Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 12, 2020

Rethinking the risks for E&P from coronavirus (COVID-19)

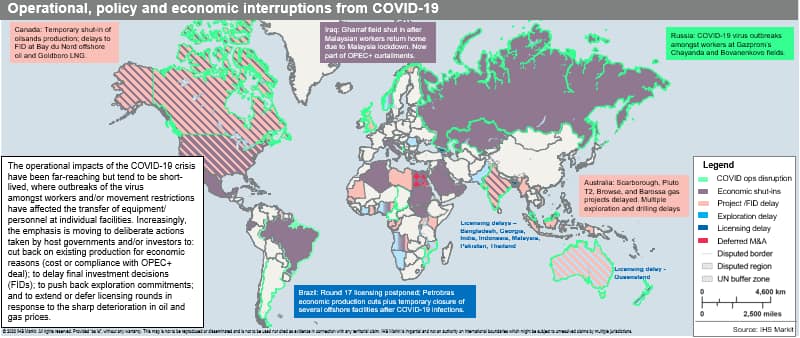

Figure 1: Operational, policy and economic interruptions from

COVID-19

The oil and gas industry is having to rethink the way in which it works yet again. Five years after the 2014 oil price rout unleashed waves of stress in the form of government austerity budgets, company cost-cutting, and shifts in asset preferences, coronavirus (COVID-19) has thrown a new set of challenges into relief, forcing companies and host countries to adapt. It's not just an operational issue, although plenty of rigs, platforms, worker rotations and equipment deliveries are being affected by the pandemic. Rather, the bigger issue is the long tail caused by an extended brush with sub-$50/bbl prices. Few producing countries or companies are likely to emerge unscathed or unchanged by the pandemic, or more accurately, its impact on global oil and gas demand, cash flows, investment strategies and project finance. Still, some resource holders are in a far better position than others to adapt as a result of structural factors and policy choices. This will make for a recalibration in global upstream investment attractiveness as assessed by IHS Markit's PEPS E&P Attractiveness Index.

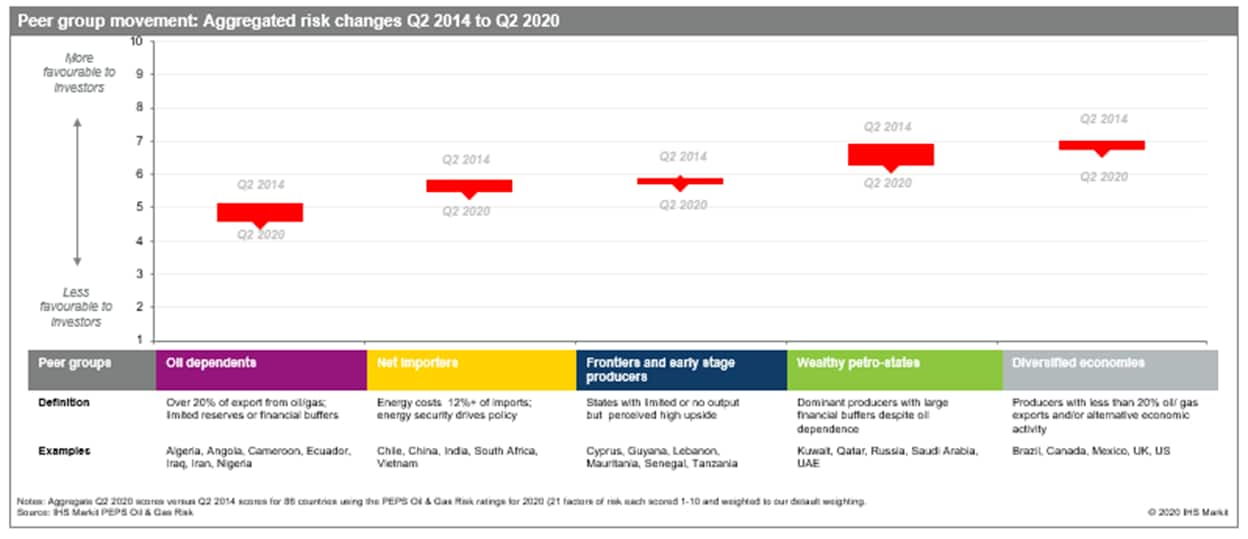

Comparing peers Q2 2014 vs Q2 2020

Our recent report - Oil & Gas Risk Quarterly: COVID-19 and the shifting above-ground calculus for E&P investment - details how COVID-19 is playing into above-ground risk across over 80 countries globally and looks at the factors that will help determine the speed and effectiveness of any recovery based on entrenched systemic factors and those that host governments have more control over.

In our above-ground risk analysis, IHS Markit divides resource holding countries into five peer groups based on structural factors relating to the role of oil and gas in the economy, access to fallback options such as sovereign wealth funds or alternative industries, and E&P industry maturity. Two peer groups show particularly distinct risk changes post-COVID - those that are oil-dependent, which generally lag the rankings for overall E&P risk and where above-ground risk has generally deteriorated since 2014, and frontier and early stage producers, which have seen the least movement in risk through the course of the last six years, in part due to their relative independence from oil price cycles.

Figure 2: Peer group movement: Aggregated risk changes Q2 2014

to Q2 2020

Oil dependents:

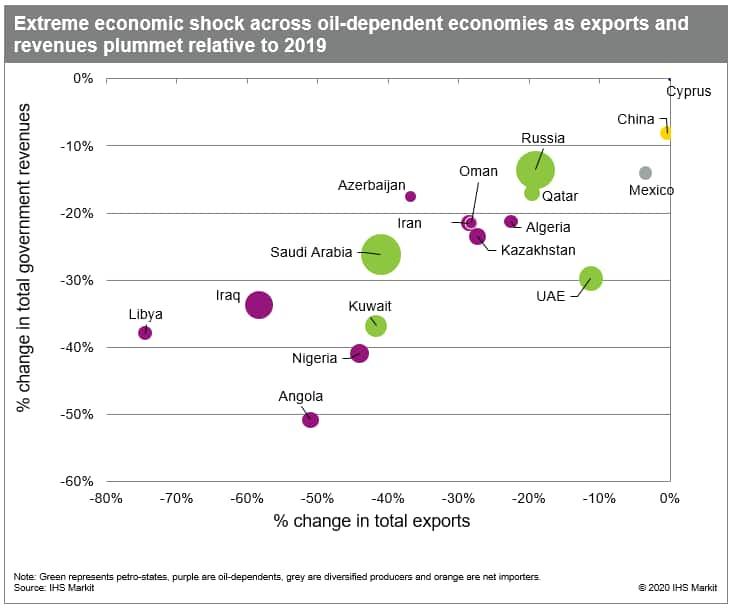

The worst immediate hit from the pandemic will be on oil dependents, already in poor shape as a group. These established producers' economies rely on oil for over 20% of exports and the oil and gas sector is a first port of call to support political systems and economic strategies. Where possible, many governments in this peer group have tended to ride out previous oil price gyrations, hoping for a recovery in fortunes via external factors, rather than implement holistic and structural change at home - whether of the broader economy, or of the hydrocarbon sector.

Where hard choices on spending and savings have already been deferred, the economic impacts of COVID-19 may be the final straw forcing more immediate change on governments with limited room for manoeuvre. This will increase the risk of civil society unrest on the one hand - and defaults and non-payment to trade partners and investors on the other, as governments chart an uncertain path between the newfound economic constraints, host publics wearied by rounds of austerity and the demands of E&P investment partners. Recourse to the IMF and multilateral funding is one option traditionally available for distressed producers, but one that often carries a high political cost, suggesting significant political and policy volatility amongst this peer group while the price lows continue. Longer-term, the size of the resource base, the availability of monetisation options and a strong E&P investor mix will provide some advantages to this peer group over time if governments can weather the immediate storm. Where political and institutional wherewithal allow, some governments may act to improve contractual terms and flexibility as a means to kickstart revival, a must-have for many countries in this peer group given future intense competition for capital.

Figure 3: Extreme economic shock across oil-dependent economies

as exports and revenues plummet relative to 2019

Frontier and early stage producers:

Post-COVID, those producers with less than 200,000 boe/d in play and significant perceived upside will feel less direct impact from the oil price cash near-term, at least where energy economies are concerned. There may even be current account benefits as a result of lower energy import costs amongst this group. However, the reliance on external capital and technical expertise leaves many peers in this group hostage to the strength of their E&P investor mix and the strategies of a select group of companies.

Cuts to E&P discretionary spending will tend to hit this group hard, given the disproportionate impact of curtailed exploration expenditure. Moreover, investor moves to defer final investment decisions in a period of oversupply will also affect would-be producers where projects are in the early stages or have yet to pass sanction: Cyprus is one country grappling with such challenges. Near-term leverage for these host governments tends to be limited, given weak technical and financial wherewithal, a generally shallow competitor mix and often, hurdles to commercialisation and monetisation, particularly where natural gas assets are concerned. Those frontiers and early stage producers where projects are advanced or entering production are in a far better position and may even look to start tightening terms to match the de-risking of geological and commercialisation approaches. It is likely, however, that some will over-rate their attractions in a changing market, making for divergent tracks on contractual and fiscal change in this peer group in particular, where regulatory volatility is often at its most extreme.

What next?

Looking ahead, producing and frontier countries are likely to come under increasing pressure to make adjustments to their upstream investment environments in order to capture investment from diminished global E&P capital pool. Research undertaken so far suggests that there are significant difference in countries' motivation to secure E&P investment as well as in governments' capacity to implement the required changes. In our next Oil & Gas Quarterly, we will look at early signs of regulatory shifts and assess the likelihood that different producer states will follow through with such changes.

Catherine Hunter is a Director for North Africa and Levant in IHS Markit's exploration and production (E&P) terms and above-ground risk group.

Posted 12 June 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frethinking-the-risks-for-ep-from-coronavirus-covid19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frethinking-the-risks-for-ep-from-coronavirus-covid19.html&text=Rethinking+the+risks+for+E%26P+from+coronavirus+(COVID-19)+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frethinking-the-risks-for-ep-from-coronavirus-covid19.html","enabled":true},{"name":"email","url":"?subject=Rethinking the risks for E&P from coronavirus (COVID-19) | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frethinking-the-risks-for-ep-from-coronavirus-covid19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Rethinking+the+risks+for+E%26P+from+coronavirus+(COVID-19)+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frethinking-the-risks-for-ep-from-coronavirus-covid19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}