Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 18, 2021

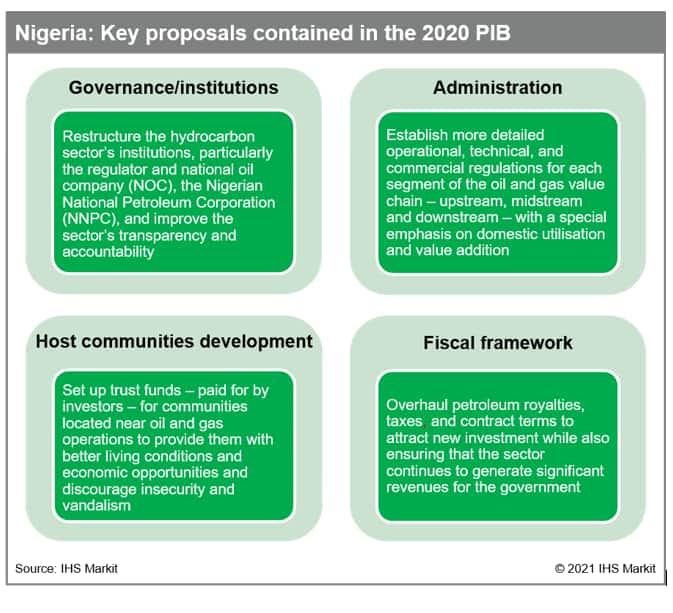

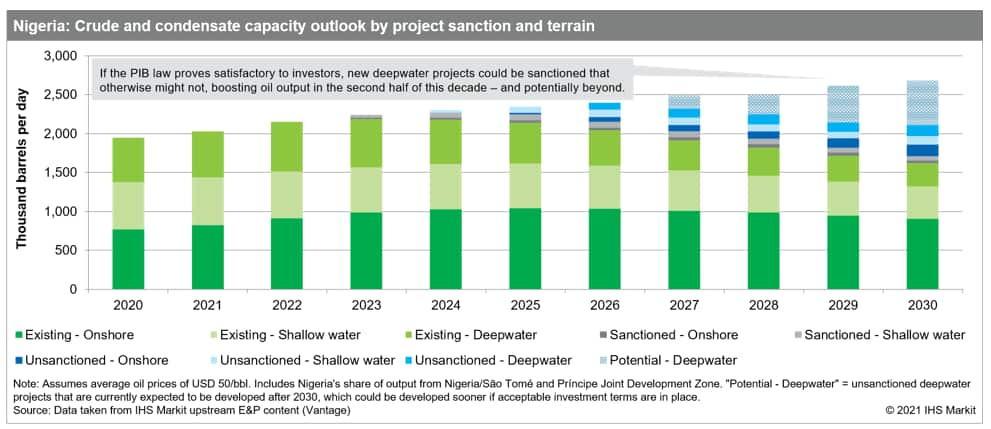

Make or break legislation: Nigeria’s latest hydrocarbon sector reform bill risks not going far enough to incentivize new E&P investment

After years of consideration and several failed attempts, Nigeria may finally overhaul its oil sector legal framework in 2021 - potentially within the next few months. However, investors have pushed back against some of the changes proposed in the Petroleum Industry Bill (PIB), 2020 such as the new fiscal terms and host community development regulations (see graphic). E&P companies argue - and IHS Markit agrees - that if these provisions are not revised to make the country more competitive, then over 30% of its recoverable reserves are at risk of being stranded. Given the headwinds that the global hydrocarbon industry faces from the energy transition, there may be only a narrow window of opportunity for some large Nigerian new source projects to be sanctioned (see graphic). If this window is missed, Nigeria's future output could be severely constrained.

Figure 1: Nigeria: Key proposals contained in the 2020 PIB

Figure 2: Nigeria: Crude and condensate capacity outlook by project sanction and terrain

At long last, in the face unrelenting pressures, a breakthrough looks increasingly likely

The country now appears to be on the cusp of a definitive petroleum sector revamp. This is important because hopes for such "reforms" have been repeatedly dashed since the first PIB was introduced in 2008. Since then, many international oil companies (IOCs) have trimmed their Nigerian portfolios, particularly onshore and shallow water assets with the most exposure to insecurity, sabotage and oil theft, while waiting for clarity on the applicable investment terms to use for making final investment decisions (FIDs) on undeveloped discoveries under existing licenses. Meanwhile, the government has imposed relatively high local content requirements in 2010 and raised deepwater royalties at the end of 2019 and indirect taxes for upstream firms in early 2020. These moves have made Nigeria less attractive as an E&P venue than many of its large producer peers.

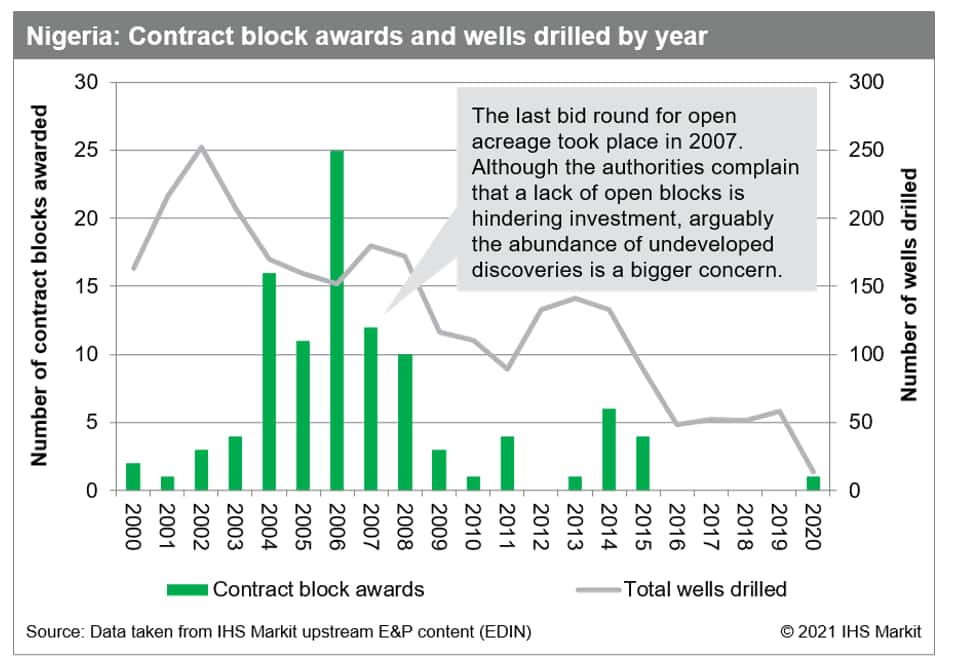

Unless clear and acceptable investment terms - at least the same as existing contracts if not better - are made available soon, licensing and drilling, which have trending down since the late 2000s (see graphic), are unlikely to recover to where they were in the mid-2010s. And the country's hydrocarbon production will probably be held well-below its potential, with liquids output stagnating further or increasing only modestly from 2019 levels. Although there is greater scope for gas production to grow regardless of what happens with the PIB, given Nigeria's prolific gas resource base, electrification and industrialization needs, and new recently completed or soon-to-be-completed gas pipeline projects, lackluster regulations could still retard the development of the gas sub-sector - a cornerstone of the government's medium-to-long term economic strategy.

Figure 3: Nigeria: Contract block awards and wells drilled by year

However, there is a good chance that the reforms may end up falling short, limiting the upside for both investors and the state

The PIB currently before the National Assembly is better than what was previously put forward, but is still flawed in the eyes of investors. E&P companies have made their criticisms known - calling out the expected adverse impact of the proposed fiscal terms and host community development regulations on existing licenses and current and future operations in particular - and are lobbying for revisions. However, economic difficulties and competition for oil rents between different interest groups stemming from Nigeria's deep-rooted hydrocarbon dependency could limit the extent for investor-friendly revisions in the finalized bill, thereby blunting its impact. To avoid or mitigate such an outcome, the Nigerian National Petroleum Corporation (NNPC) is talking with investors about potentially renegotiating contracts under the existing framework - presumably to try to facilitate the sanctioning of at least a few key upstream developments in the near term.

Although neither the NNPC-led contract renegotiations nor the PIB are expected to significantly reduce the operational risks that investors face such as facility and personnel violence and labor unrest, they may finally provide the clarity on terms and regulations that license holders have been yearning for to make empowered decisions on stalled E&P investments. For the Nigerian oil and gas industry, the stakes could not be higher.

Learn more about our coverage of Africa's petroleum sector risk profile.

Learn more about our well, field & basin summaries.

Learn more about our asset evaluation, portfolio view, and production forecasts.

Josh Holland is a principal research analyst at IHS Markit.

Posted 18 March 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnigeria-latest-hydrocarbon-sector-reform-bill.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnigeria-latest-hydrocarbon-sector-reform-bill.html&text=Make+or+break+legislation%3a+Nigeria%e2%80%99s+latest+hydrocarbon+sector+reform+bill+risks+not+going+far+enough+to+incentivize+new+E%26P+investment+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnigeria-latest-hydrocarbon-sector-reform-bill.html","enabled":true},{"name":"email","url":"?subject=Make or break legislation: Nigeria’s latest hydrocarbon sector reform bill risks not going far enough to incentivize new E&P investment | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnigeria-latest-hydrocarbon-sector-reform-bill.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Make+or+break+legislation%3a+Nigeria%e2%80%99s+latest+hydrocarbon+sector+reform+bill+risks+not+going+far+enough+to+incentivize+new+E%26P+investment+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnigeria-latest-hydrocarbon-sector-reform-bill.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}