Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 10, 2023

Sluggish LNG imports expected in the Philippines and Vietnam

Key Implications

- In the Philippines, the declining Malampaya gas field increases the dependence on LNG imports to meet the country's gas demand. However, the cancellation of the power supply agreement between Meralco and San Miguel Corp. poses some uncertainty on future gas dispatch.

- In Vietnam, LNG demand is forecast to be stymied in the short term by the absence of power purchase agreements and higher dispatch from renewables. Gas offtake has fallen, owing to the coal overbuild and the large influx of renewables, which reduces LNG requirements.

The Philippines: Dwindling domestic gas supply and increased power demand necessitate LNG imports

The Philippines' gas demand has been in decline, owing to the dwindling Malampaya gas supply that generated 311 MMcf/d in 2022. Consequently, gas-fired power plants operated at a reduced capacity, despite the country's higher power demand. In 2022, gas generated 18 TWh, representing 17% of the total fuel mix. Notably, San Miguel's Ilijan plant supply contract with Malampaya expired in June 2022 and the delivery of banked gas from the Philippine National Oil Company has yet to commence. Consequently, the lack of piped gas supply is expected to intensify the need for LNG.

San Miguel and First Gen are slated to start importing LNG in 2023, but S&P Global Commodity Insights forecasts the terminal utilization to remain low, at 2 MMtpa by 2025. San Miguel is heard to have agreed to two LNG supply contracts ― a three-year contract starting in 2023 and a 11-year contract starting in 2026. The LNG supply would fuel San Miguel's operating Ilijan power plant and the Ilijan expansion that is under construction and slated to come online by end-2024. But offtake is uncertain owing to the power supply agreement cancellations with Meralco.

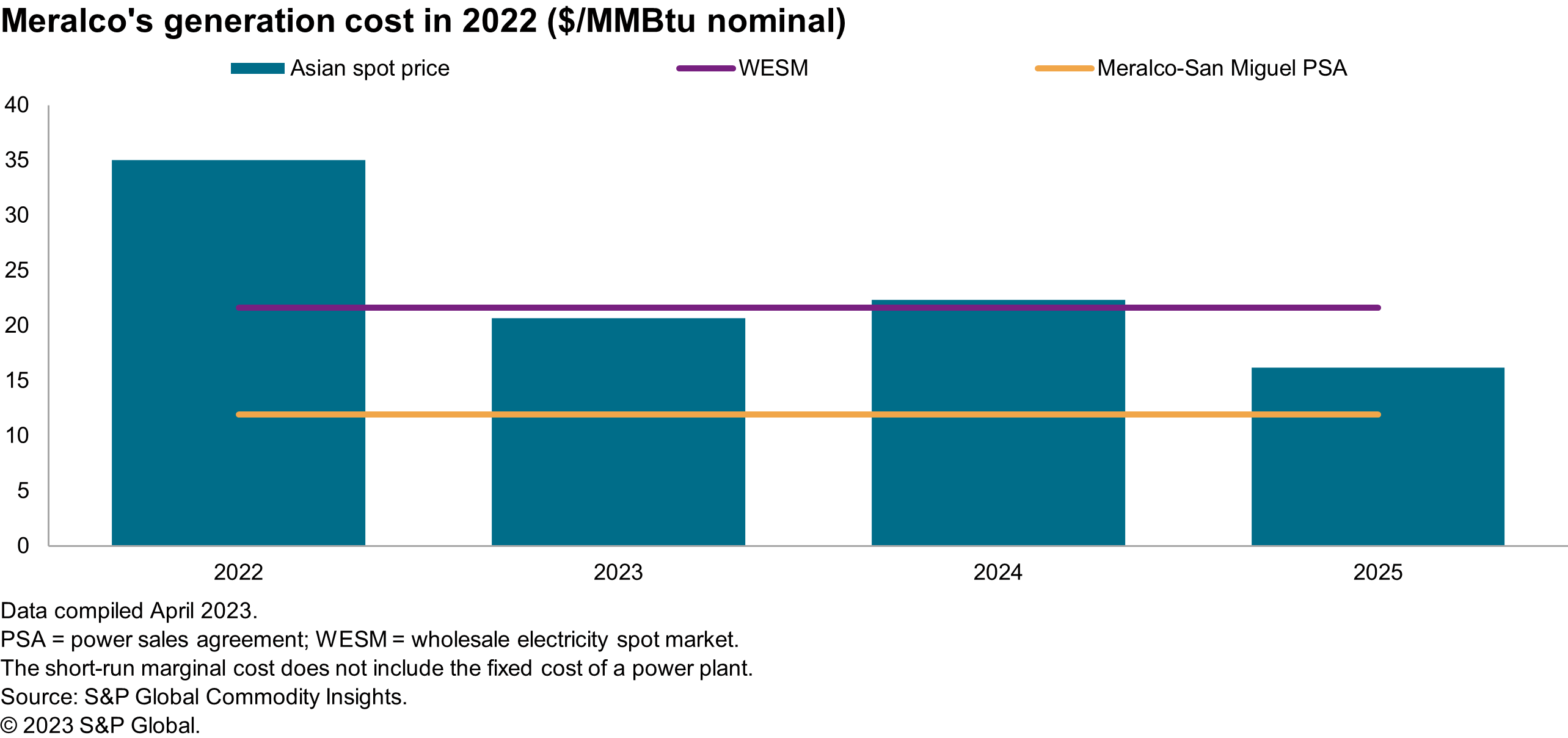

San Miguel terminated its 670 MW baseload power supply agreement for the Ilijan plant that was initially signed in late 2019, citing financial losses. The current contract at 4.3 pesos/kWh translates to a maximum payment of $12/MMBtu for LNG (see Figure 1). As the Ilijan plant would have to rely on spot LNG imports, San Miguel could have incurred significant financial losses in an attempt to meet its obligations.

In March 2023, further uncertainty was introduced when San Miguel terminated its 1,200 MW agreement with Meralco, declaring that the Energy Regulatory Commission had not given its final approval for the power supply agreement by the long stop dates of September 2021. The generation cost signed was lower at 3.26 pesos/kWh that translates to a maximum LNG price of $9/MMBtu on a short-run marginal cost basis. Similar to its earlier 670 MW baseload contract, the sales price to Meralco was insufficient to cover the cost of LNG.

Figure 1

Over the next few years, LNG imports would have to be sought from the volatile spot market. Out to 2025, spot LNG prices are forecast to be $16-$22/MMBtu. However, this price expectation remains above the sales price to Meralco under existing power supply agreements.

The alternative for San Miguel and First Gen would be to sell electricity to the wholesale electricity market that offers higher prices. However, while the current wholesale electricity market price is supportive of spot LNG imports, the price and offtake are inconsistent. Meralco's offtake from the wholesale electricity market has varied between 7% and 12% of its total power purchase in the past five years. Underpinning LNG imports with the uncertain wholesale electricity price is also an additional risk.

Vietnam: Delays in downstream power plants to stunt LNG demand

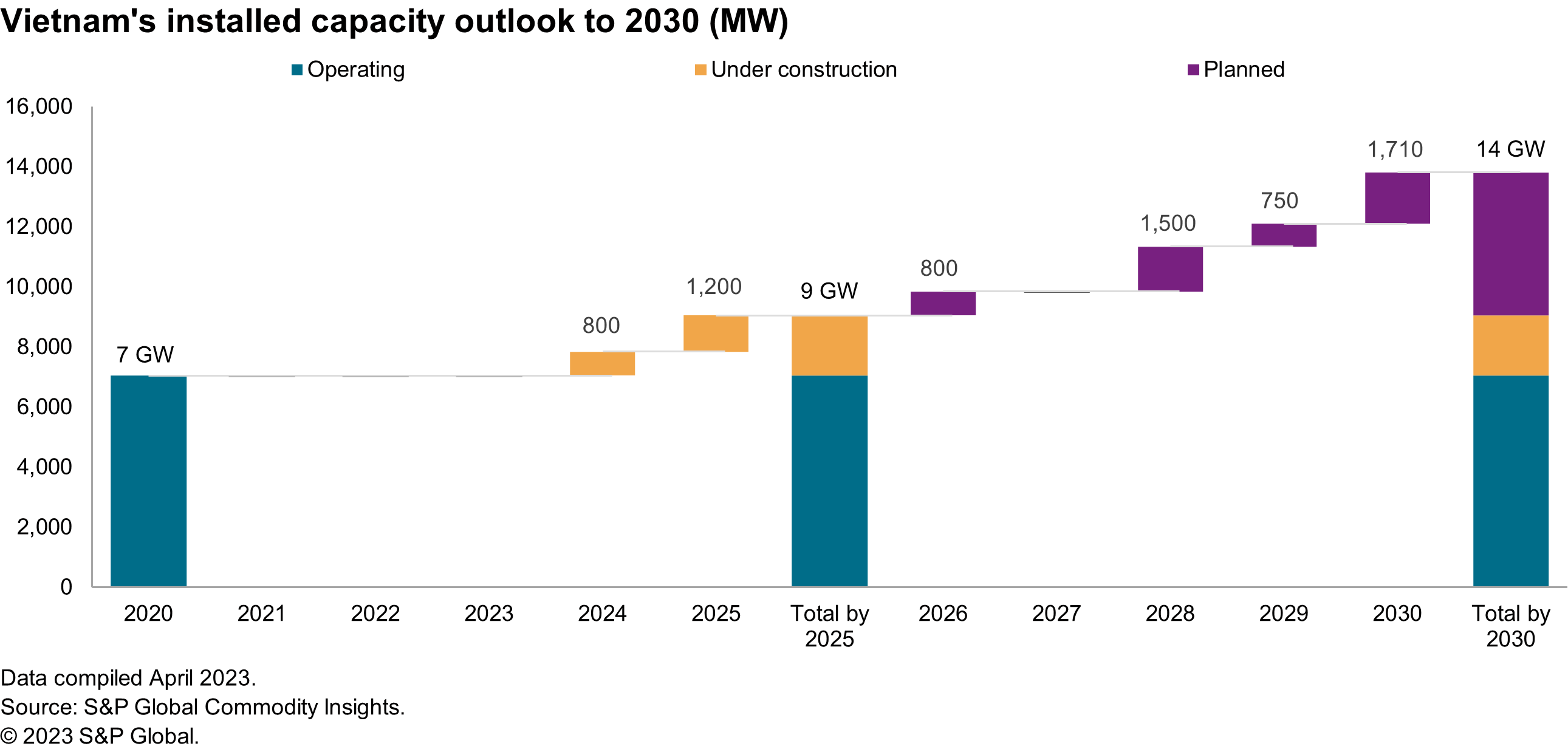

In the short term, LNG demand is expected to be stymied by the absence of a term supply agreement and reduced gas dispatch in power. Since 2020, the share of gas in power has been declining at an alarming rate of 23% year on year. This is primarily owed to the large influx of renewable capacity leading to renewable dispatch growing more than twofold. The progress of Vietnam's regasification terminals and the start of the Hiep Phuoc and Nhon Trach 3 and 4 LNG-fired power plants should reverse gas' decline. However, we forecast gas-fired additions to be much more moderate compared with government targets, owing to the absence of power purchase agreements and competition from renewables.

In the draft Power Development Plan VIII, Vietnam targets 13 GW of gas-fired power plants by 2025 and 31 GW by 2030. However, we expect delays given the power purchase agreement negotiation impasse with Vietnam Electricity (EVN), the state-owned enterprise that is the sole offtaker of electricity. The template power purchase agreement, issued by the Ministry of Industry and Trade, does not support nonrecourse project financing, as there are limited government guarantees and lacks take-or-pay obligations.

Thus far, prolonged negotiations with EVN have not yielded any material results for investors. Until risk allocation concerns are resolved, it will be difficult for a power purchase agreement to be signed, which is necessary for projects to obtain international financing. Therefore, projects with 100% private foreign direct investment projects, such as Bac Lieu, have reached a stalemate, despite the project being given an administrative fast track under a new private sector model initiative.

Figure 2

Vietnam's Hai Linh LNG terminal completed construction in 2020, but the terminal has not been commissioned, owing to the delay of the integrated Hiep Phuoc gas-fired power plant to 2024. The Hai Linh company plans to sell the power generated to the wholesale electricity market. However, without a firm offtake agreement in place, the Hai Linh group would struggle to obtain the required letter of credit to underpin LNG purchases.

For the Thi Vai regasification terminal, LNG imports will be used to supply existing customers in the Phu My Gas Distribution Center with the Thi Vai-Phu My LNG pipeline. We expect LNG demand to only pick up post-2025 with the start of the 1,600 MW Nhon Trach 3 and 4 power plants. These plants have faced construction delays owing to COVID-19 and the sourcing of construction materials. There is a risk of further delays to the start date from continued negotiations with EVN on the power purchase agreement.

Opposition against coal and net-zero goals to drive LNG growth

The Philippines and Vietnam are committed to move away from coal-based power generation. S&P Global Commodity Insight forecasts investment in renewables and gas infrastructure will take precedence in their decarbonization goals. Additions of CCGTs and open-cycled gas turbines are needed to maintain a healthy reserve margin and stabilize the power grid with the influx of renewables and shift away from coal.

We maintain that should the Philippines and Vietnam choose to move away from coal-fired power generation, natural gas will be the only option to achieve this goal until new technologies are proven and affordable to provide baseload power generation.

For more information, download the full report.

Learn more about our Asia-Pacific energy research.

Huyen Trang Vu, research analyst for S&P Global Commodity Insights, focuses on Southeast Asia and includes natural gas market fundamentals, policy analysis, supply, and demand outlooks.

Zhi Xin Chong, director at S&P Global Commodity Insights, emerging Asia market team covering natural gas and LNG in South and Southeast Asia, with a focus is on understanding supply, demand, and pricing outlooks.

Posted 10 July 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsluggish-lng-imports-expected-in-the-philippines-and-vietnam.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsluggish-lng-imports-expected-in-the-philippines-and-vietnam.html&text=Sluggish+LNG+imports+expected+in+the+Philippines+and+Vietnam+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsluggish-lng-imports-expected-in-the-philippines-and-vietnam.html","enabled":true},{"name":"email","url":"?subject=Sluggish LNG imports expected in the Philippines and Vietnam | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsluggish-lng-imports-expected-in-the-philippines-and-vietnam.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sluggish+LNG+imports+expected+in+the+Philippines+and+Vietnam+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsluggish-lng-imports-expected-in-the-philippines-and-vietnam.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}