Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 08, 2022

Optimizing asset development with analytics-ready data

The list of prep work for analyzing data retrieved in oil and gas exploration is long: collecting data from different sources and databases, cleansing and normalizing it, and loading it into a common platform. This process can take up to six weeks, meaning that by the time oil and gas data is ready for analytics, it is already outdated.

An oil and gas analytics-ready web platform called 'Energy Studio: Impact' removes the pre-work stage from a workflow, saving time and money. The ready-to-use datasets remove the need for tedious pre-work and manual calculations. As the name suggests, these oil and gas datasets have been vetted, cleansed, normalized, and integrated into a single platform. In today's market, where disruptions are constant and companies must do more with less, analytics-ready data is a critical tool for petroleum engineers and geoscientists. These oil and gas datasets connect information across the entire energy value chain: acreage, rigs, oil and gas production, type curves, midstream, transactions, forward curves and more. The analytics-ready data can be quickly applied to standard workflows like well spacing analysis and economic sensitivity analysis.

S&P Global Commodity Insights' unrivaled oil and gas data is the most comprehensive and accurate dataset available to strategy and development teams. Information like operator name, formation name, daily oil and gas production, type curves, well spacing, and more have been vetted and normalized, so users can start analyzing immediately.

Type curves

Generating type curves is no simple task. Each curve requires several pieces of data, including well vintage, geology, operational practices, completion technique, spacing and, of course, oil and gas production. Once all of the data is in place, production must be analyzed before applying a decline curve analysis regression model. The entire process can take about 10 minutes per well — for engineers dealing with multi-well pads, disparate oil and gas datasets and complex reservoirs, it adds up quickly.

'Energy Studio: Impact' is ahead of the curve, with pre-calculated type curves for all producing wells in North America. Harmony's proven screening methods and artificial intelligence were used to partition wells and produce hyperbolic parameters for accurate oil and gas production forecasts. This oil and gas dataset accomplishes what used to be days or weeks of work in mere minutes.

The type curve dataset also removes analytical limitations. For operators with limited datasets that are restricted by basin, formation or discipline, pre-generated type curves are critical. Users have access to type curves for entire basins, enabling analysis at a much larger scale than most operators have access to. These type curves provide a comprehensive, unbiased view of oil and gas production forecasting - without tedious manual calculations.

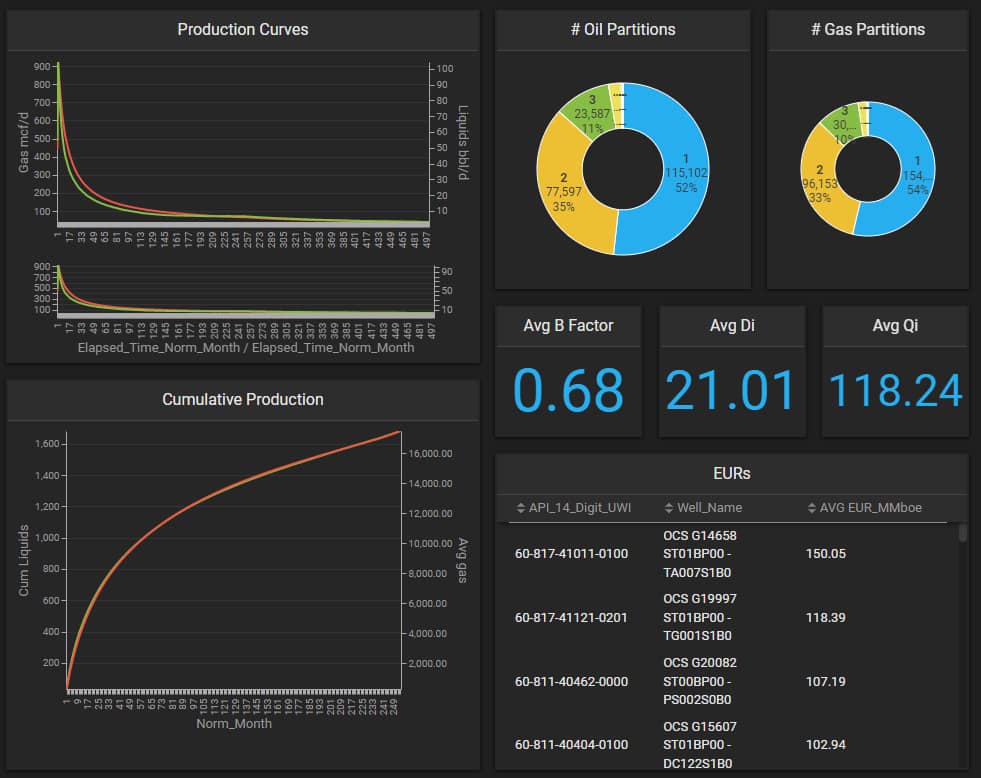

An example of the type curve capabilities in 'Energy Studio: Impact'.

Left: production curves and cumulative production for all wells in the U.S.

Right: details of hyperbolic parameters (by well) for all wells in the U.S.

Well design analysis

Determining optimal well spacing is a constant challenge for operators. With stacked laterals and ever-larger multi-well pads, understanding parent-child-sibling relationships are more complicated than ever. And, the impact of well spacing is different for each scenario: infill drilling, recompletions, and new field development. Analytics-ready datasets provide pre-calculated well spacing and parent-child-sibling information, eliminating the need to individually measure and calculate this data. With a better understanding of well spacing and how it relates to oil and gas production, teams can customize and optimize well spacing for each asset.

With analytics-ready datasets, teams can test well design scenarios without drilling any wells. Economics drive business decisions, so teams must make sure that the economics are viable at a range of commodity prices and well-spacing designs. The predictive modeling capabilities of 'Energy Studio: Impact' allows users to adjust key well design parameters in addition to well spacing, like lateral length, proppant volume, and fluid-to-proppant ratio, to see how they impact oil and gas production. Insight into how well design impacts production gives teams greater confidence in asset development planning.

Well spacing and parent-child-sibling relationships in the Marcellus. Users can view horizontal well spacing color-coded by distance to nearest neighbor and by parent-child-sibling relationship.

Identify recompletions candidates

Underperforming wells - every asset has them. While identifying poor-performing wells can be straightforward, determining the root cause is more complex. Understanding the acreage quality is the first step. Wells drilled in high-quality acreage may have room for improvement, while wells drilled in low-quality acreage may not. Scenario and sensitivity analysis can help determine the impact of well and completion design on production, and help teams plan new drills in areas with underperforming wells.

Many underperforming wells can be improved by recompletions. The vast data library in Energy Studio: Impact allows users to analyze completions and production for every well in a basin, not just their own wells. Basin-wide completions trends can give insight into best practices and help users quickly identify which wells are good recompletions candidates. Predictive modeling lets teams model how recompletions will impact existing wells, before doing the work.

Convert data into insights at the speed of curiosity

Analytics-ready oil and gas data enables quick, out-of-the-box analyses. Driven by data science, 'Energy Studio: Impact' provides insights across the entire energy value chain. Scalable data analytics turns months-long research projects into afternoon work sessions. Go from data to insights to decisions at the speed of curiosity.

About 'Energy Studio: Impact'

'Energy Studio: Impact' is a web-based platform that transforms big

data into real-time energy analytics across the entire energy value

chain. It covers upstream, midstream, emissions, and commodity

pricing datasets and was created to help engineers, geoscientists,

strategists, business development, and financial analysts to make

better decisions faster. 'Energy Studio: Impact' provides

normalized and derivative content that accelerates the ability to

extract meaningful insights. Whether you are trying to understand

what drives productivity, do a quick screen for opportunities, or

benchmark performance, our integrated workflows will get you there

faster.

Utilizing the power of Heavy.AI's GPU processing power, you can answer questions at the speed of curiosity, and save custom dashboards in order to revisit the analyses that are most important to you. By integrating upstream and midstream datasets with derivative content, 'Energy Studio: Impact' is able to provide a clear end-to-end workflow solution to reduce risk, improve returns and provide objective valuation abilities.

***

Want to test Energy Studio: Impact? Book a

15-minute personalized demo to review pre-built type curves for

every producing well in North America.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foptimizing-asset-development-with-analytics-ready-data.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foptimizing-asset-development-with-analytics-ready-data.html&text=Optimizing+asset+development+with+analytics-ready+data+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foptimizing-asset-development-with-analytics-ready-data.html","enabled":true},{"name":"email","url":"?subject=Optimizing asset development with analytics-ready data | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foptimizing-asset-development-with-analytics-ready-data.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Optimizing+asset+development+with+analytics-ready+data+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foptimizing-asset-development-with-analytics-ready-data.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}