Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 28, 2023

Raia-1: Mozambique’s next high-impact well

Key industry players will be keeping a close eye on Mozambique over the coming weeks as Eni look to complete the Raia-1 high-impact well (HIW) which spudded on April 19, 2023, in the offshore Area A5-A Licence of the undeveloped Zambezi Delta. The operator hopes to make the first commercial oil discovery offshore East Africa, despite several substantial gas discoveries in the region over the last 15 years.

Eni are targeting Eocene deep marine clastics of the Cheringoma Formation situated in the Angoche Sub-basin. If successful, Raia-1 could trigger a new wave of exploration activity and investment in the Zambezi delta, starting with ExxonMobil's drilling commitments in the neighbouring Area A5-B licence, where ExxonMobil are expected to drill the Angoche Prospect (Angoche-1 HIW). Success in the region would also create an alternative investment opportunity to the highly prospective Rovuma basin in Northern Mozambique, where development has been plagued by delays due to conflict in the Cabo Delgado.

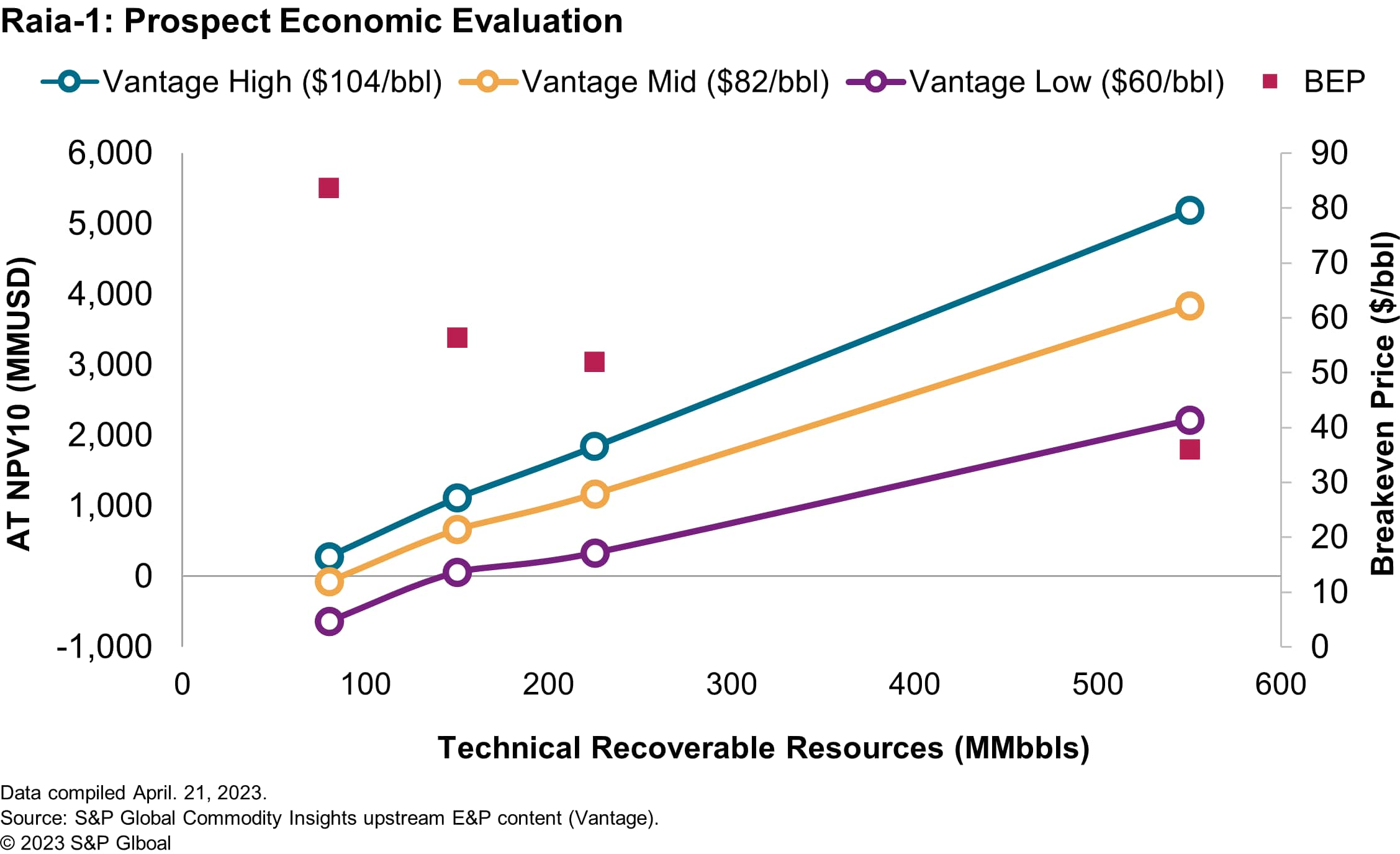

However, success at a geological level does not imply economic or commercial success. Analysis of the Raia prospect suggests a minimum economic field size of around 85 MMbbls at $82/bbl and a potential NPV of around USD 3.8 billion with a discovery size equal to 550 MMbbls. S&P Global analysis of the global cost curve for crude oil supply indicates that the average annual production from new sources globally in 2040 breaks even below $50/bbl. Considering this as a minimum long term price expectation, alongside the added risk of the Zambezi as a greenfield area for development, Eni will likely be targeting at least 300 MMbbls recoverable.

Figure 1: Raia Prospect Valuation

For more information regarding

well, field & basin summaries, please refer to

EDIN

For more information regarding

asset evaluation, portfolio view, and production forecasts, please

refer to Vantage

For more information regarding

our country activity reporting, please refer to our Upstream

Intelligence solutions

For more information regarding

E&P costs please refer to Que$tor

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fraia1-mozambiques-next-highimpact-well.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fraia1-mozambiques-next-highimpact-well.html&text=Raia-1%3a+Mozambique%e2%80%99s+next+high-impact+well+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fraia1-mozambiques-next-highimpact-well.html","enabled":true},{"name":"email","url":"?subject=Raia-1: Mozambique’s next high-impact well | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fraia1-mozambiques-next-highimpact-well.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Raia-1%3a+Mozambique%e2%80%99s+next+high-impact+well+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fraia1-mozambiques-next-highimpact-well.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}