultimately will depend on the arbitration case between Turkey and Federal Iraq being resolved. In that regard, it may well be out of Kurdistan's hands.

***

Want to access more upstream content? Visit S&P Global

Commodity Insights EDIN and VantageTM to

keep up-to-date with events as they unfold.

Posted November 27, 2023

By Kishore Thamilselvan, Senior Specialist, Technical Research

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-kurdistan-region-oil-forecasts-following-pipeline-shutdown.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-kurdistan-region-oil-forecasts-following-pipeline-shutdown.html&text=The+Kurdistan+region%3a+Oil+forecasts+following+pipeline+shutdown+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-kurdistan-region-oil-forecasts-following-pipeline-shutdown.html","enabled":true},{"name":"email","url":"?subject=The Kurdistan region: Oil forecasts following pipeline shutdown | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-kurdistan-region-oil-forecasts-following-pipeline-shutdown.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Kurdistan+region%3a+Oil+forecasts+following+pipeline+shutdown+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-kurdistan-region-oil-forecasts-following-pipeline-shutdown.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}