Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 20, 2020

Novel coronavirus outbreak: Slowing Chinese gas demand growth and disrupting LNG trade

The novel coronavirus (COVID-19) outbreak has had the world's attention, the LNG world's included. To prevent the virus from spreading further, the Chinese government has implemented a series of measures, such as reducing workdays and placing travel restrictions, which will lower production output and energy demand, including natural gas. These measures will affect all gas-consuming sectors directly through production shutdowns and operation curtailment and indirectly through lower domestic consumption. Gas consumption from hospitals and manufacturing facilities for healthcare products such as gears and medicines will increase, but not enough to offset the reduction from the other sectors. Most importantly, the disruption will reduce economic growth this year, putting many economic targets set under the 13th Five-Year Plan at risk. Even after the outbreak is brought under control, gas demand will continue to be under pressure as the coal-to-gas switch will be sidelined even more than before to make way for economic growth stimulation.

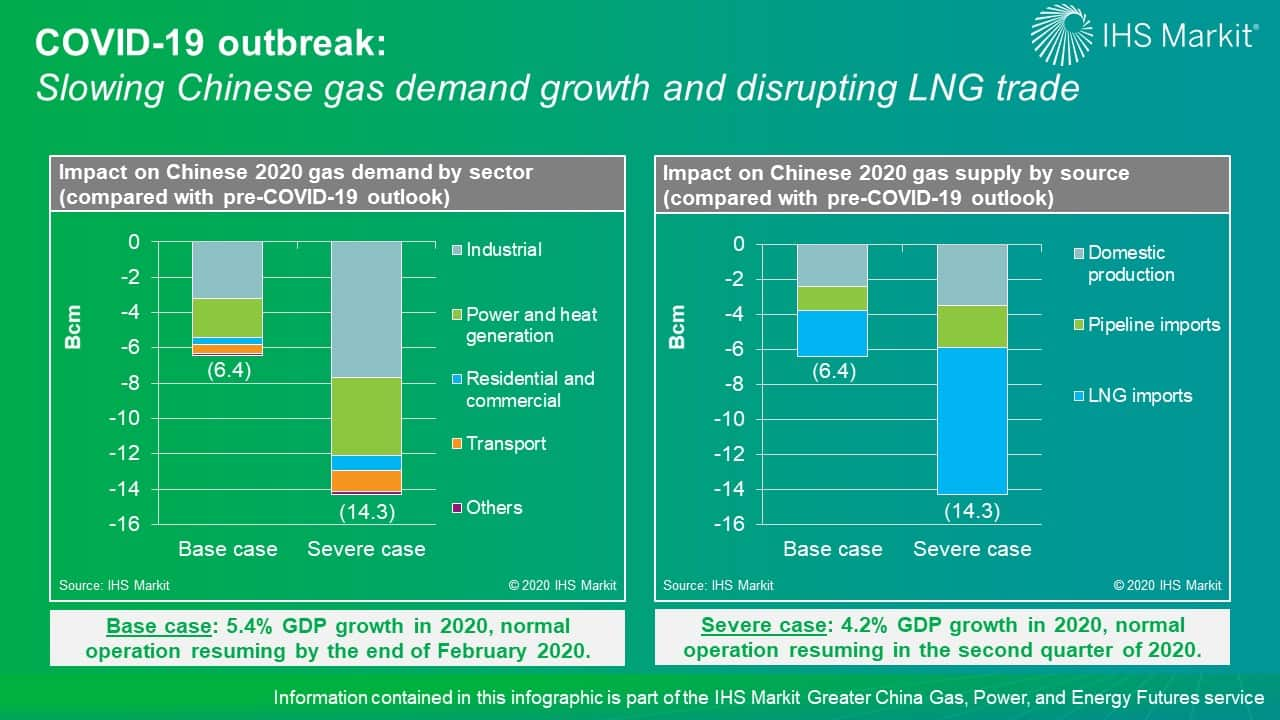

Figure 1:COVID 19 outbreak Slowing Chinese gas demand

growth and disrupting LNG trade.

In addition to the increasing competition in the supply mix amid the downward pressure on gas demand growth, LNG imports also face additional challenges from the COVID-19 control measures. Currently, workforce-related operation disruption is occurring at ports, LNG receiving terminals, and trucking operation to bring gas out of LNG receiving terminals in liquid form. In addition, Chinese LNG importers are reportedly considering or already triggering force majeure clauses on contracts with their global suppliers, after themselves receiving force majeure declarations from their own downstream users. Furthermore, some governments are imposing bans or a quarantine period on travels originating from China. This may apply to commercial vessels coming from China, adding additional uncertainty and costs to supplying LNG to China.

As a result, we expect that the measures implemented to contain the spread of COVID-19 will shave 6.4 Bcm off Chinese gas demand in 2020 in the base case, entailing 6.0% growth instead of the 8% pre-outbreak outlook. LNG imports into China is expected to increase by 2.5 million metric tons (MMt), down 1.9 MMt from the previous outlook, bringing total LNG import volumes to 62.8 MMt in 2020. This is based on the assumption that normal operations will resume by the end of February 2020 at the latest, and that the government will follow up with economic stimulus packages to backfill as much as possible the production shortfall resulting from the implementation of the COVID-19 control measures. In the severe case where normal operation does not resume until the second quarter of 2020, gas demand growth may drop to only 3%, as coal-to-gas efforts come to a complete halt in favor of economic growth.

Note: All data in this report refer to mainland China.

Learn more about our coverage of the Greater China energy market through our Greater China Gas, Power, and Energy Futures service.

Jenny Yang is a Director covering Greater China's gas and LNG analysis.

Posted 20 February 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnovel-coronavirus-outbreak-slowing-chinese-gas-demand-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnovel-coronavirus-outbreak-slowing-chinese-gas-demand-growth.html&text=Novel+coronavirus+outbreak%3a+Slowing+Chinese+gas+demand+growth+and+disrupting+LNG+trade+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnovel-coronavirus-outbreak-slowing-chinese-gas-demand-growth.html","enabled":true},{"name":"email","url":"?subject=Novel coronavirus outbreak: Slowing Chinese gas demand growth and disrupting LNG trade | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnovel-coronavirus-outbreak-slowing-chinese-gas-demand-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Novel+coronavirus+outbreak%3a+Slowing+Chinese+gas+demand+growth+and+disrupting+LNG+trade+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnovel-coronavirus-outbreak-slowing-chinese-gas-demand-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}