Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 03, 2019

Mexico trip report: Key takeaways

Significant exploration potential continues to exist in Mexico and though opportunities are slowing down, the region will continue to be attractive for long-term players. During my recent visit to Mexico, conversations centered around three key topics:

- Opportunities for investment

- Mexico's future energy outlook

- PEMEX, Mexican state-owned petroleum company's development activity

Several discussions centered around the fact that overall exploration opportunities in Mexico are slowing. The long-term outlook for Mexico is uncertain and a slowdown in investments has impacted the country's supply. Bid rounds are expected to be delayed for at least another 2-3 years and though PEMEX's CNH-A6-7 Asociaciones/2018 farm-out is still ongoing, additional farm-outs are unlikely in the near term.

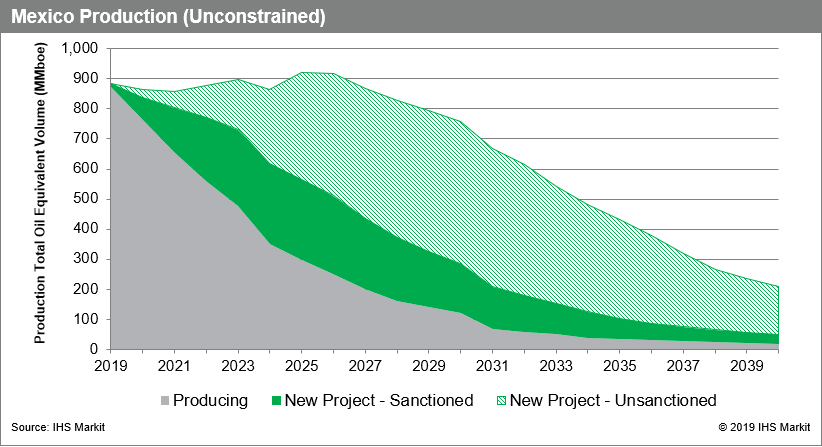

PEMEX is focused on development activity to stabilize their portfolio and improve their financial outlook. Mexico's near-term liquid output is approximately 900-1000 million barrels of oil equivalent (MMboe) or 1.8-2.1 thousand barrels per day (Mbbl/d) of oil. Without additional investments, we expect Mexico's production to decline after 2026 (Figure 1).

Figure 1: Near term Mexico production showing PEMEX

contribution

PEMEX and the winners of recent bid rounds aim to quickly bring projects online, as they look to steady production declines. The urgency set forward by the new administration to improve the production and reserves portfolio, and thus financial situation, has already been set into motion with the current proposal by PEMEX to begin developing 20 new fields in 2019. Accelerated approvals by CNH have already occurred for fields, including Xikin, Esah and now Cheek.

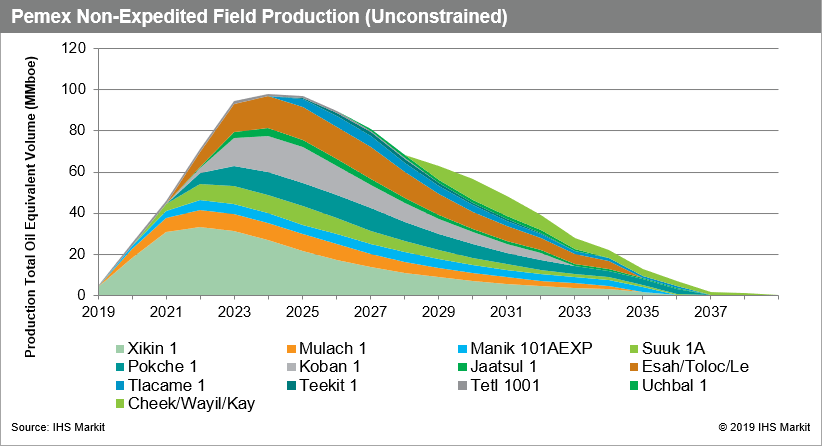

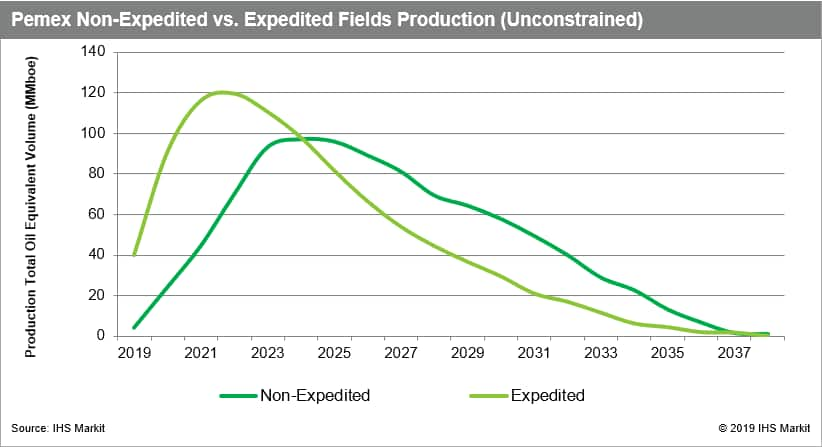

We conducted a sensitivity analysis on a subset of PEMEX's 20 new fields that are now planned to be developed in 2019. 13 of 20 fields were chosen for this review due to their similar shallow-water terrain and more than 10 MMboe reserves volumes. Figure 2 shows the 13 fields selected for this analysis, with their current "non-expedited" outlook. We adjusted the development start dates to begin in 2019 ("expedited") to determine which approach is more favorable (Figure 3).

Figure 2: Non-expedited production - current Vantage

forecast

Figure 3: Non-expedited production compared with expedited

production

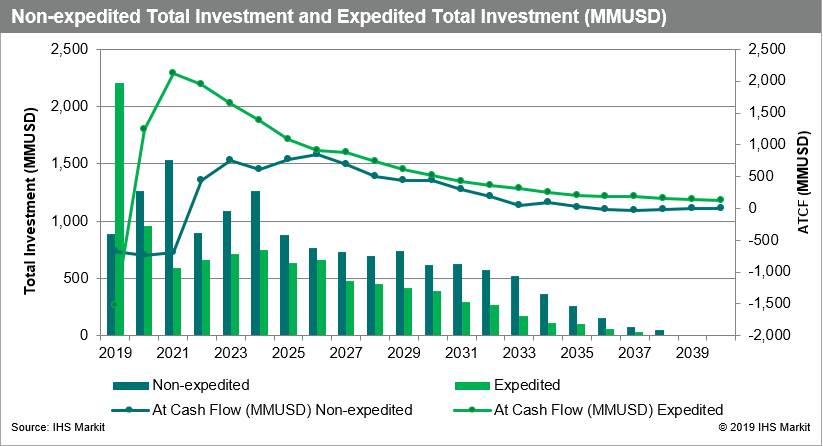

Overall economics improve when the 20 new fields PEMEX plans to develop in 2019 are expedited (Figure 4). Total investments for the expedited fields scenario significantly increase in 2019 as these projects require significant capital to start up but overall capital is reduced in comparison to the non-expedited approach. Assets become cash flow positive within a year, as opposed to the non-expedited fields which would require 3 years. In addition, break-even prices are also significantly reduced for several assets.

Figure 4: Non-Expedited vs.

Expedited ATCF and total investments.Total investment includes

capital total (including E&A), operating cost total, and

decommissioning total (MMUSD. Oil priced at $60, with 2%

inflation

Figure 4: Non-Expedited vs.

Expedited ATCF and total investments.Total investment includes

capital total (including E&A), operating cost total, and

decommissioning total (MMUSD. Oil priced at $60, with 2%

inflation

Emily McClain is a Technical Research Analyst at IHS Markit.

Posted 3 June 2019

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexico-trip-report-key-takeaways.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexico-trip-report-key-takeaways.html&text=Mexico+trip+report%3a+Key+takeaways+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexico-trip-report-key-takeaways.html","enabled":true},{"name":"email","url":"?subject=Mexico trip report: Key takeaways | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexico-trip-report-key-takeaways.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mexico+trip+report%3a+Key+takeaways+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexico-trip-report-key-takeaways.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}