Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 01, 2018

Strong balance sheet may determine eventual buyer of Permian pure-play Endeavor Energy

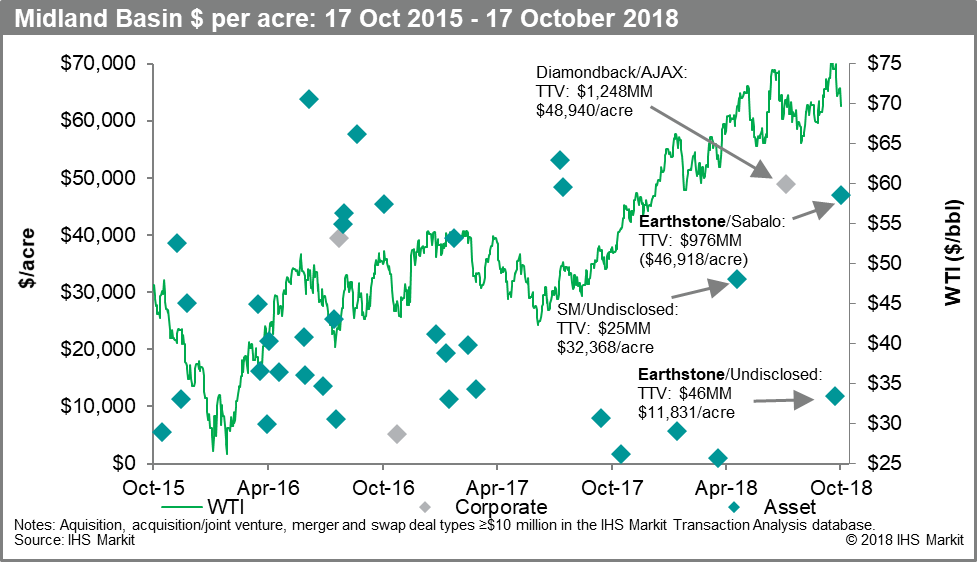

Midland Basin pure play Endeavor Energy has recently decided to sell itself entirely or partially, rather than offer shares to the public, the Wall Street Journal reported. The company's huge amount of undeveloped, core acreage in Midland, Martin, and northwest Reagan counties is a rare find, and we believe any supermajor would be high-grading its Permian acreage by the acquisition. But companies may prefer to wait for oil prices to possibly settle down in 2019-20 before buying.

Endeavor's reported decision to pursue a full or partial company sale rather than an IPO may be wise, given the company's relatively small producing asset value. Currently, equity markets are not enthusiastic about ascribing value to raw acreage, so prospective buyers must be more willing to finance the transaction with more debt or cash than is typical for an acreage-focused deal. Despite Endeavor's abundant core acreage, unfavorable timing may impede a prospective deal value at the top end of its rumored buyout range of $10-15 billion. Buyers might be limited to large entities with strong balance sheets, such as supermajors, which can best minimize execution risk in a region short on oil services, so that returns will be less burdened by nonproductive capital.

Among supermajors, Chevron needs more operated assets, and is closest to Endeavor's operations in Midland County. Shell has the smallest Permian acreage position, and needs to grow inorganically. Finally, ExxonMobil has enough execution risk to manage with its Permian assets in New Mexico, and its investors would not welcome more capital investment, which is already aggressive versus peers. Among E&Ps, EOG Resources might qualify as a potential suitor.

Learn more about IHS Markit's Companies and Transactions Service.

Sven del Pozzo is a Research & Analysis Director at

IHS Markit

Posted 1 November 2018

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstrong-balance-sheets-may-determine-eventual-buyer-of-permian.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstrong-balance-sheets-may-determine-eventual-buyer-of-permian.html&text=Strong+balance+sheet+may+determine+eventual+buyer+of+Permian+pure-play+Endeavor+Energy+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstrong-balance-sheets-may-determine-eventual-buyer-of-permian.html","enabled":true},{"name":"email","url":"?subject=Strong balance sheet may determine eventual buyer of Permian pure-play Endeavor Energy | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstrong-balance-sheets-may-determine-eventual-buyer-of-permian.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Strong+balance+sheet+may+determine+eventual+buyer+of+Permian+pure-play+Endeavor+Energy+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstrong-balance-sheets-may-determine-eventual-buyer-of-permian.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}