Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 12, 2024

Seizing opportunities: Chappal Energies expands holdings in Nigeria

Chappal Energies has made notable strides in Nigeria's energy sector through two recent acquisition agreements with two major international firms, Equinor and TotalEnergies. As supermajors seek to divest their onshore and shallow-water assets in Nigeria, aiming to decarbonize their portfolios and align themselves with their energy transition strategies, Chappal Energies, registered in Mauritius, is set to expand its holdings and significantly boost its reserves marking a potential growth of its operations in the Nigerian market.

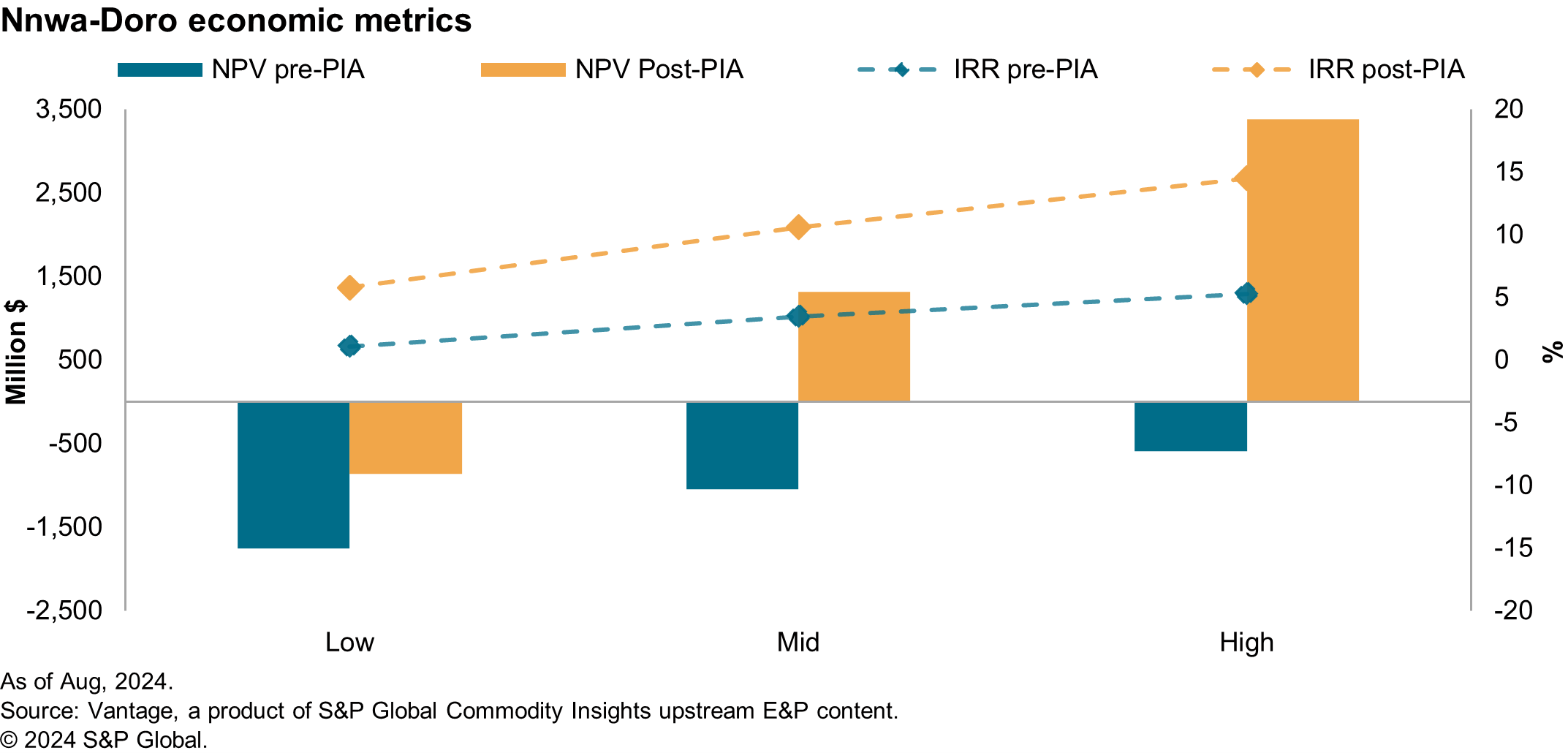

The first Chappal Energies' transaction to acquire Equinor's Nigerian portfolio is believed to be at the final stage of approval by the Nigerian Upstream Petroleum Regulatory Commission. The acquisition includes operational rights and a 53.85% ownership in the OML 128 and OML 129 fields alongside with a unitized 20.21% stake in the Agbami field, operated by Chevron. The deal contains around 570 million barrels of remaining net recoverable oil equivalent resources (boe) and also encompasses a 26.93% interest in the Nnwa-Doro gas asset, which is located within OML 129 and extends to the OML 135 license, operated by Shell. The asset is situated in the water depth of approximately 1,300 m, about 150 km away from Bonny terminal and is estimated to hold approximately 4.5 Tcf of recoverable gas resources. The project is considered marginal due to the stranded and deepwater location and will likely require favorable fiscal terms to be economically viable. Should the partners successfully negotiate specific terms for developing the Nnwa-Doro resources or integrate the project under the Petroleum Industry Act (PIA), it could significantly enhance the project's economics (Figure 1). The application of post-PIA terms, which involve reduced royalties of 5% (export) or 2.5% (domestic) for gas and gas liquids, improves project's Net Present Value (NPV) by more than $1.00 billion at a base case gas price scenario of around $3/Mcf, and also reduces the break-even price (BEP) from $7/Mcf to $3/Mcf.

Figure 1-Nnwa-Doro economic metrics

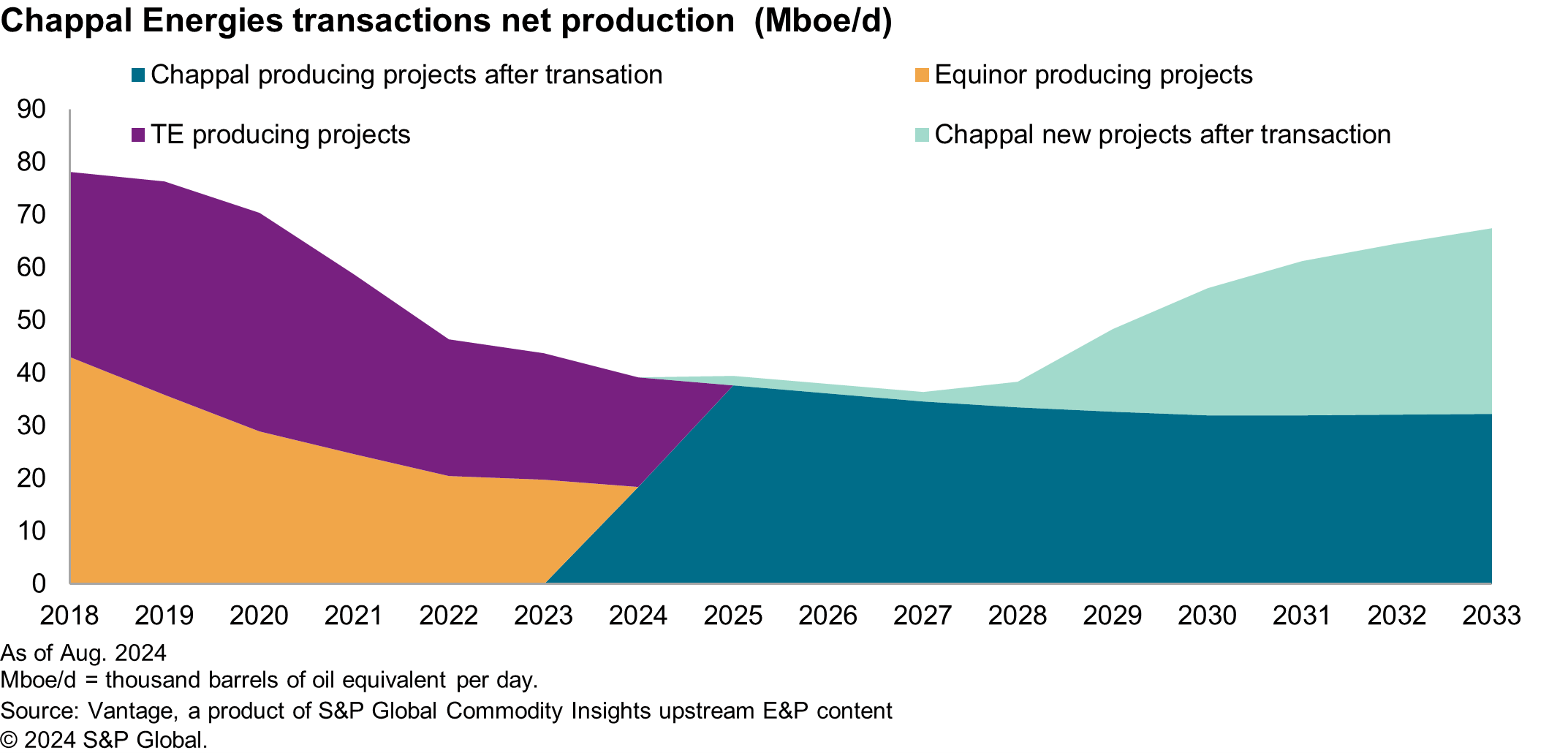

Another sale and purchase agreement was signed in July 2024 with TotalEnergies to take over the French supermajor's 10% stake in the Shell-operated SPDC joint venture, including 18 licenses in the Niger Delta, containing about 670 million boe of remaining net recoverable resources. This transaction will expand the portfolio of the indigenous company, adding about 20,000 boe per day in net production. Furthermore, there is a potential to double this output by the early 2030s (Figure 2) through the development of the numerous untapped discoveries, holding about 200 million boe net recoverable resources, of which gas accounts for a significant 85% of recoverable volumes. The current portfolio valuation of the assets is estimated to be roughly around $1.00 billion at a base case Brent price of $82/b and a discount rate of 10%.

Figure 2-Chappal Energies transactions net production (Mboe/d)

As major companies shift their focus to deepwater projects and prioritize future investments in offshore and integrated gas operations, they are gradually reducing their presence in Nigeria's onshore and shallow-water sector. This transition creates a unique opportunity for indigenous companies such as Chappal Energies to take on a leading role in the Nigerian oil and gas industry and become key contributors to the country's energy future.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fseizing-opportunities-chappal-energies-expands-holdings-in-nig.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fseizing-opportunities-chappal-energies-expands-holdings-in-nig.html&text=Seizing+opportunities%3a+Chappal+Energies+expands+holdings+in+Nigeria+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fseizing-opportunities-chappal-energies-expands-holdings-in-nig.html","enabled":true},{"name":"email","url":"?subject=Seizing opportunities: Chappal Energies expands holdings in Nigeria | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fseizing-opportunities-chappal-energies-expands-holdings-in-nig.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Seizing+opportunities%3a+Chappal+Energies+expands+holdings+in+Nigeria+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fseizing-opportunities-chappal-energies-expands-holdings-in-nig.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}